CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

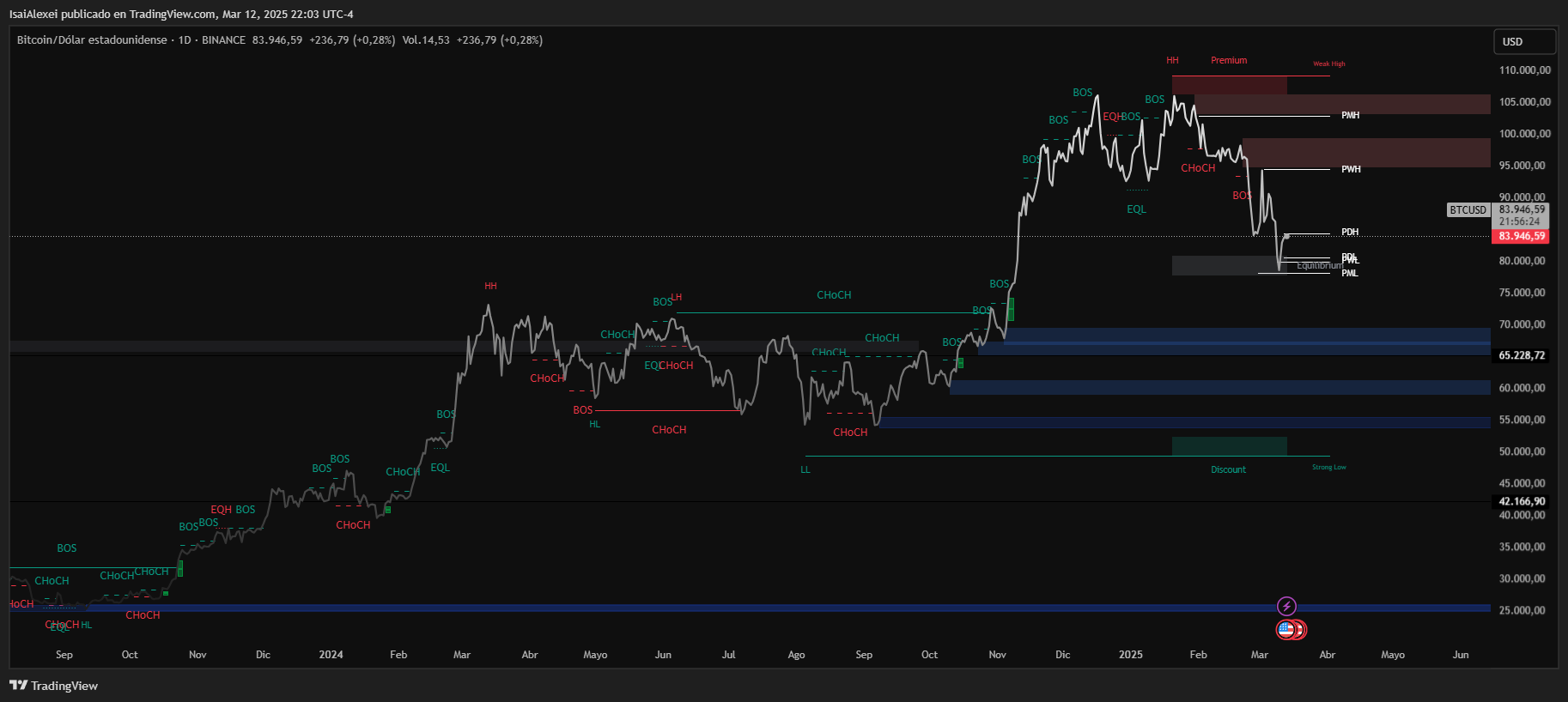

- Bitcoin’s recent 30% correction aligns with historical cycles; analysts anticipate volatility, citing $70,000–$75,000 as a potential short-term floor.

- The SEC’s shift toward collaborative dialogue, rather than litigation, signals incremental progress for crypto regulatory frameworks.

Crypto markets face downward pressure across crypto assets, equities, and social media platforms. Crypto influencer Wendy O views this as typical market behavior. “Bitcoin has volatile moves up, we have volatile moves down” she stated on a recent podcast, referencing a 50% price drop in April 2021, when Bitcoin fell from $65,000 to $30,000 before recovering. She emphasized that each market cycle follows distinct patterns.

Bitcoin recently reached a record high of $109,000 but has since declined. Wendy O anticipates further price adjustments, aligning with trader Arthur Hayes’ prediction of a drop to $70,000–$75,000—a 30% correction. “The monthly chart looks unfavorable,” she noted, adding that she prioritizes longer-term strategies over short-term trades. David Brickell of FRNT echoed this, stating that four-year cycles historically include such pullbacks.

Wendy O highlighted macroeconomic factors influencing crypto markets. She argued that U.S. economic struggles, including rising costs for essentials like food and energy, are overlooked in official inflation metrics. “Americans are in a recession,” she said, dismissing textbook definitions. She expects President Trump to address broader economic stability before advancing crypto policies, with potential regulatory clarity emerging after mid-2025.

Despite current volatility, Wendy O maintains a long-term bullish outlook. She cited regulatory progress, including the SEC’s willingness to engage with industry participants rather than pursue litigation. “Markets are positioned to perform well,” she said, urging investors to adopt patience.

Short-term traders may face challenges, but Wendy O’s analysis underscores a recurring theme: Crypto markets evolve through phases of rapid growth and contraction, often mirroring broader economic conditions. While prices fluctuate, structural shifts in regulation and macroeconomic policy could shape the next phase of adoption.

The interplay between asset volatility, regulatory dialogue, and economic recovery timelines suggests a complex path ahead. For now, market traders are advised to weigh immediate risks against longer-term opportunities in an environment where certainty remains elusive.

As of today, Bitcoin (BTC) is trading at $83,926, reflecting a 0.37% increase in the past 24 hours. Over the past week, BTC has dropped by 7.31%, and over the last month, it has declined 13.84%. Despite this short-term pullback, Bitcoin remains strong over the past six months with a 38.68% gain, and it is up 17.49% year-over-year. However, its year-to-date performance is down 10.04%, indicating some correction after its recent bullish rally.

Bitcoin’s market capitalization stands at $1.66 trillion, with a 24-hour trading volume of $39.87 billion. The cryptocurrency remains below its all-time high of $109,356, but strong institutional interest—such as BlackRock holding nearly $52 billion in BTC—continues to support long-term buying pressure.

Additionally, recent political moves, such as President Trump’s order to create a “Strategic Bitcoin Reserve”, have fueled speculation about government involvement in BTC accumulation.