CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

According to news sources, crypto asset manager 21Shares has officially submitted an updated S-1 application for its spot Polkadot ETF to the U.S. Securities and Exchange Commission (SEC). This latest filing, dated March 6, follows an initial submission on January 31, indicating that 21Shares may be refining its proposal in response to SEC feedback or expanding its disclosures.

This move positions 21Shares alongside Grayscale, which filed its own spot Polkadot ETF application on February 25 through Nasdaq. With institutional interest in crypto-backed ETFs accelerating, 21Shares has also recently applied for XRP and Solana ETFs, signaling a broader push for mainstream adoption of crypto-based investment products.

Meanwhile, Polkadot’s (DOT) price remains at a critical juncture, holding above the $4 support level. With Polkadot 2.0 on the horizon, analysts speculate whether ETF approval and network upgrades could drive a major breakout.

Polkadot’s ETF Race Heats Up as Crypto ETFs Gain Institutional Momentum

The push for crypto-based ETFs has intensified in 2025, with multiple firms vying for SEC approval. 21Shares and Grayscale’s Polkadot ETF applications represent a growing interest in altcoin-based exchange-traded funds, following the success of Bitcoin (BTC) and Ethereum (ETH) ETFs.

Historically, ETF approvals have acted as a bullish catalyst for crypto markets, as they provide institutional investors with regulated exposure to digital assets. If Polkadot’s ETF gets the green light, it could increase adoption and liquidity, potentially driving DOT’s price higher.

However, regulatory hurdles remain, as the SEC has yet to approve any spot-based altcoin ETFs beyond Bitcoin and Ethereum. The approval process for Polkadot could face additional scrutiny, especially given the SEC’s evolving stance on crypto securities classification.

DOT Price Holds $4 Support—Will Polkadot 2.0 Spark a Breakout?

