In a recent survey of 64 asset managers overseeing $600 billion collectively, 15% have added Solana to their portfolios. This marks a notable rise in institutional support compared to earlier in the year.

The surge in adoption is fueled by Solana’s technological advancements and growing market presence, making it an appealing long-term investment option for savvy investors.

Shifting Dynamics in Cryptocurrency Investments

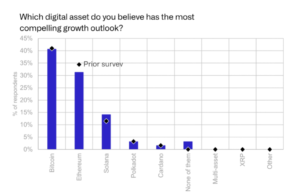

Bitcoin maintains its dominance, with over 25% of respondents investing in it, closely followed by Ethereum. However, the landscape is evolving.

While Bitcoin remains prominent, its growth prospects have slightly declined, with 41% of investors remaining bullish, a slight drop from previous figures.

Digital assets with the most promising growth outlook | Source: CoinShares

Similarly, Ethereum experiences a slight decline in investor confidence, dropping from 35% to approximately 30%. This retreat could stem from growing curiosity among investors about alternative blockchains like Solana.

Rising Optimism Surrounding Solana’s Future

The outlook for Solana is steadily becoming more positive, with approximately 14% of surveyed investors expressing belief in its promising future. This small yet notable increase from previous surveys reflects a growing optimism about Solana’s potential role in the digital asset landscape.

Solana’s technological advancements and scalability potential are resonating well with institutional investors. These attributes make Solana an appealing addition to diversified investment portfolios, further bolstering its attractiveness in the eyes of investors.

SOL price, 1-week chart | Source: SOLUSD on TradingView.com

Navigating Challenges on Solana’s Path to Success

Despite its potential, Solana faces regulatory challenges that investors view as a significant barrier to further investment. However, the diminishing concerns regarding volatility and custody issues provide some optimism.

As the digital asset landscape evolves, Solana’s innovative approach positions it as a frontrunner in the race for blockchain supremacy. However, the pace of adoption will depend on regulatory developments and broader economic factors, presenting both challenges and opportunities for forward-thinking investors.

Despite the hurdles, investor interest in blockchain technologies remains high, with Solana leading the enthusiasm. With digital assets constituting 3% of the average investment portfolio, their highest share ever, the outlook for cryptocurrencies like Solana appears promising.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News