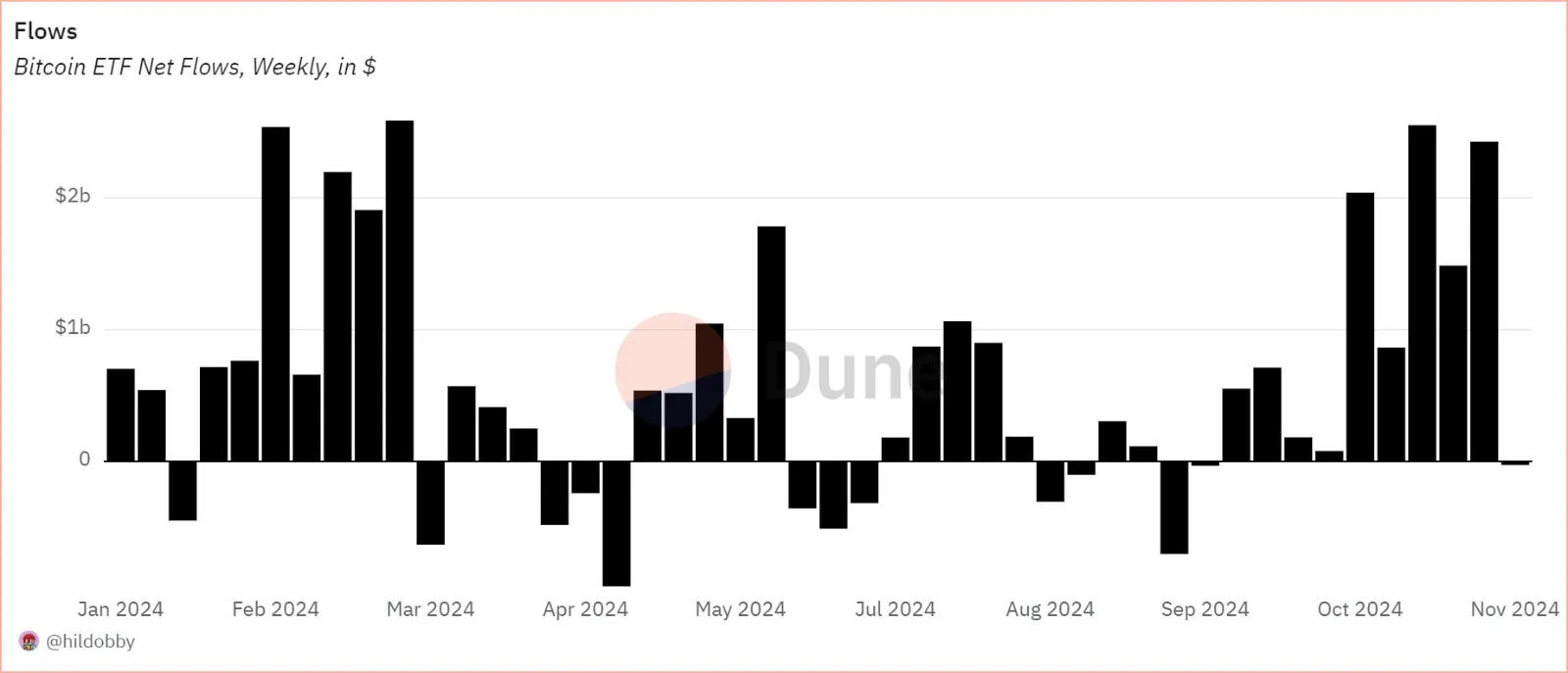

Bitcoin ETFs experienced outflows totaling $105.3 million, with six out of 11 ETF issuers losing $59.3 million. Fidelity’s FBTC saw a $10.4 million outflow, while Bitwise’s BITB and VanEck’s HODL lost $8.7 million and $10.1 million, respectively.

Grayscale’s products also experienced outflows, with $8.0 million and $8.8 million withdrawn from GBTC and BTC, respectively. BlackRock’s IBIT did not register any outflows.

The total net inflow for Bitcoin ETFs remains positive at $17.85 billion. Ethereum ETFs have shown a slight positive shift, with $5.9 million coming in, but Grayscale’s ETHE continued to see outflows at a reduced rate of $3.8 million.

Note that the U.S. exchange-traded funds market experienced significant changes on August 23, 2024, with Bitcoin ETFs experiencing a substantial influx of $252 million and Ethereum ETFs experiencing an outflow of $5.7 million.

The iShares Bitcoin Trust, managed by BlackRock, attracted $86.8 million, making it the top recipient of Bitcoin ETF inflows.