A recent report from research firm Messari provided an overview of the NEAR (NEAR) protocol’s performance during the turbulent third quarter (Q3) of 2024, when the broader cryptocurrency market experienced significant volatility.

NEAR Protocol Q3 Performance

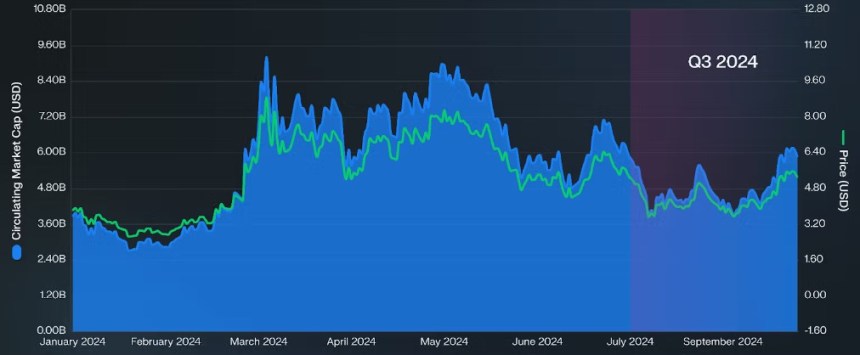

Throughout Q2 2024, the crypto market saw a downturn that continued into Q3 for NEAR. The protocol’s circulating market cap fell to approximately $5.16 billion, reflecting a significant quarter-over-quarter (QoQ) decrease of about 27.52%.

NEAR’s token price also retraced slightly, closing the quarter at around $5.29, a marginal decline of 0.21% QoQ. Despite these challenges, NEAR managed to maintain its position as the 17th largest crypto by market cap, indicating relative stability among leading digital assets.

However, over the past three weeks, it has gained 54% in terms of market capitalization, rising to $7.99 billion amid the broader market rally led by Bitcoin (BTC) and the catalyst that was Donald Trump’s election.

Related Reading

One of the notable aspects of NEAR’s Q3 performance was its revenue, which measures network transaction fees while excluding storage staking. Revenue dropped to approximately $1.64 million, marking a 30.13% decline QoQ.

This dip is particularly significant as it represents the first quarter in the past year where revenue ended lower than it began. The report attributes this to a decline in transaction volume, which resulted in reduced transaction fees—down by approximately 10.48% QoQ and 34.23% year-over-year.

As of the end of Q3 2024, about 93.46% of NEAR’s total token supply was in circulation, with 52.36% of that supply staked. The annualized nominal yield from staking stood at approximately 8.60%, while the annualized real yield was 4.09%.

Despite the challenges in transaction volume, NEAR experienced an uptick in address activity. The average daily active returning addresses increased by 7.27% QoQ, and the average daily new addresses rose by 11.06%.

TVL Rises, Liquid Staking Sees Increase

The report also highlighted a concerning trend in developer engagement. NEAR saw a significant drop in its weekly active core developers, decreasing by 41.28% from 177 to 104. Similarly, the number of weekly active ecosystem developers fell by 19.70%, from 286 to 230.

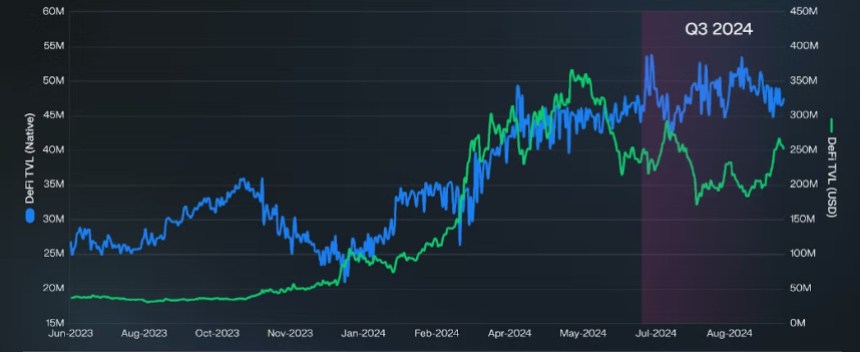

In terms of decentralized finance (DeFi), NEAR’s Total Value Locked (TVL) recorded a modest increase, ending Q3 at approximately $251.44 million, which is a 7.63% rise from the previous quarter.

Related Reading

Notably, NEAR’s liquid staking TVL also grew by 9.85% QoQ, reaching around $279.66 million. The LiNEAR Protocol accounted for a TVL of approximately $145.14 million, while the Meta Pool saw a 12.70% increase, totaling around $126.61 million.

At the time of writing, the NEAR token is trading at $6.745 and has seen substantial gains of 27% and 46% in the fourteen and thirty day time frames respectively, while on a year-to-date basis it has seen a massive 266% surge.

Featured image from DALL-E, chart from TradingView.com