Recent updates to the Injective Protocol have been very positive, but the network’s own cryptocurrency, INJ, hasn’t seen much movement. Its price has been holding steady around $35.

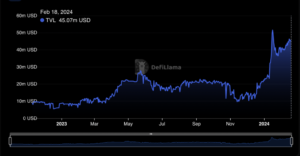

The launch of Injective Bridge v2 and the addition of new assets to its decentralized exchange (DEX) likely contributed to INJ’s price surge of 157.8% since October 2023. This surge has led to higher trading volume and a new all-time high in total value locked (TVL) on the platform. These indicators show that there is strong interest in the market and the potential for further growth.

Injective Protocol’s Token Burn Event: Bolstering Economic Model

Injective Protocol TVL. Source: Defi Llama

The blockchain project recently finalized a token burn event scheduled for Feb. 14. Injective Oritticik’s million worth of INJ tokens were burned during this event, showcasing Injective’s proactive approach to maintaining a strong economic model.

Token burning is a strategic move aimed at reducing the overall token supply, potentially leading to an increase in token value. In addition to the scheduled burn, Injective Protocol burned an additional 6,200 INJ tokens during the event. This action supplements the $200 million worth of INJ tokens that the project has already burned, further reinforcing its economic model.

INJ Price Analysis and Potential Scenarios

INJUSD daily price chart with RSI. Source: Tradingview.com

INJ price has been consolidating after dropping below the 20-day Exponential Moving Average (EMA), reaching a daily low near $33.5 before showing signs of correction. If the token fails to maintain support, it may drop to the 100-day EMA support near $29.7.

Updates from Injective Protocol could drive INJ price to rally towards resistance near $40.3. Breaking above this level and consolidating may allow the token to target resistance near $46 before facing a potential retreat.

However, if the latest updates fail to attract traders, INJ price might decline further to the 200-day EMA support near $23. Short traders could seize the opportunity if immediate support is breached, leading to a temporary drop in price before recovery.

The Relative Strength Index (RSI) for INJ remains neutral, with a score of 49.19 on the daily charts, indicating a balanced market sentiment.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News