CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Despite broader market improvements and a weaker US dollar, meme coins continue to underperform. Meanwhile, Robinhood is expanding its crypto offerings with new meme coin listings, capitalizing on the more favorable regulatory shifts under the Trump administration. However, concerns over politically backed meme coins persist, especially after the Libra (LIBRA) token collapse.

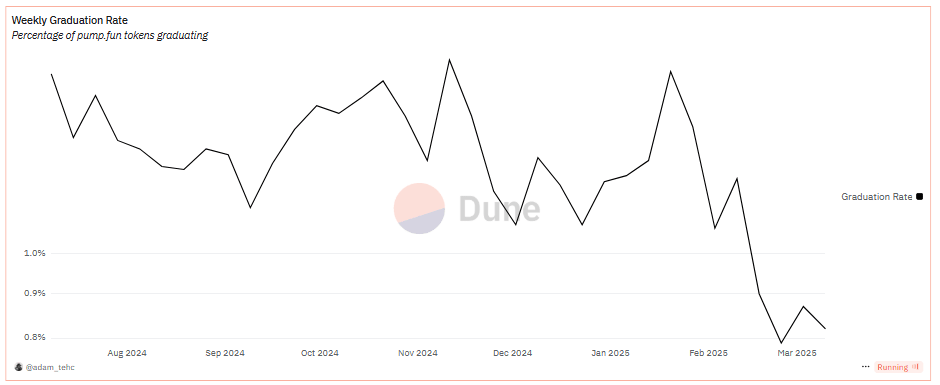

Pump.fun Graduation Rate Hits Record Lows

The meme coin market on Pump.fun is facing major challenges, with the platform’s “graduation rate” falling to below 1% for a fourth consecutive week. This metric refers to the percentage of tokens that successfully transition from the incubation phase to full tradability on a Solana decentralized exchange (DEX) after meeting liquidity and trading requirements. According to Dune Analytics data, this is the first time Pump.fun’s graduation rate stayed consistently below 1% over a four-week period.

Pump.fun weekly graduation rate (Source: Dune Analytics)

Historically, the platform’s graduation rate was particularly high. The best-performing week came in November of 2024 when 1.67% of launched tokens moved to the open market. However, the importance of this percentage was amplified by the sheer volume of tokens that were created at the time.

During the week beginning Nov. 11, around 323,000 tokens were launched on Pump.fun. This means that approximately 5,400 tokens successfully graduated into Solana’s DeFi ecosystem. In contrast, with a decline in token creation on both Pump.fun and Solana, the average weekly graduation rate over the past month dropped to around 1,500 tokens.

The continued struggles of meme coins proves that there is waning investor enthusiasm, as these assets have increasingly become synonymous with speculative gambling or quick-profit schemes for their creators. Despite broader market improvements, meme coins are failing to respond to positive liquidity signals.

The weakening of the US dollar, which has historically improved liquidity conditions for risk assets, has not led to a recovery in the sector. Matrixport analysts pointed out that the US Dollar Index (DXY) peaked at 107.61 on Feb. 28 before declining to 103.95 on March 14, signaling a potential improvement in liquidity. Despite these shifts, meme coins still underperform, with no signs of a meaningful resurgence.

TRUMP’s all-time price action (Source: CoinMarketCap)

Even high-profile people entering the meme coin space have not been able to reverse the trend. US President Donald Trump’s token plummeted from its all-time high that was set on Jan. 19. While meme coins were once a dominant narrative in the bull market, their persistent decline suggests that there is a major shift in investor sentiment. Matrixport’s report proves this by stating that although liquidity conditions have improved and inflation data has shown marginal progress, the meme coin sector is still in a prolonged slump.

Robinhood Expands With New Meme Coin Listings

Despite the troubles that meme coins are facing, Robinhood recently expanded its crypto offerings by listing three new meme coins—Pengu (PENGU), Pnut (PNUT), and Popcat (POPCAT). The new listings were announced on March 13, and are part of Robinhood’s broader strategy to compete with major exchanges like Coinbase and Binance.US both of which have been ramping up their own meme coin listings after US President Donald Trump’s election victory in November.

The company pointed to strong customer demand for additional meme coin trading options as one of the main reasons for the listings. In addition to the new listings, Robinhood already supports Dogecoin (DOGE), which is the largest meme coin by market capitalization, and launched crypto futures trading in January. Johann Kerbrat, vice president and general manager of Robinhood Crypto, said that the company wants to provide customers with what they want, as long as an offering can be provided safely.

