CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

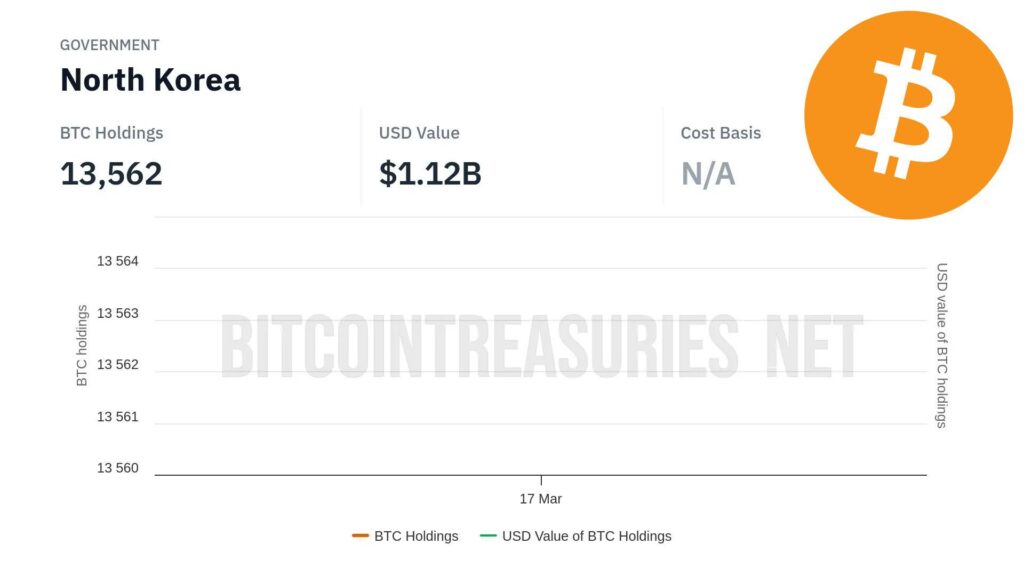

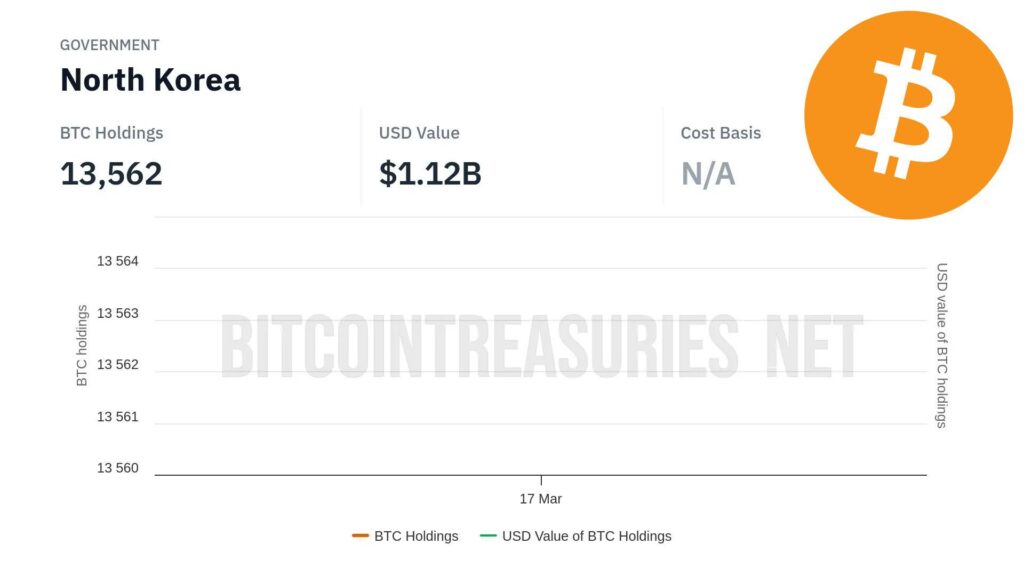

North Korea has been making headlines in the cryptocurrency market. This comes after the recent Bybit hack. North Korea’s state-backed hacker group Lazarus has been active for years now. But the $1.4 billion attack on Bybit put the group under the crypto spotlight. The group was formed back in 2010 and has carried out several attacks since then. As a result, the cryptocurrency community began investigating the group’s Bitcoin (BTC) holdings.

Also Read: Dogecoin: DOGE Primed For A 200% Surge: Here’s When

How Did North Korea Become One of The Largest Holders of BTC?

Even though it was associated with the dark web several years ago, Bitcoin has emerged as a prominent asset in the past decade. Governments from all across the globe have been seen stacking up on the king coin. While countries like El Salvador, Bhutan, and the United States are at the top, North Korea isn’t too far behind. Bhutan has 10,635 BTC, whereas El Salvador holds about 6,117 BTC. The increase in North Korea’s Bitcoin holdings demonstrates the country’s growing interest in using cryptocurrencies to evade international sanctions and finance activities.

The North Korean cyber squad possesses 13,562 BTC, or around $1.14 billion, after converting ETH into BTC following the Bybit hack. North Korea is now the third largest government in the world with Bitcoin holdings. The United Kingdom, with 61,245 BTC, and the United States, with 198,109 BTC have taken over the first two spots.

Also Read: BRICS: New Country Plans to Reduce 25% of Trade Without US Dollar

BTC’s Price Today

The Bitcoin market has been struggling to recover. Despite hitting an all-time high of $109,114.88 at the beginning of the year, the asset was trading 23% below this peak. Bitcoin was priced at $83,237.89, at the time of writing. This comes after a small rise of 0.32% over the past 24 hours. Earlier today, the BTC market spooked its investors as it dropped to a low of $81,179.99.

Also Read: Chainlink (LINK) Price: When Will LINK Reach $24?