Silver’s market cap has grown to over $500 billion, making it larger than Bitcoin’s. This is a significant change, as Bitcoin had overtaken silver just two months ago.

Silver has made a strong comeback this year, now ranking as the 8th largest asset by market cap after losing that position in March. Since Bitcoin hit a record high of $73,737 on March 14, silver has surged by 33.4%, while Bitcoin has dropped by 9.5%, according to CoinGecko.

Silver’s Market Cap Surges Past Bitcoin

As a result, silver’s market cap has now reached $1.83 trillion, which is $500 billion more than Bitcoin’s current market cap of $1.31 trillion, according to Companies Market Cap. For Bitcoin to surpass silver’s current market cap, it would need to rally 40% to $93,000, assuming all other factors remain equal.

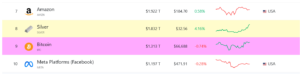

World’s largest assets by market cap. Source: Companies Market Cap

Bitcoin is currently the world’s ninth-largest asset, trailing gold, Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Google (GOOG), Saudi Aramco (2222.SR), Amazon (AMZN), and silver.

Gold has also shown significant growth, increasing by 22.4% since February 13, according to Trading Economics. It now boasts a market cap of $16.4 trillion.

Industry experts remain divided on Bitcoin’s future price movements after reaching a new all-time high in March.

Predictions for Bitcoin’s Future Price Movements

Bitcoin analyst Dylan LeClair has previously noted that Bitcoin often doubles within months of reaching new highs, especially around halving events. However, with Bitcoin’s market cap now significantly higher than in 2020, 2016, and 2012, achieving such growth is more challenging.

Galaxy Digital founder and CEO Mike Novogratz predicts that Bitcoin will remain in a “consolidation phase” between $55,000 and $75,000 over the next month, potentially rising toward the end of the second quarter.

Analysts at the cryptocurrency trading platform Bitfinex are more optimistic, predicting that Bitcoin could reach $150,000 over the next 12 months.

Many industry experts attribute these high predictions to the introduction of spot Bitcoin exchange-traded funds and the anticipated post-halving effect.

Currently, Bitcoin’s market sentiment score is 70 out of 100, indicating “Greed” on the Crypto Fear & Greed Index.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News