Bitcoin is currently facing its “biggest challenge” with GBTC outflows, but predictions suggest that good times may return for BTC price action after next week.

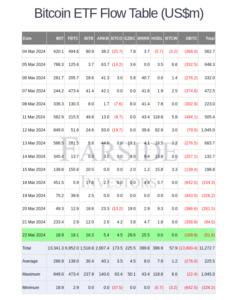

There are signs that momentum may be shifting already, especially as institutional BTC outflows decrease. Recent data, including from United Kingdom-based investment firm Farside, indicates that the Grayscale Bitcoin Trust (GBTC) only lost $170 million on March 22.

Challenges for US Spot Bitcoin Exchange-Traded Funds (ETFs)

This week, United States Spot Bitcoin exchange-traded funds (ETFs) have been in the spotlight for what some consider the wrong reasons. Inflows into these ETFs have notably decreased compared to the beginning of March, while outflows from GBTC have reached record highs, resulting in five consecutive days of net reductions in assets under management for GBTC.

The timing of these events seems strategic, as reports suggest that bankrupt crypto lender Genesis has been selling its GBTC position throughout the week. If this selling pressure has indeed subsided, it could alleviate downward pressure on ETF trends.

Investor and entrepreneur Alistair Milne commented on X (formerly Twitter) regarding the flow data, noting, “Net flows out of the Bitcoin ETFs dropped to -$51.6mil yesterday, helped by a big slowdown in GBTC selling.” This observation suggests a potential stabilization or improvement in ETF flows following the slowdown in GBTC selling.

Bitcoin ETF flows (screenshot). Source: Farside

Pivot Point Theory and Insights from Willy Woo

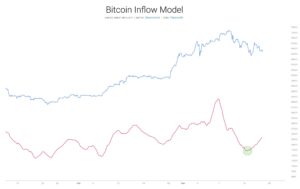

The pivot point theory, a concept in cryptocurrency analysis, is also endorsed by statistician Willy Woo, known for creating the on-chain data resource Woobull.

In a recent post on X (formerly Twitter), Woo unveiled a new model that compares ETF inflows with Bitcoin price movements. Although he didn’t specify the data used for this metric, he indicated that the most intense phase of offloading may have passed.

Commenting on the new model, Woo suggested, “According to this new model I’ve been playing with, the worse of the sell down in this first phase of the consolidation may be over.” He further added, “I’m kinda expecting consolidation to run right into the halvening, thus more choppiness through April.”

Agreement on BTC Price Outlook from Pseudonymous Commentator

Pseudonymous commentator WhalePanda echoed similar sentiments regarding the outlook for Bitcoin’s near-term price action. Despite the recent fluctuations, he remained optimistic and suggested that conditions for a return to price discovery could be favorable by next week.

“Now we’ll most likely have a sideways weekend and potentially consolidate a bit more next week before the path up to new ATH,” WhalePanda wrote. He highlighted the prevalence of individuals waiting for lower prices and emphasized the significance of the current emission schedule.

WhalePanda pointed out, “With the current emission schedule at $64k, we need $57.6 million of inflows per day to scoop up the daily mined coins. In less than a month with the halving, that total is $28.8 million.” These insights shed light on the dynamics of Bitcoin’s supply and demand and its potential impact on future price movements.

Mixed Reactions to GBTC’s Declining AUM

Some individuals expressed criticism towards the Grayscale Bitcoin Trust (GBTC), which now holds only half of the Assets Under Management (AUM) it had when it converted to an ETF in January. Crypto author and educator Vijay Boyapati argued that the ecosystem would be healthier without GBTC, attributing it to the 2022 market collapse and noting that its net outflows pose a significant challenge to Bitcoin.

On the other hand, spot Bitcoin products have seen remarkable success, representing the most successful ETF launch in history. Cumulative flows for these products have reached $12.15 billion since they began trading.

Cathie Wood, CEO of ARK Invest, one of the ETF providers, earlier stated that the bulk of institutional exposure to Bitcoin is yet to come. This indicates optimism about future institutional participation in the cryptocurrency market.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News