CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Indeed, Hong Kong has made noteworthy progress in establishing governance over digital currencies, especially stablecoins connected to traditional forms of money. In early December of 2024, the government issued the Stablecoins Act in the Gazette, representing a defining moment in the creation of a complete system of rules for fiat-backed stablecoins.

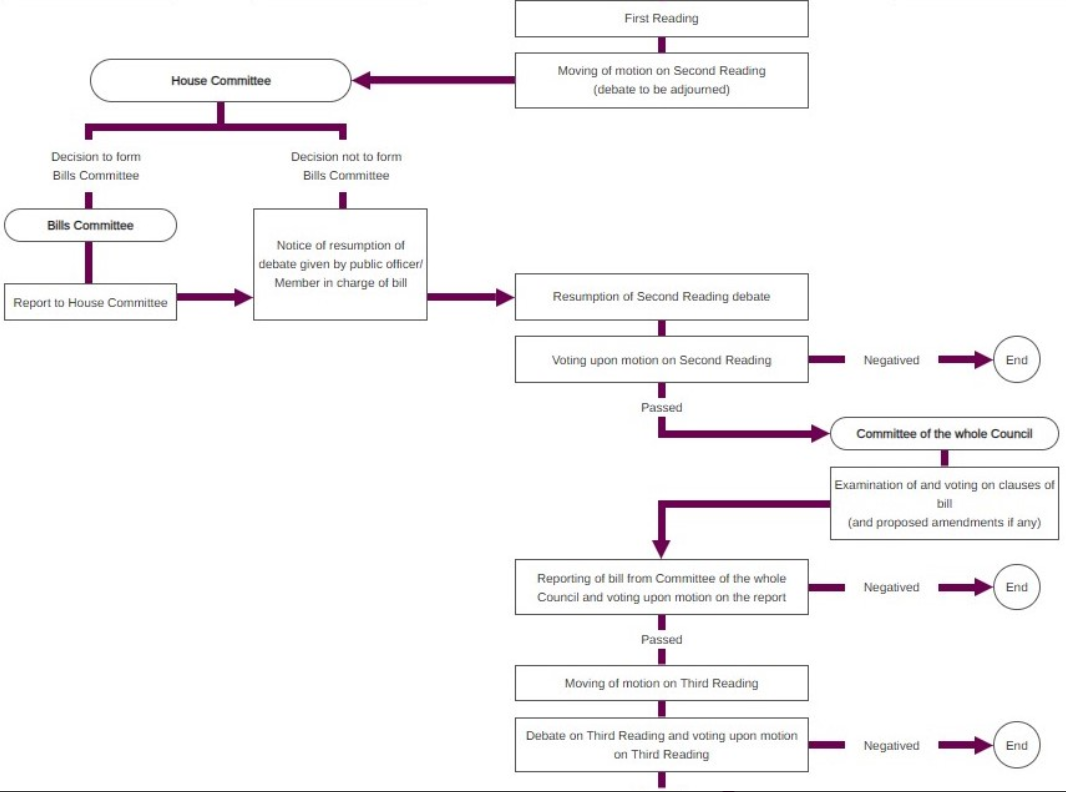

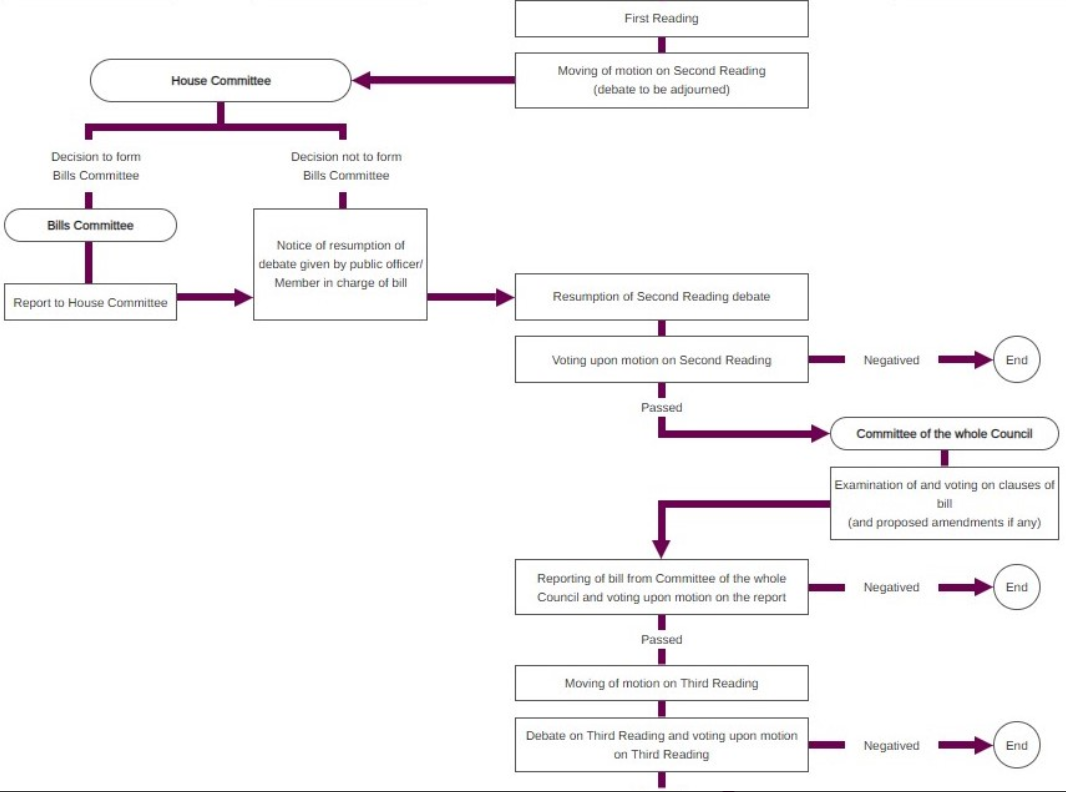

The proposed legislation was brought before the Legislative Council for initial review on December 18th of that same year. While work remains, Hong Kong’s commitment to reasonable and well-considered supervision of this emerging economic sector is evident.

Key Provisions of the Stablecoins Bill

The proposed legislation focuses on three main areas:

Regulation of Stablecoin Issuance in Hong Kong: Any entity seeking to release a stablecoin backed by the Hong Kong dollar must obtain prior authorization from the regulatory body, the Hong Kong Monetary Authority. The licensing procedure entails a meticulous vetting of the issuer’s governance structures, financial reserves, and mechanisms established to preserve stablecoin value parity.

Limitations on Marketing Stablecoins: Only duly licensed and regulated firms will be granted permission to advertise or promote stablecoins to the public within Hong Kong. This regulatory manoeuvre aims to confirm that entities conducting all stablecoin-related activities have cleared the required compliance standards, thereby shielding consumers from potential dangers linked with unstable or unsupervised offerings.

Protecting Stablecoin Users: The proposed law spells out provisions fashioned to safeguard users, such as demands for transparency, sufficient disclosure of relevant information, and systems to guarantee redemptions can be made at nominal worth. These protective measures are intended to reinforce public belief in employing stablecoins throughout Hong Kong’s financial ecosystem.

Regulatory Perspectives

Eddie Yue, Chief Executive of the HKMA, emphasized the importance of firm oversight for the sustainable evolution of the steady coin ecosystem in Hong Kong. He stated, “Extensive consultations helped shape regulatory specifics after considering divergent stakeholder perspectives.”

Similarly, Christopher Hui, Secretary for Financial Services and the Treasury, commented, “Comparable activities warrant similar risk management and regulation. Fulfilling FSB obligations, this risk-focused plan fosters robust protection for innovation aligning with Hong Kong’s balanced virtual asset progress.”

