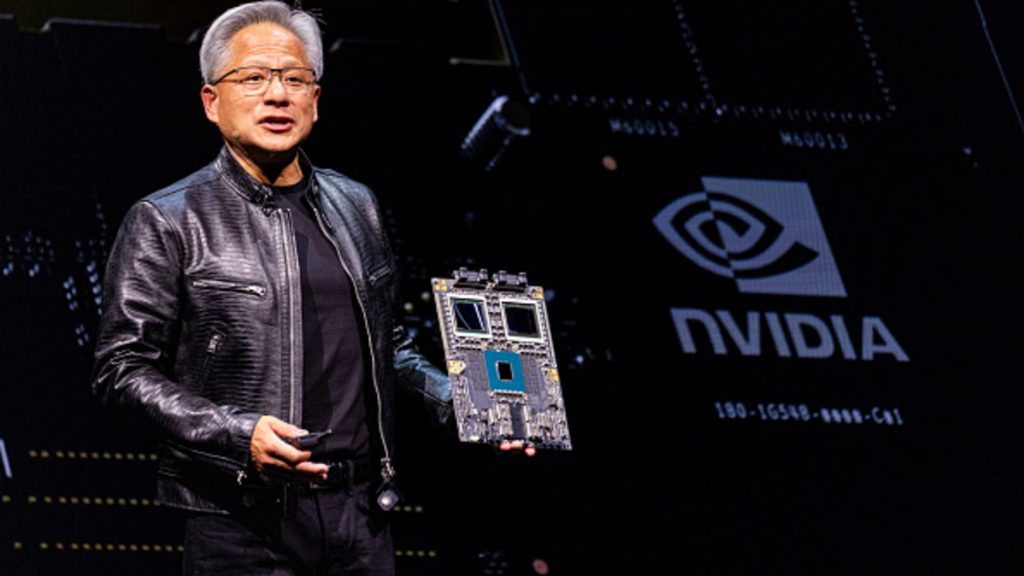

Leading chipmaker and tech giant Nvidia recently made public all the details about the U.S. stocks that it owns. The data shows that the firm owns stocks of other top AI companies, signifying it investing heavily in the sector. According to the latest 13-F filing, Nvidia has invested hundreds of millions of dollars into AI companies. The firm owns only six stocks and the majority of them deal in the AI sector.

Also Read: Ripple CEO Blasts SEC Appeal as ‘Insanity’ – What’s Next for XRP?

Nvidia: Here’s the U.S. Stocks the Company Owns

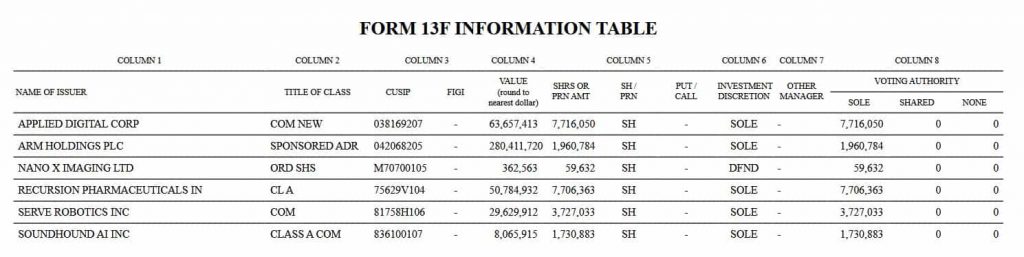

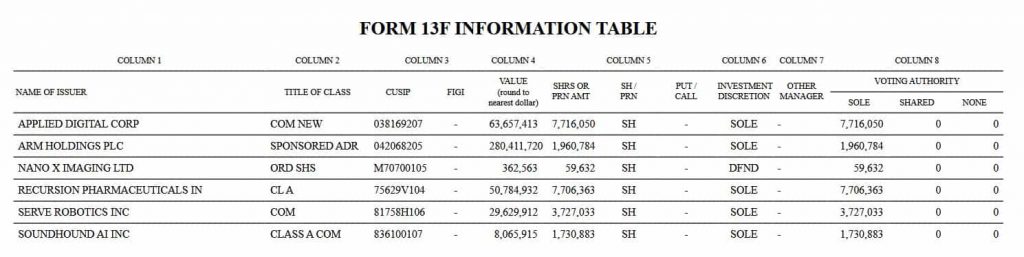

Nvidia’s filing shows that the company owns six U.S. stocks: Arm Holdings (ARM), Applied Digital Corp (APLD), Recursion Pharmaceuticals (RXRX), Nano X Imaging Ltd (NNOX), Serve Robotics Inc (SERV), and Soundhound AI Inc (SOUN).

Also Read: Cryptocurrency: 3 Coins Best For Cross Border Transactions Per Grok

The tech firm owns the highest stocks in Arm Holdings, worth a staggering $280.4 million, with 1,960,784 shares. Nvidia’s second-highest investment is in Applied Digital Corp, which owns $63.6 million worth of stocks.

Recursion Pharmaceuticals, though, is a pharma company that utilizes AI for the purpose of drug discovery. Overall, Nvidia’s filings show that it is strongly positioned towards AI and takes the sector seriously. The company is also working towards the launch of its own AI and ushering into a new era of technology. The stocks that Nvidia owns could generate huge profits when the AI sector grows in the coming years.

Also Read: Bitcoin Hits $99,000: New ATH Before Donald Trump Takes Oath?

What Next For NVDA?

NVDA stock entered 2025 on the back foot as the U.S. imposed AI chip export curbs. The move will limit Nvidia’s export of AI chips and stunt its profits, as 56% of its revenues come from overseas customers. However, investors are confident that the Trump administration could reverse the curbs allowing the firm to continue business. Buying the dips on NVDA could prove beneficial as it’s now at its lowest point. A rally from here could take its price to new highs, generating stellar profits to investors.