Based on what Bloomberg’s Mike McGlone says, Bitcoin is becoming less risky compared to gold because its ups and downs are not as big.

In the past years, Bitcoin’s ups and downs have become smaller, and Mike McGlone, a senior person at Bloomberg who looks at big money trends, thinks this will keep happening. This means Bitcoin will keep being less risky.

But, if you look at how much Bitcoin goes up and down compared to gold, it’s still higher. Gold is something people think will keep its value, so it’s used as a way to save money.

Convergence of Bitcoin and Gold Volatility

On August 21, Mike McGlone, who is an expert at Bloomberg, shared some information about how much Bitcoin’s ups and downs have become similar to those of gold. This is called “volatility convergence.”

McGlone thinks that Bitcoin’s ups and downs are getting smaller compared to gold’s, and this might keep happening. This makes Bitcoin less risky when compared to traditional things you can invest in.

He said, “My chart shows that Bitcoin’s ups and downs over 90 days are about 3 times those of gold. This is still a bit higher than gold’s, but not as much as it was in 2018.”

According to a report, big changes in the price of Bitcoin are not happening as much anymore. This means Bitcoin might not suddenly become worth a lot more or jump to a new record high because the ups and downs are not as big.

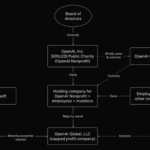

Source: Mike McGlone

More and more people in the regular finance world are starting to use Bitcoin, especially after BlackRock said they want to have a Bitcoin fund. Things like futures, which are like bets about what the price of Bitcoin will be, and exchange-traded funds, which are like baskets of different investments, show that Bitcoin is becoming more mature.

Could Bitcoin Price Bounce Back?

Bitcoin is becoming more popular in the regular finance world, especially after BlackRock said they want to have a Bitcoin fund. Things like futures, which are like bets about what the price of Bitcoin will be, and exchange-traded funds, which are like baskets of different investments, show that Bitcoin is getting more mature.

But there are some things affecting the price of Bitcoin. One is that the US Federal Reserve wants to keep increasing the interest rates, and this has made the US dollar stronger. This caused the price of Bitcoin to go down recently.

A well-known person who looks at cryptocurrencies, Ali Martinez, says that every time in the last 10 years when Bitcoin’s price went below something called the 200-day SMA, it later reached something called the Realized Price. Right now, this Realized Price is about $20,350.

In the past 24 hours, the price of Bitcoin went up by 0.5%. Right now, it’s worth $26,090. The lowest and highest price in the past 24 hours were $26,004 and $26,260. But, the amount of Bitcoin being traded has gone down by 10% in the last 24 hours.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News