Tesla CEO Musk’s political influence continues to rub certain individuals the wrong way. His battle with the US Security and Exchanges Commission (SEC) is very much alive, and with outgoing chair Gary Gensler still in office, the political war is undoubtedly far from over.

Gary Gensler and the SEC have revived an investigation into Musk’s company, Neuralink. The regulator issued a 48-hour notice for the DOGE co-head to agree to a monetary settlement or face several charges.

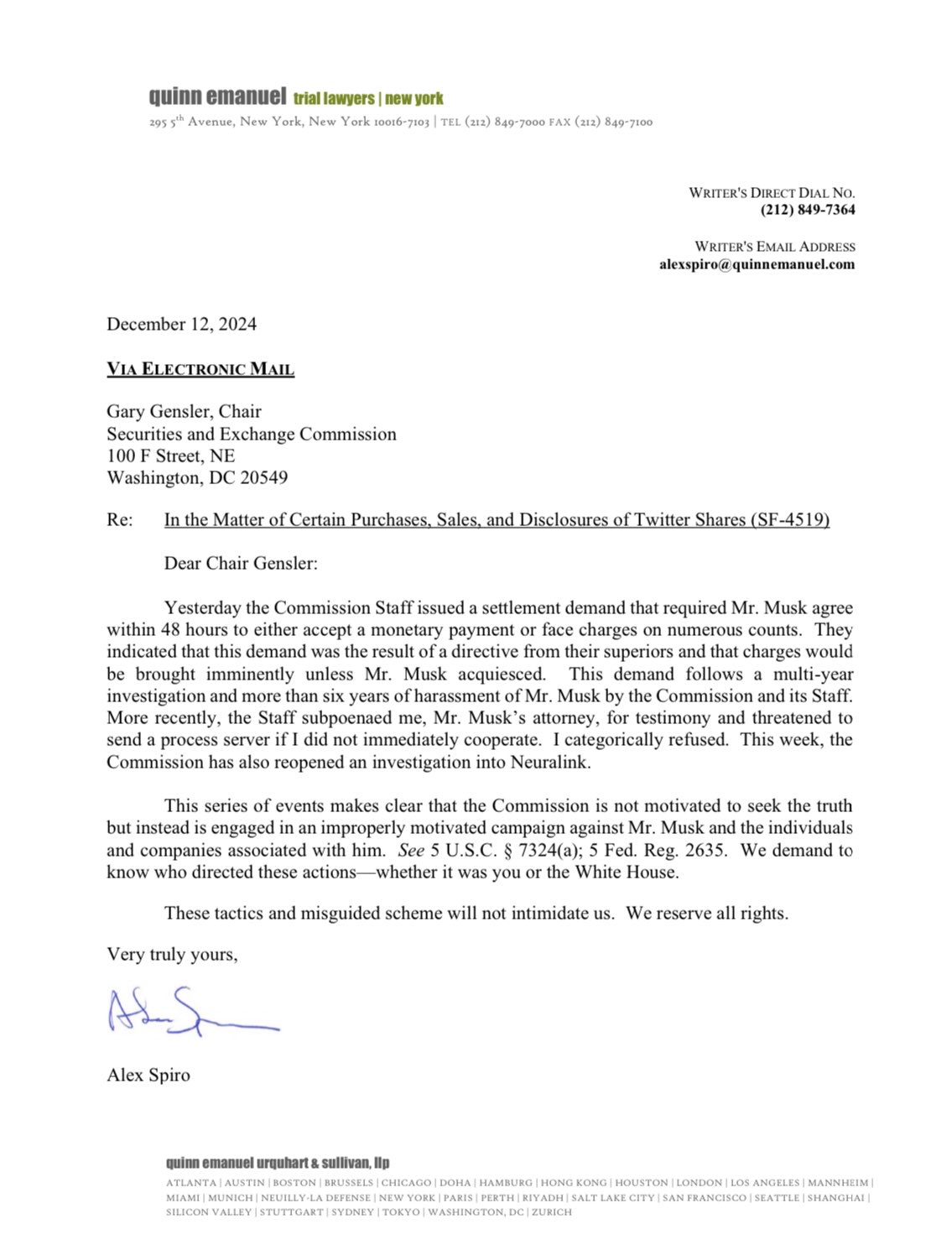

Elon Musk shared a letter from his attorney, Alex Spiro, confirming the allegations on his official X account, in which he remarked, “Oh Gary, how could you do this to me?”

Neuralink has long been scrutinized by several government agencies since 2023 when lawmakers expressed concerns over the safety of its brain implants. The company is now being criticized for overstating its product’s safety features, fueling doubts about its reliability.

The back and forth between Musk and Gensler

With the new charges coming in, Musk’s attorney, Alex Spiro, addressed SEC Chair Gary Gensler in a letter posted on the social media platform X.

The December 12-issued letter highlights that the SEC has given Musk a 48-hour window to agree to a settlement, or he will face charges on “numerous counts.” However, the SEC has not disclosed the specifics of these allegations; instead, it is referring to a multi-year investigation into Neuralink.

Musk’s attorney described the ongoing investigations as an “unwavering campaign” to target the billionaire, given his strong ties to President-elect Donald Trump, another “foe” of Gary Gensler.

The Tesla CEO doesn’t lack confidence when speaking about his feelings toward the financial regulator. When the US SEC chair first announced his resignation, Elon Musk took to X to describe the agency as ineffective, suggesting the possibility of dismantling it.

Yesterday, Musk called the agency “just another weaponized institution doing political dirty work,” and went on to say that the agency was “wasteful,” claiming that he heard employees only “work once a month.”

The SEC is just another weaponized institution doing political dirty work https://t.co/5w9ajcS6bf

— Elon Musk (@elonmusk) December 12, 2024

Vivek Ramaswamy, Elon Musk’s partner and co-head of the Department of Government Efficiency (D.O.G.E), has also publicly criticized the SEC severally, specifically for ignoring certain violations in the stock markets.

“When an agency like the SEC is so repeatedly and thoroughly embarrassed in federal court for ignoring the law, it loses its legitimacy as a law enforcement entity,” Ramaswamy posted on X.

The crypto community delighted with Gensler’s exit

The crypto community sees Gary Gensler’s departure as a big positive. Crypto enthusiasts believe that his January 2025 exit will end a harsh regulatory regime against the industry. All eyes now fall on Paul Atkins, the incoming SEC chair, who is expected to actualize Donald Trump’s promises by implementing more crypto-friendly reforms.

Analysts expect that under Atkins’ leadership, the SEC may move away from aggressive tactics that prioritize high-profile penalties over meaningful results.

Atkins was a former SEC commissioner under President George W. Bush and a former staff member at the agency. He believes the US should foster an environment that encourages more crypto companies to operate within the country.

During his tenure at the SEC, Paul Atkins worked under Richard Breeden, who chaired the regulator from 1989 to 1993. Breeden, now leading Breeden Capital Management, praised his collaboration with Atkins as “superb in every way.”

Breeden told Bloomberg that digital-asset supporters have reason to celebrate Atkins’ nomination. “If I were in the crypto industry, I’d be excited to have such a knowledgeable and thoughtful person overseeing regulation, knowing you’d likely receive fair and balanced oversight,” he said in the interview.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan