Michael Saylor has always been an ambitious visionary. His latest proposal aims to upend traditional finance through strategic accumulation and utilization of the premier digital asset, Bitcoin. Central to the plan is the formation of a sizable Bitcoin stockpile by the United States, which, according to Saylor’s calculations, could yield astronomical returns far exceeding the country’s towering national debt obligations.

If actualized, it would solidify America’s dominance in the rapidly expanding digital economic sphere for decades to come, just as the previous financial system enters its twilight years. The potential prize of over $81 trillion for taxpayers makes it an offer that leaders may be foolish to refuse, though hurdles abound on the road to realizing Saylor’s ambitious design.

A Strategic Bitcoin Reserve: The $81 Trillion Proposition

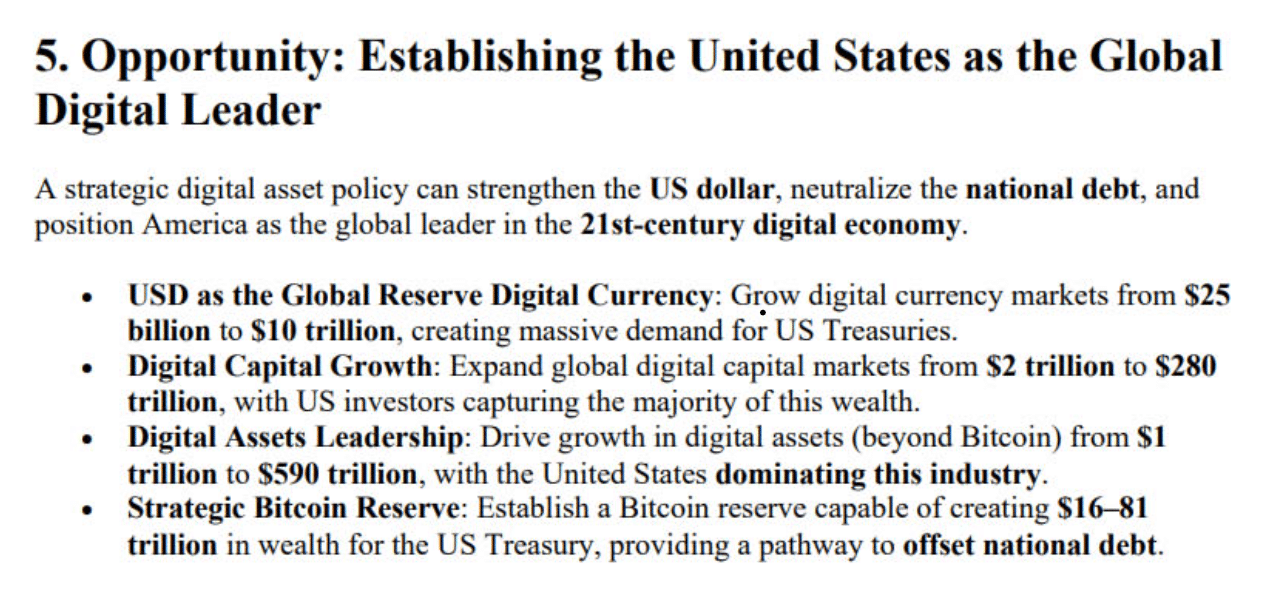

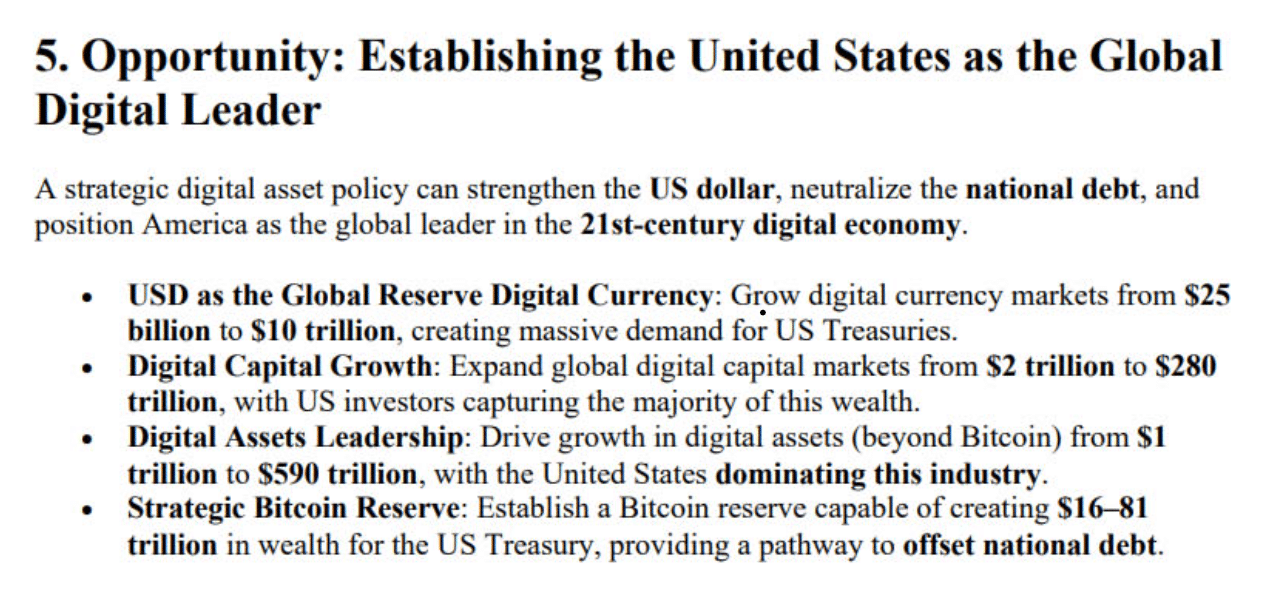

Saylor’s framework proposes unlocking untold wealth by amassing Bitcoin reserves. With a sizable hoard, he calculates the nation could glean $16 to $81 trillion, addressing the ballooning debt burden.

“Forging ahead with a digital asset strategy strengthens the dollar’s position, offsets obligations, and ensures American leadership in tomorrow’s digital economy,”

stated Saylor.

This idea emerges as policymakers cast about novel answers to the debt dilemma, with obligations reaching unprecedented scale. Saylor’s vision relies on Bitcoin appreciating dramatically in time, suggesting an early, substantial bet could reward treasuries handsomely. Meanwhile, others caution that cryptocurrency remains enigmatic, with its long-term trajectory unclear. As the debt debate intensifies, all approaches warrant scrutiny.

Defining Digital Assets: A Clear Taxonomy

In his seminal framework, Michael Saylor expounded upon the crucial importance of precisely defining the diverse forms of digital holdings. He segmented these nascent assets into six distinctly unique classifications: digital commodities like Bitcoin, digital securities, digital currencies, digital tokens, non-fungible tokens or NFTs, and asset-backed digital receipts. This categorization aims to imbue regulatory lucidity, cultivating an environment where pioneering innovations may flourish while still ensuring adherence and safety.

Through delineating these sectors, Saylor believes the United States can construct a clear and efficient marketplace for digital assets, enticing institutional investment and encouraging more widespread adoption.

“Rules for digital assets must prioritize efficiency and new ideas over hurdles and bureaucracy,”

he commented.

Economic Expansion: From Trillions to Quadrillions

Saylor’s ambitions extend beyond debt alleviation. He envisions that with a prudent digital resource strategy, the United States could broaden international digital capital markets from $2 trillion to $280 trillion, with the majority of this wealth captured by American investors. Furthermore, he foresees digital asset markets beyond Bitcoin growing from $1 trillion to $590 trillion, confirming U.S. leadership in the sector.

