In December, there are exciting developments expected for altcoins like Chainlink (LINK), ImmutableX (IMX), NEO, KAVA, and MultiversX (EGLD), and these events might influence their prices.

The cryptocurrency market had a positive trend in November, particularly in the first half of the month. Looking ahead, these five altcoins could capture even more interest in December.

Chainlink (LINK) Staking: Early Entry Opportunities and Price Analysis

Chainlink (LINK) presents a staking opportunity with the launch of Staking v0.2, offering early entry chances. Currently priced at $14.79, with a market cap of $8.235 billion, LINK holds the 12th position in the market rankings.

Staking v0.2, introduced this year, initiated priority migration on Nov. 28, exclusively available for existing v0.1 LINK stakers. Early access for eligible addresses to stake begins on Dec. 7, followed by public staking availability on Dec. 11.

Building upon the foundation of v0.1, Staking v0.2 enhances flexibility, security, introduces a dynamic reward mechanism, and adopts a modular architecture.

While LINK’s price experienced a decline from its peak of $16.58 on Nov. 11 to a low of $12.86 six days later, it has since rebounded. The Relative Strength Index (RSI) indicates a positive momentum, with readings bouncing at 50 and revealing a hidden bullish divergence (green), signaling a potential trend continuation.

In the case of further price increases, the next resistance at $18.30 becomes crucial, marked by the resistance trend line of an ascending parallel channel, requiring a 22% upward movement to reach it.

Despite this optimistic LINK price prediction, a close below the November 17 low of $12.86 (red) would invalidate the bullish scenario, potentially leading to a 27% fall to the channel’s support trend line.

LINK/USDT Daily Chart. Source: TradingView

ImmutableX (IMX) Mainnet Launch: Price Surge and Analysis

ImmutableX (IMX) gears up for a significant milestone with the release of its new mainnet. Currently priced at $1.28, IMX holds a market cap of $1.606 billion, securing the 39th position in market rankings.

Having launched its zkEVM Testnet in August, ImmutableX aims to establish itself as the hub for gaming on Ethereum, attracting commitments from over 50 games to build on the zkEVM. The Testnet’s recent upgrade from Polygon Edge to Geth in November sets the stage for the much-anticipated mainnet launch scheduled for December.

The IMX price has witnessed a rapid increase since the beginning of November, reaching a peak of $1.50 on November 23. Despite a slight dip afterward, it continues to trade above the $1.20 horizontal area, now expected to act as a crucial support level.

In the event of a price bounce, IMX could see a 24% increase, reaching the next resistance at $1.60.

While this forecast presents a positive outlook for IMX, a daily close below the $1.25 area may result in a 20% drop, finding support at the next level of $1.

IMX/USDT Daily Chart. Source: TradingView

NEO Mainnet Upgrade: Price Movement and Analysis

NEO, currently priced at $10.84 and holding a market cap of $764.286 million, stands at the 65th position in market rankings. Notably, NEO is gearing up for a significant development with its mainnet upgrade scheduled for December 4, following the testnet upgrade on Nov. 21. The new upgrade promises various improvements and optimizations.

The NEO price has experienced rapid growth since breaking out from a descending resistance trend line on Oct. 26. The upward momentum reached its peak at $15.46 on Nov. 5. However, sustaining this upward movement proved challenging, resulting in several long upper wicks (red icons), indicative of selling pressure.

Despite this, the NEO price remains above the main horizontal support area at $10. In the event of a bounce, there is potential for a 35% upward movement, targeting the $14.50 resistance area.

NEO/USDT Daily Chart. Source: TradingView

While this presents a positive outlook for NEO, a close below the $10 area could trigger a 30% decline, finding support at the next level of $7.50.

MultiversX (EGLD) Governance Proposal: Voting and Price Analysis

MultiversX (EGLD) is in the spotlight as stakers actively participate in voting for the first protocol governance proposal. The voting period commenced on Nov. 23 and extends until Dec. 3. Notably, nearly 98% of participants have voted in favor of the Sirius 1.6 Protocol upgrade. This upgrade introduces enhancements such as optimized consensus signature checks, advanced voting features, and multi-key support for chain shards.

As of now, EGLD’s price stands at $43.36, with a market cap of $1.138 billion, placing it at the 50th position in market rankings.

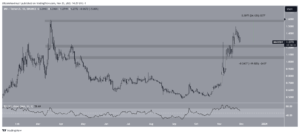

The EGLD price trajectory has been noteworthy, breaking out from a long-term descending resistance trend line in October and reaching a high of $53.45. Despite a subsequent dip, the price is currently trading within the $43 horizontal support area, maintaining a bullish trend.

In the scenario of a resumption in price ascent, EGLD could experience a 45% increase, reaching the next resistance at $63.

EGLD/USDT Weekly Chart. Source: TradingView

Conversely, a closing below the $43 area may lead to a 25% decline, validating the significance of the long-term descending resistance trend line.

KAVA’s Spotlight in December: Launch and Price Outlook

As the final contender in the December altcoins to watch, KAVA takes center stage. Priced at $0.765 and holding a market cap of $747.165 million, KAVA currently ranks 68th in the market hierarchy. The spotlight is on KAVA 15, scheduled to launch on Dec. 15, although detailed information about its upgrades remains limited. To address this, the team conducted an Ask Me Anything (AMA) session on Nov. 29 to shed light on new developments.

KAVA’s price journey has been notable, breaking out from a descending resistance trend line on Oct. 20 and experiencing swift growth. The upward momentum reached a peak of $0.87 on Nov. 11. Despite subsequent declines, the KAVA price is still above the $0.70 horizontal support area, suggesting a positive future outlook with a potential 30% increase to the next resistance at $1.

KAVA/USDT Daily Chart. Source: TradingView

However, a cautious note accompanies this optimistic prediction – a close below the $0.70 area could trigger a 25% decrease, finding support at $0.57.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News