Following the approval of several spot Bitcoin ETFs by the United States Securities and Exchange Commission (SEC) earlier this year, many in the crypto community anticipated that Ethereum ETFs would soon receive similar approval.

Many are speculating about how this decision could affect the price of Ethereum.

Ethereum’s Recent Surge and the Potential Impact of an ETF Approval

Ethereum has experienced a significant rise in value, breaking the $3,000 mark on February 20 for the first time since April 2022. This upward trend is partially attributed to growing optimism surrounding the potential approval of a spot Ethereum ETF. Financial experts believe that such approval could lead to Ethereum’s greater integration into the mainstream financial system, potentially attracting more investors and increasing its overall value.

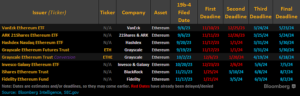

Ethereum ETF deadlines. Source: Bloomberg / SEC

Dave LaValle, head of ETFs at Grayscale, has assessed the likelihood of an SEC approval for Ethereum ETFs at 50%. This assessment is slightly lower than the 70% projected by Bloomberg Analyst Eric Balchunas back in November 2023. Balchunas expressed confidence in the approval, noting that the SEC has already approved futures Ethereum ETFs, making a denial of spot Ethereum ETFs seem illogical and potentially subject to legal challenge.

Despite these assessments, the SEC’s stance on Ethereum ETFs remains cautious. While the commission has not explicitly classified Ethereum as a security, SEC Chair Gary Gensler has been vocal about the need for regulatory compliance in the cryptocurrency space to prevent fraud and market manipulation. This cautious approach reflects broader concerns within regulatory circles about the potential risks associated with cryptocurrencies.

Analysts’ Views on the Potential Impact of an ETH ETF Approval

Many analysts believe that the approval of an Ethereum (ETH) ETF could serve as a catalyst for pushing ETH to new price highs. They anticipate that the ETF approval would attract a broader investor base and enhance the market legitimacy of Ethereum, thereby driving its value upwards.

Ryan Sean Adams, from Bankless, expressed this optimism in a tweet, highlighting the positive indicators such as L2 acceleration and restaking yields, contrasting them with past market turmoil. He emphasized the improved foundation this time around, suggesting that $3,000 could serve as a strong support level for ETH.

However, some analysts are less optimistic about the immediate impact of an ETH ETF approval on the price of Ethereum. They draw parallels to the approval of Bitcoin ETFs, which initially led to a price surge followed by a significant decline. Geoff Kendrick, head of Digital Asset Research at Standard Chartered, projected that ETH would reach $4,000 before an ETF approval. He noted that Ethereum’s smaller market share compared to Bitcoin could make it less susceptible to a post-approval selloff, offering a more stable trajectory.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News