Such amplification could drive significant demand for U.S. Treasuries, reinforce the dollar’s position as the global reserve currency, and catalyze a renaissance in 21st-century capital markets. According to Saylor, this approach would empower millions of enterprises, propel economic development, and generate trillions in value. He argues that strategically developing digital asset infrastructure could simultaneously settle public debt and solidify American economic supremacy for generations to come.

Critics Weigh In: Skepticism and Concerns

Despite the lofty visions, Saylor’s plan encountered opposition. Economist and Bitcoin doubter Peter Schiff rejected the notion, proclaiming, “It would weaken the dollar, exacerbate America’s liabilities, and render the United States an object of ridicule on the world stage.”

Detractors argue that Bitcoin’s unpredictability poses serious perils, and depending on such holdings to reduce national debt could result in financial volatility. They also express worries about the practicality of amassing a sizeable Bitcoin cache without disturbing the marketplace and prospective regulatory barriers.

Conclusion

Michael Saylor’s bold Digital Assets Framework proposes leveraging Bitcoin to tackle rising national debt levels and stimulate the economy. By advocating for strategic Bitcoin stockpiling and precise definitions for digital currencies, Saylor aims to position America as a pioneer in the emerging digital financial realm.

While generating controversy and doubts, the plan highlights cryptocurrencies’ growing importance in modern fiscal dialogue. As leaders struggle to navigate intricate digital finance issues, Saylor’s vision presents a thought-provoking means of capitalizing on crypto’s capacity to fulfil nationwide monetary goals.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

What is Michael Saylor’s proposed Bitcoin reserve plan?

Saylor envisioned the creation of an immense United States Bitcoin stockpile, capable of generating trillions for the Treasury and helping offset the country’s ballooning debt load. The proposed reserve aimed to supercharge economic growth.

How would the Bitcoin reserve benefit the U.S. economy?

The plan promised to reinforce the dollar, encourage thriving digital markets, and position the U.S. as a pioneer in the emerging digital financial universe. By tapping into Bitcoin’s potential, debt reduction could follow.

What are the criticisms of this proposal?

Sceptics warned that the chief cryptocurrency’s notorious instability and risky nature might threaten more harm than good. Additionally, successfully implementing a reserve of that scale presented an enormous logistical hurdle, causing some to doubt feasibility.