Dogecoin experienced a significant price rebound, surging over 7% within 24 hours. During this period, a major investor offloaded approximately 200 million DOGE, amounting to $30.86 million. Technical indicators suggest that Dogecoin’s price dynamics are currently at a critical juncture.

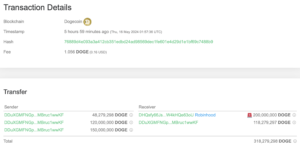

The popular altcoin Dogecoin (DOGE) made a noteworthy comeback, surging by over 7% in the past day. However, amidst this positive movement, a significant investor, often referred to as a whale, sold around 200 million DOGE, totaling $30.86 million. This sale, executed from an undisclosed wallet to the well-known trading platform Robinhood, has stirred speculation about possible selling pressure that might slow down Dogecoin’s recent progress in the cryptocurrency realm.

Speculation Surrounds Dogecoin Whale’s Potential Sell-Off

A significant transfer in Dogecoin holdings has sparked speculation that a crypto whale might be gearing up to sell off a substantial portion of their assets. This move could potentially create selling pressure and halt the current rally. However, buying pressure from other whale accumulations continues to lend support to the DOGE price.

Data from on-chain provider IntoTheBlock reveals a notable uptick in large Dogecoin transactions over the past month, reaching a peak of 1.86 thousand transactions on May 14, 2024. This surge in network activity suggests heightened involvement from whales and institutional investors. Furthermore, the volume of these transactions surged to 11.55 billion DOGE on the same day, indicating strategic positioning by major investors.

Currently trading above $0.15 and nearing $0.16, DOGE shows resilience in its price. As of today, DOGE is valued at $0.1556 with a market cap of $22.46 billion and a 24-hour trading volume of $1.96 billion, marking an 18.33% increase. Open interest in Dogecoin futures has also risen by 11.83% to $884.94 billion, signaling growing interest among derivative investors. Additionally, short sellers dominate liquidations with $2.51 million, hinting at a potential short squeeze that could sharply drive up DOGE’s price.

Technical Analysis: Dogecoin Price Dynamics

Technical indicators indicate that Dogecoin’s price dynamics are currently at a critical juncture. The 50-day Exponential Moving Average (EMA) at approximately $0.1652 poses as a key resistance level. A breakout above this level could signify entry into a bullish market, potentially propelling DOGE’s price towards the next resistance levels at $0.18 and $0.20.

In the event of a negative scenario, the 100-day EMA at $0.1434 emerges as a significant support level against substantial declines. Additionally, the 200-day EMA at $0.1237 serves as a major long-term support level. Should a decline occur, these two levels are anticipated to hold the price and prevent a deep decline.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News