Global Context and Implications

Hong Kong’s move mirrors global efforts to regulate stablecoins, most notably the European Union’s comprehensive Markets in Crypto-Assets (MiCA) regulation. MiCA has profoundly reshaped the stablecoin landscape across Europe, as issuers demonstrating regulatory compliance have captured a substantial portion of the market. By implementing a parallel framework, Hong Kong aims to cultivate fintech innovation while safeguarding financial stability and consumer interests.

Industry Response

Reaction to the introduction of the Stablecoins Bill from those in the digital finance sphere has been keen. In a statement, legal firm King & Wood Mallesons noted the bill represents a watershed moment in establishing clear and consistent rules for stablecoins in Hong Kong.

As the experts observed, numerous entrepreneurs eager to launch stablecoin ventures in the region previously faced hurdles stemming from the lack of an overarching legal structure; with these guidelines now in place, Hong Kong is well-positioned to strengthen its reputation as a premier global hub for digital currency developments and applications.

Conclusion

As the Stablecoins Bill progresses through the Legislative Council, Hong Kong is poised to establish robust regulations for stablecoins. When implemented, the guidelines would assure consumers through licensing stablecoin issuers

Simultaneously, the rules aim to integrate digital currencies into traditional finance in a prudent manner. By concentrating on licensing, marketing constraints, and investor protections, legislators pursue a balanced strategy. The approach balances responsible growth with ensuring the stability of this emerging technology.

FAQs

1. What is the purpose of Hong Kong’s Stablecoins Bill?

The bill strives to construct a comprehensive administrative framework for stablecoins, with a focus on licensing those who provide them, restricting uncontrolled advertising, and boosting customer security.

2. How will the Stablecoins Bill affect issuers in Hong Kong?

Providers must obtain a permit from the Hong Kong Monetary Authority after fulfilling strict benchmarks, such as sound governance, sufficient financial reserves, and mechanisms ensuring the coin’s purchasing power remains consistent.

3. How does this compare to Europe’s MiCA regulations?

Similar to MiCA, Hong Kong’s proposed law confirms stablecoin activities are policed to shelter customers and preserve financial stability, fostering a belief in the developing digital asset sector.