- $1.2 billion liquidated as market downturn amplified memecoin sell-offs.

- DOGE showed resilience; BONK, SHIB lagged with weaker buy-side momentum.

The market is in turmoil, with a sharp sell-off sending shockwaves across all sectors.

Nowhere is the impact more pronounced than in the memecoin market, where speculative assets like Bonk [BONK], Floki [FLOKI], dogwifhat [WIF], Shiba Inu [SHIB], and Dogecoin [DOGE] have endured staggering double-digit losses.

Leveraged traders are facing mounting liquidations, and the fragility of this high-risk niche is being exposed as prices hit new lows amid the broader market correction.

Memecoin fragility amid broader market turmoil

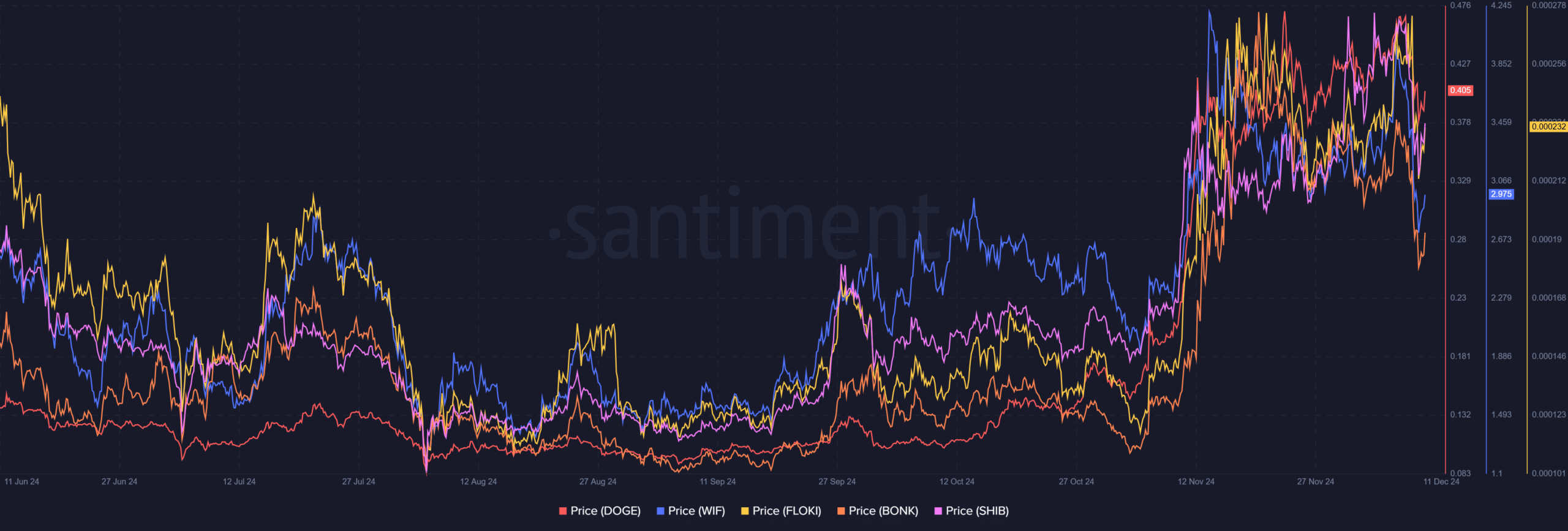

Santiment data highlighted the volatility across these prominent memecoins during the ongoing market downturn. After mid-year gains, all five assets plunged from November, tied to liquidity issues.

DOGE and WIF rebounded sharply, while BONK and SHIB lagged as well.

The divergence shows the fragility of speculative assets in volatile environments.

FLOKI’s heightened correlation with broader crypto trends suggests its susceptibility to macroeconomic shifts, while DOGE’s recovery reflects its resilience, bolstered by high liquidity.

This fragmentation among memecoins serves as a warning for traders: herd behavior can amplify losses when sentiment turns bearish.

Market-wide liquidations

The market-wide liquidation cascade has deepened, with over $1.2 billion in positions liquidated across exchanges in the past 48 hours.

This aggressive unwinding was triggered by a convergence of factors: sudden BTC price drops breaching critical support levels, exacerbated by high leverage ratios.

Altcoins, particularly memecoins, faced the brunt, with liquidation volumes disproportionately higher compared to larger-cap assets like ETH or BTC.

Liquidation spikes often fuel self-reinforcing cycles — price slippage triggers margin calls, forcing traders to sell, which further pressures prices.

This liquidation feedback loop has been particularly brutal for speculative niches, revealing the fragility of overleveraged positions in risk-off scenarios.

Such volatility underscores the importance of risk management, especially in markets where sentiment can shift on macroeconomic or regulatory catalysts.

A high-stakes gamble

The recent memecoin fall reminds us of the extreme volatility inherent in this niche.

These assets, largely driven by social media trends and speculative trading, lack the underlying utility or adoption metrics of more established cryptocurrencies.

During broader market downturns, memecoins are particularly vulnerable, as their price floors often collapse under low liquidity and a lack of institutional backing.

High leverage amplifies these risks, as cascading liquidations further depress prices.

This volatility exposes traders to outsized losses, making memecoins a double-edged sword; capable of explosive gains during rallies but disproportionately susceptible to catastrophic declines in sell-offs.