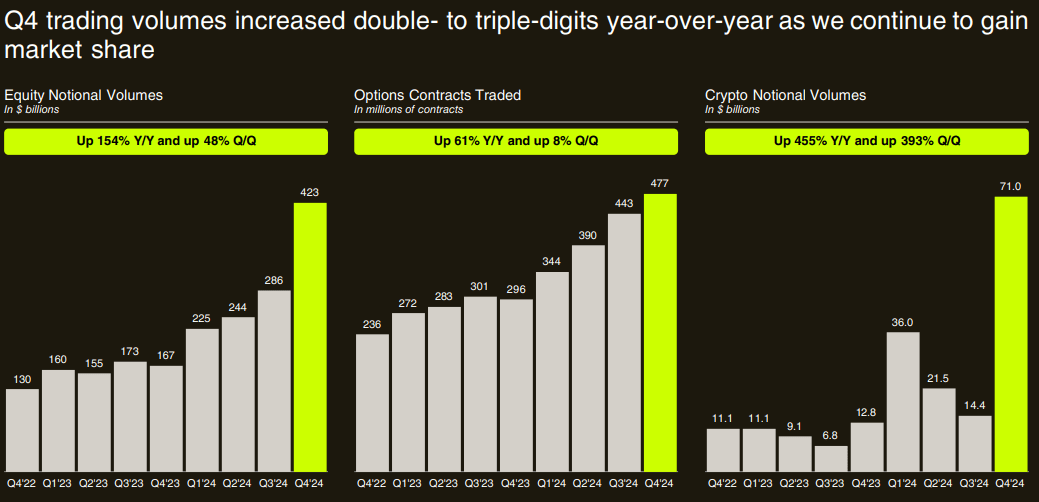

Robinhood is primarily known as a stock trading platform, and has been investing in its crypto segment since last year. The brokerage reported a staggering 400% year-over-year increase in crypto revenues for February, driven by Trump’s election win and a broad recovery in crypto market prices.

Robinhood Q4 2024 results (Source: Robinhood)

Regulatory shifts have also played a crucial role in Robinhood’s crypto expansion. Trump pledged to transform the United States into the “world’s crypto capital” and has appointed many industry-friendly leaders to key regulatory positions. In February, the US Securities and Exchange Commission (SEC) also announced that most meme coins do not qualify as securities and therefore do not fall under its jurisdiction.

This was a big policy reversal from the stance of the Biden administration, during which former SEC Chair Gary Gensler held firm that most cryptocurrencies should be classified as securities. The same month, the SEC also dropped an enforcement action against Robinhood over alleged securities law violations tied to its crypto trading platform.

Political Meme Coins Under Fire

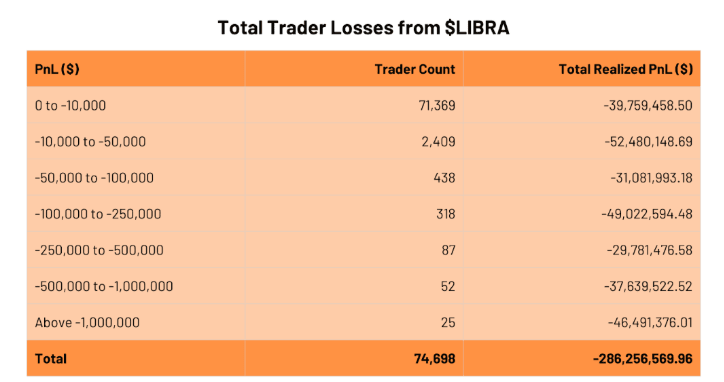

Meanwhile, industry experts are raising concerns about politically endorsed cryptocurrencies, and believe there is a need for stronger investor protections and liquidity safeguards to prevent another market collapse. These warnings come after the Libra (LIBRA) token, which was endorsed by Argentine President Javier Milei, suffered a catastrophic $4 billion market cap wipeout because of insider cash-outs. Blockchain analytics firm DWF Labs reported that at least eight insider wallets withdrew $107 million in liquidity, triggering the collapse and shaking investor confidence.

To avoid similar failures, tokens backed by high-profile political figures will need more robust safety measures, like liquidity locking or making tokens in liquidity pools non-sellable for a predetermined period. DWF Labs revealed in a report that these mechanisms could help prevent mass sell-offs and sudden liquidity drains.

The report also placed a lot of emphasis on how important it is to limit participation from crypto-sniping bots and large holders, as excessive whale activity can allow insiders to dominate token supply. Andrei Grachev, managing partner at DWF Labs, believes that fair launches are essential to prevent well-funded players from securing disproportionate amounts of a token while retail investors are left at a disadvantage.

(Source: DWF Labs)

The Libra debacle left 74,698 traders with a cumulative loss of $286 million, proving the need for liquidity locking. Grachev said that this safeguard is particularly important during the launch phase of a token, when volatility is at its highest, to maintain a stable trading environment and reduce the risk of quick market crashes.

The fallout from the Libra scandal attracted increased scrutiny from regulators, with New York lawmakers introducing new legislation that is aimed at protecting crypto investors from rug pulls and insider fraud. The incident also reignited discussions about the need for more transparent token launches.

Grachev pointed out that pre-launch wallet transparency and rigorous due diligence from launchpads could help mitigate risks for investors. While launching any token carries inherent risks, he argued that the transparency of blockchain technology allows launchpads to provide users with the tools they need to make more informed decisions.