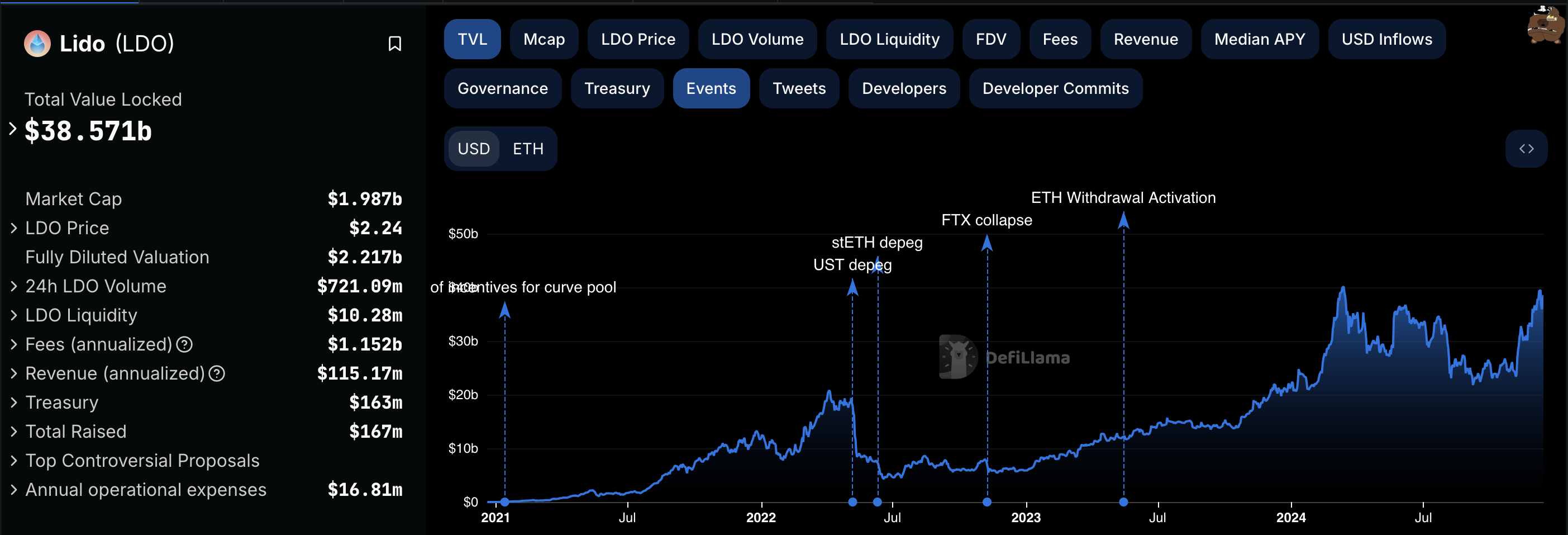

Ethereum-based liquid staking solution Lido has seen its Total Value Locked (TVL) climb by 25% in the last 30 days. As a result, the Lido TVL is on the verge of reaching its all-time high of $40 billion, which it reached in March.

Despite the rise in this metric, Lido DAO Token (LDO), the native cryptocurrency of the Decentralized Finance (DeFi) project, might find it hard to continue appreciating. Here is why.

Confidence in Staking on Lido Circles Back Toward March Peaks

In November, Lido’s TLV was $24.60 billion. The TVL measures the value of the total assets locked or staked on a blockchain. As TVL rises, an influx of assets is being locked into a platform.

This growth often enhances liquidity, fosters greater user confidence, and can lead to increased demand for the platform’s native token. On the other hand, a decrease in TVL suggests a surge in asset withdrawals, indicating less investor confidence.

According to DeFiLlama, the protocol’s Total Value Locked (TVL) currently stands at $38.57 billion, placing it less than $2 billion shy of its all-time high. This growth suggests renewed confidence in Lido’s ability to provide competitive yields.

This surge aligns with a 10% increase in LDO’s price over the past 24 hours. The rally might be attributed to the Grayscale Lido DAO Trust, which indicates that institutional investors can now gain exposure to the cryptocurrency.

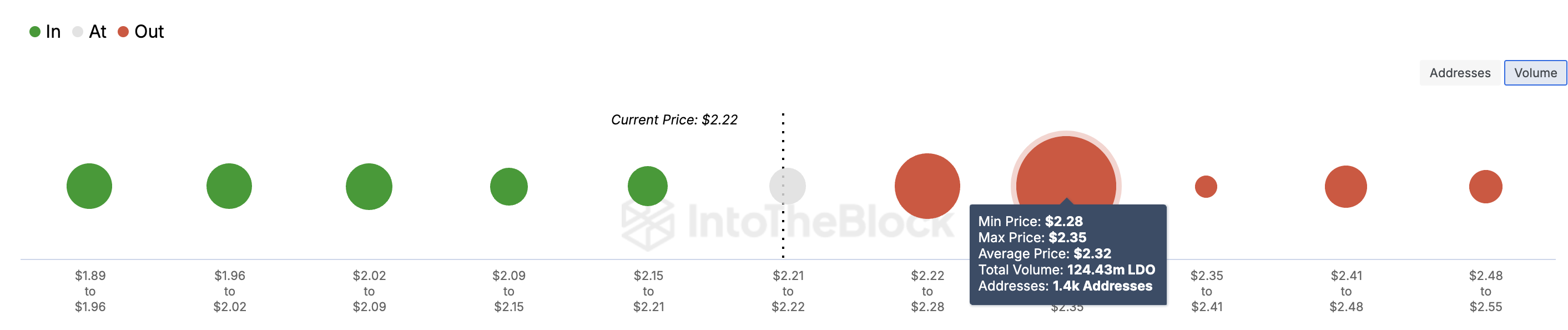

However, the In/Out of Money Around Price (IOMAP) revealed that it could be challenging for the altcoin’s price to rise toward the $3 mark. This is because of the significant resistance around $2.32.

For context, the IOMAP classifies addresses based on those in the money, out of the money, and addresses at the breakeven point. When there is a larger volume of tokens in the money, it indicates resistance, while a large cluster out of the money indicates resistance.

As seen above, about 1,400 addresses hold 124.43 million and accumulated at an average price of $2.32. This volume is higher than those purchased between $1.89 and $2.22, indicating strong resistance around the current value. Given this situation, LDO might experience a notable pullback.

LDO Price Prediction: Altcoin Eyes Lower Levels

From a technical perspective, the Awesome Oscillator (AO) on the daily chart is positive. However, the AO, which measures momentum, has flashed red histogram bars. The red bars on the AO indicate that momentum around LDO is waning.

Like the AO, the Moving Average Convergence Divergence (MACD) also supports a bearish outlook. Typically, when the MACD is positive, it means that the momentum is bullish

However, in this case, the negative reading suggests that LDO’s price could drop to $1.65. This value is where the 61.8% Fibonacci retracement indicator is.

If buying pressure increases, this might not be the case, LDO could climb to $2.38. Should that intensify and the Lido TVL all-time high comes to pass, the altcoin could surpass $3 in the short term.

The post LDO Price Faces Critical Moment While Lido TVL Nears $40 Billion All-Time High appeared first on BeInCrypto.