- XRP exchange inflows hit $28M ahead of RLUSD global launch

- MACD signals increasing bearish momentum

- Technical analysis suggests potential 10% correction

As Ripple prepares for the global launch of its RLUSD stablecoin, XRP experiences an interesting market dynamic where positive news has paradoxically triggered increased selling pressure. This phenomenon, while seemingly counterintuitive, reveals important insights about market psychology and short-term price movements.

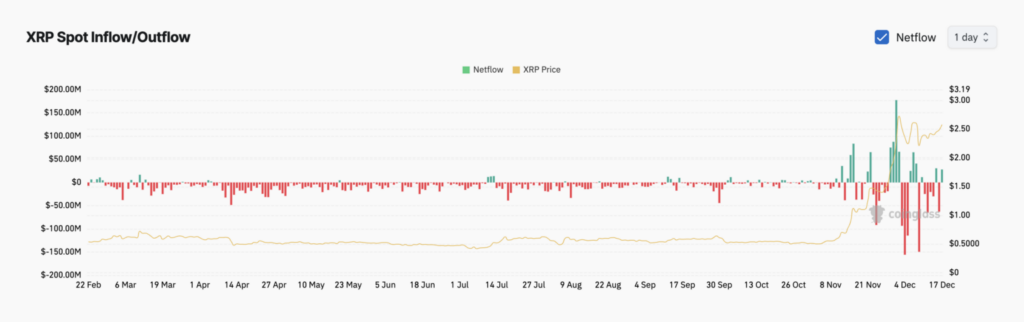

XRP Exchange Inflow Analysis

The surge in exchange inflows to $28 million provides a critical window into investor behavior. When cryptocurrency moves to exchanges in large volumes, it typically signals that holders are positioning themselves to sell.

Think of exchanges as the marketplace where crypto assets are converted to other currencies – when more assets arrive at these marketplaces, it often precedes increased selling activity.

The Moving Average Convergence Divergence (MACD) adds technical validation to the cautious outlook. The positioning of the MACD line (blue) below the signal line (orange) indicates deteriorating momentum. This technical formation often precedes price corrections, particularly when combined with increased exchange inflows.

The RLUSD stablecoin launch represents a significant milestone for Ripple, with major exchanges including Uphold, MoonPay, Archax, and CoinMENA participating in the initial rollout. Additional platforms like Bitso, Bullish, Bitstamp, and others are expected to follow.

While this development sparked a 10% price increase, the market’s reaction suggests some investors view this as an opportunity to realize profits.

The convergence of increasing exchange inflows and bearish technical signals suggests XRP could experience a correction toward $2.31, representing a 10% decline from current levels.

However, the successful launch of RLUSD could shift market sentiment, potentially driving prices toward the recent multi-year high of $2.90. The resolution of this tension between positive fundamental developments and short-term selling pressure will likely determine XRP’s immediate price direction.