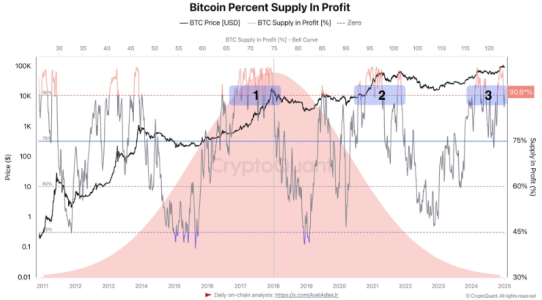

As Bitcoin’s price continues to rise, 90% of its total supply is currently in profit, according to crypto analyst Axel Adler Jr.. Highlighting this significant milestone on X, Adler suggested that the market is showing signs of a bullish trend, similar to the trajectory seen during Bitcoin’s 2017 cycle.

He noted that, barring any unexpected “black swan” events, the current market conditions could sustain this upward momentum, with minimal pullbacks to the 80% profit level. Adler also speculated that the 2021 cycle might have followed this bullish pattern if not for the China mining ban that disrupted market dynamics.

Key Insights into Bitcoin’s Bullish Momentum

1. Profitability Milestone

- 90% Supply in Profit: A clear indication that most Bitcoin holders are seeing gains, signaling strong market sentiment.

- Historical Comparison: Similar conditions were observed during the 2017 bull run, which saw Bitcoin reach then-record highs.

2. Minimal Pullback Expected

- Adler predicts potential corrections could take Bitcoin’s profitable supply to 80%, but these are likely to be short-lived.

- Past cycles have shown that profitability levels between 80%-90% often precede new all-time highs.

3. Resilience Against Disruptions

- While the 2021 cycle faced challenges like China’s mining ban, the current market shows greater resilience with diversified mining operations and robust institutional adoption.

Factors Driving Bitcoin’s Bullish Outlook

1. Institutional Adoption

- Increased participation from institutions, including ETFs and corporate treasuries, is stabilizing and bolstering the market.

- Companies like MicroStrategy and Tesla continue to expand their Bitcoin holdings, signaling long-term confidence.

2. Global Economic Conditions

- Bitcoin is increasingly viewed as a hedge against inflation, attracting both retail and institutional investors amid global economic uncertainty.

3. Regulatory Clarity

- The growing regulatory acceptance of Bitcoin, particularly in major markets like the U.S., is reducing uncertainty and fostering growth.

Historical Parallels: 2017 vs. 2025

| Metric | 2017 Cycle | 2025 Cycle |

|---|---|---|

| Supply in Profit | 90% (peak bull run) | 90% (current trend) |

| Major Disruptions | None | China’s mining ban (2021) recovery complete |

| Market Sentiment | Overwhelmingly Bullish | Positive, with cautious optimism |

| Institutional Involvement | Minimal | Significant, driving stability |

What Could Derail the Bullish Trend?

Despite the positive outlook, certain factors could disrupt Bitcoin’s momentum:

- Black Swan Events: Geopolitical crises, regulatory crackdowns, or economic downturns.

- Profit-Taking by Whales: Large-scale sell-offs by early adopters or institutional players could trigger temporary corrections.

- Macro Market Shifts: Changes in global monetary policy or economic conditions impacting liquidity and risk appetite.

FAQs

What does it mean that 90% of Bitcoin supply is in profit?

This indicates that 90% of Bitcoin’s total circulating supply was acquired at prices lower than the current market price, reflecting strong gains for most holders.

How does Bitcoin’s current cycle compare to 2017?

The 2025 cycle shows similarities to 2017, with high profitability levels and strong market sentiment. However, the current cycle benefits from greater institutional involvement and regulatory clarity.

What factors could sustain Bitcoin’s bullish trend?

- Continued institutional adoption.

- Growing use of Bitcoin as an inflation hedge.

- Regulatory clarity in major markets.

Could there still be a significant correction?

While minor pullbacks are expected, analysts like Adler suggest corrections will likely be limited to profitability levels of 80%.

How did the 2021 mining ban affect Bitcoin’s market?

China’s mining ban in 2021 caused a temporary drop in Bitcoin’s price and mining hash rate. However, the market has since rebounded as mining operations relocated to other regions.

Conclusion

With 90% of Bitcoin’s supply in profit, the current market reflects a strong bullish trend, reminiscent of the 2017 cycle. While potential risks remain, the growing influence of institutional investors, improved market resilience, and favorable global conditions point to a sustained upward trajectory.

Investors and traders should remain cautious but optimistic as Bitcoin continues to evolve as a leading asset in the global financial landscape.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.