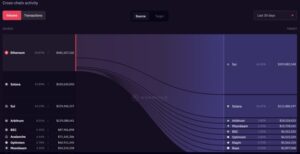

Sui, a Layer 1 blockchain, has seen significant growth since its launch nine months ago. Recently, there’s been a big move of funds from Ethereum to Sui, with almost $310 million transferred through the Wormhole Portal in the past month.

This data comes from wormholescan.io, which monitors the flow of funds through Wormhole, a crucial cross-chain bridge for wrapped tokens and NFTs. Wormhole is widely utilized on prominent decentralized exchanges like Uniswap.

Sui Ecosystem Surpasses $600M TVL and Dominates DeFi Inflows

As the Sui ecosystem gains significant momentum, reaching over $600 million in Total Value Locked (TVL) and securing a spot in the top 10 of DeFi ecosystems, data from Wormhole highlights Ethereum as a primary source of these funds.

Of the nearly $500 million bridged from Ethereum through Wormhole in the last month, over 64% flowed into Sui, surpassing inflows to Solana, Arbitrum, Polygon, and other chains combined. Most of these bridged assets are stablecoins, with USDC and USDT bridged to Sui accounting for $134 million and $78 million, respectively.

source: wormholescan.io

Greg Siourounis, Managing Director at the Sui Foundation, notes the increasing belief in Sui’s technology and community, driving user migration. He emphasizes Sui’s commitment to pushing DeFi boundaries and providing a leading experience for users and developers.

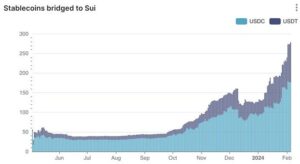

source: Sui Internal Data

Sui’s internal data also showcases a surge in bridged stablecoins, with USDC and USDT TVL skyrocketing from under $50 million to over $250 million in less than five months, marking a 400% rise since Q4 of 2023.

Sui Emerges as DeFi Hub with Top Projects Migration

In recent months, alongside empirical data, a qualitative trend has emerged indicating Sui’s ascent as a primary hub of DeFi activity, with top projects choosing to build on the platform. Notably, in December 2023, two leading projects opted for expansion or complete migration to Sui.

Solend and Bluefin Choose Sui: Solend, the top lending protocol on Solana with nearly $180 million in TVL, allocated a full team to launch a new lending protocol on Sui, named Suilend. Similarly, Bluefin, a decentralized derivatives exchange with over $1 billion in transaction volume on its v1 application on Arbitrum, shifted entirely to Sui, achieving $2.3 billion in volume within its first four months on the network. Both projects cited Sui’s performance capabilities as reasons for their moves.

Sui’s Recent Milestones: More recently, Sui announced two significant steps toward solidifying its position as the preferred DeFi platform for builders, developers, and users. Collaborating with Ondo Finance, the third-largest platform for tokenized real-world assets on public blockchains, Sui launched interest-bearing stablecoin substitutes. Additionally, a partnership with Banxa, a leading payments infrastructure provider, enables on and off-ramps via the Banxa platform. These initiatives aim to broaden the appeal of the Sui platform, attracting a wider audience.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News