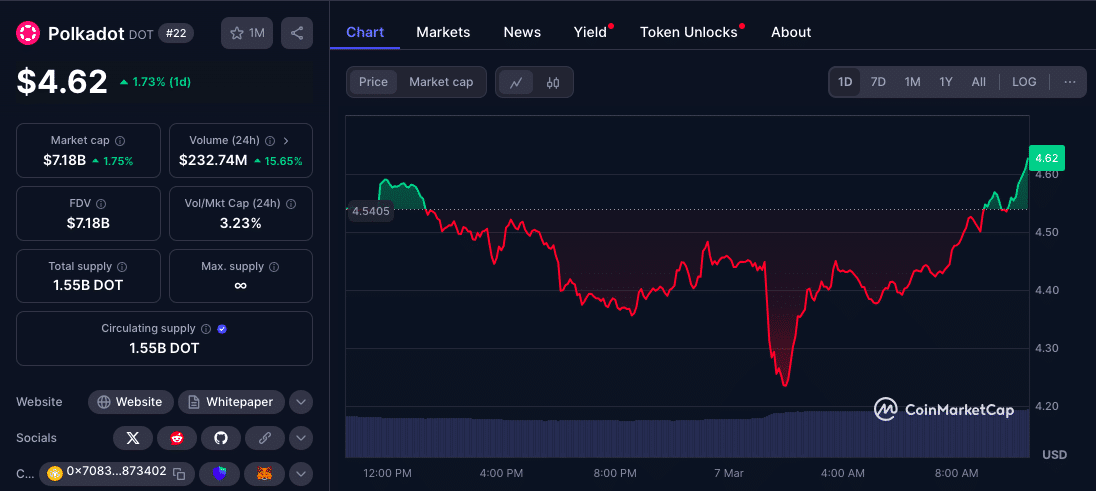

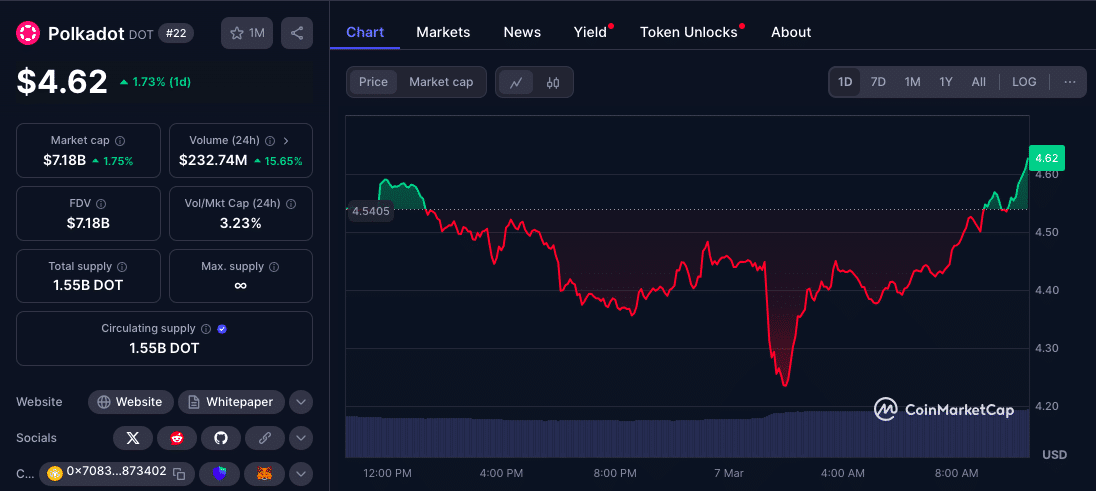

While 21Shares and Grayscale push for ETF approval, Polkadot’s price action remains in focus. DOT has been trading near the $4.50 mark, attempting to stabilize above its key support at $4.

Technical analysis suggests that DOT has formed a falling wedge pattern, a bullish reversal setup characterized by lower highs and lower lows converging into a tightening range. This indicates that selling pressure is weakening, and a breakout may be imminent.

Key price levels to watch:

- Resistance: If DOT breaks above $10, it could confirm the wedge breakout, potentially signaling a 170% rally.

- Support: If DOT falls below $4, it could invalidate the pattern, leading to a potential retest of $3.60.

Polkadot Price Analysis

| Key Price Levels | Significance |

| $4.00 | Strong support level |

| $3.60 | Potential lower support if $4 is broken |

| $10.00 | Breakout resistance, potential for 170% rally |

Additionally, the launch of Polkadot 2.0 in Q1 2025 could serve as a strong fundamental catalyst, improving network scalability and developer accessibility. With an early testnet already live on Kusama, anticipation is building for the full release.

Expert Insights: How the Polkadot ETF and 2.0 Upgrade Could Reshape the Market

As 21Shares pushes forward with its Polkadot ETF filing, experts are debating whether this move could drive institutional adoption or face regulatory roadblocks. Historically, ETF approvals have fueled market rallies, but the SEC’s stance on altcoin-backed ETFs remains uncertain. Meanwhile, Polkadot 2.0’s launch adds another layer of anticipation, with analysts suggesting that improved network efficiency could strengthen DOT’s long-term position in the evolving crypto landscape.

Kevin Carter, ETF Market Analyst:

“If the SEC approves a spot Polkadot ETF, it could attract institutional interest similar to Bitcoin and Ethereum ETFs. However, regulatory uncertainty remains a major hurdle.”

Elaine Murphy, Crypto Strategist:

“With Polkadot 2.0 launching soon, we could see renewed interest in DOT, especially if ETF approval coincides with positive sentiment around network upgrades.”

Paul Matthews, Technical Analyst:

“DOT’s falling wedge pattern is a textbook bullish setup. If it holds $4 and breaks above resistance, we could see a strong rally in the coming weeks.”

Final Verdict: Is DOT on the Verge of a Major Rally?

With 21Shares and Grayscale advancing their Polkadot ETF filings, institutional interest in DOT is clearly growing. If approved, the ETF could act as a major bullish catalyst, opening the doors for greater adoption and liquidity. At the same time, Polkadot 2.0’s upcoming launch is fueling speculation about DOT’s long-term potential, particularly as network upgrades improve scalability and developer engagement.

For now, all eyes are on the SEC and key resistance levels. If DOT holds $4 and breaks out above $10, it could trigger a sharp upward move; but failure to maintain support could result in further downside pressure.

Stay updated with Deythere as we’re available around the clock, providing you with updated information about the state of the crypto world.

FAQs

1. Why is 21Shares filing for a Polkadot ETF?

21Shares is expanding its crypto ETF offerings, aiming to bring institutional exposure to Polkadot (DOT). If approved, it could increase adoption and liquidity for DOT.

2. How does Polkadot 2.0 impact DOT’s price?

Polkadot 2.0 will enhance network scalability and developer accessibility, potentially boosting DOT’s utility and long-term value. An ETF approval alongside this upgrade could drive demand.

3. What price levels should DOT traders watch?

DOT is holding key support at $4. A break above $10 would confirm a bullish breakout, while a drop below $4 could lead to further downside toward $3.60.

4. When will the SEC make a decision on the Polkadot ETF?

There’s no official timeline, but historically, crypto ETF approvals take months. The SEC’s recent stance on altcoin ETFs suggests a longer review process.

Glossary

Spot Polkadot ETF: An exchange-traded fund that holds actual Polkadot (DOT) tokens, allowing investors to gain exposure without direct ownership.

Falling Wedge Pattern: A bullish technical formation that suggests decreasing selling pressure, often preceding a breakout.

Polkadot 2.0: A major network upgrade designed to enhance scalability and developer tools, expected to improve ecosystem efficiency.

SEC Approval Process: The U.S. Securities and Exchange Commission’s

References

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments involve high risk, and past performance does not guarantee future results. Always do your own research (DYOR) before making investment decisions.