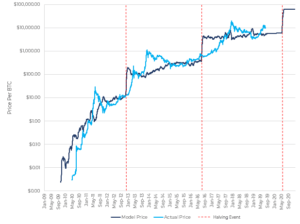

A model that correctly forecasted Bitcoin’s peak at $60,000 in 2021 is now suggesting an even higher peak around $732,000 per coin. Created by Greg Cipolaro, this adapted Stock-To-Flow (S2F) model has gained notice for its accurate predictions in the past.

Back in 2019, the go-to model for forecasting Bitcoin’s future price was Plan B’s Stock-To-Flow (S2F) model. However, Greg Cipolaro’s tweaked version turned out to be much more precise. Unlike Plan B’s model, which fell short of reaching the projected $100,000 mark, Cipolaro’s model accurately foresaw a peak around $60,000 for Bitcoin. This successful track record adds credibility to Cipolaro’s latest prediction.

Cipolaro’s Bold Bitcoin Prediction: $732,000 Peak Post-2024 Halving

Greg Cipolaro’s model relies on post-halving supply reduction price targets, and the next Bitcoin halving, anticipated in 2024, could be a catalyst for a substantial surge in Bitcoin’s price. According to Cipolaro’s model, this surge could lead to an impressive peak of $732,000 per coin.

In a tweet, Cipolaro stated, “The model predicts a price of BTC of $60,592 after the May 2020 halving and $732,256 after the 2024 halving <eye monocle falls in fancy soup>.”

Source: Greg Cipolaro on Twitter

While the prediction may appear ambitious, it’s essential to consider Bitcoin’s history of surprising investors with its price volatility. In 2017, Bitcoin witnessed a surge of over 2,000%, even after already appreciating by over 400%.

Opportunity for Continued Expansion

The forecast of a $732,000 Bitcoin price following the 2024 halving is certainly bold, yet its credibility is heightened by the model’s past accuracy. Despite its impressive track record, investors must exercise caution, understanding that such a substantial price increase is not guaranteed.

It is crucial for investors to approach this prediction with a balanced perspective, acknowledging the potential but also recognizing the uncertainties. Thorough research and informed decision-making, taking into account individual risk tolerance and investment goals, are essential in navigating the dynamic crypto landscape.

While the prediction warrants caution, the possibility of further growth in Bitcoin’s price adds an intriguing element for investors, making a careful and informed approach paramount.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News