Bitcoin (BTC)  $95,705 experienced a rapid decline to $95,199 after nearing the $100,000 mark. This swift drop follows a period of slow increases, and such sharp declines have become familiar occurrences. For altcoins, this decline is one of the speculative movements resulting from low trading volumes towards the year-end. However, institutional demand remains strong. What are the expert opinions on this situation?

$95,705 experienced a rapid decline to $95,199 after nearing the $100,000 mark. This swift drop follows a period of slow increases, and such sharp declines have become familiar occurrences. For altcoins, this decline is one of the speculative movements resulting from low trading volumes towards the year-end. However, institutional demand remains strong. What are the expert opinions on this situation?

Has the Cryptocurrency Decline Ended?

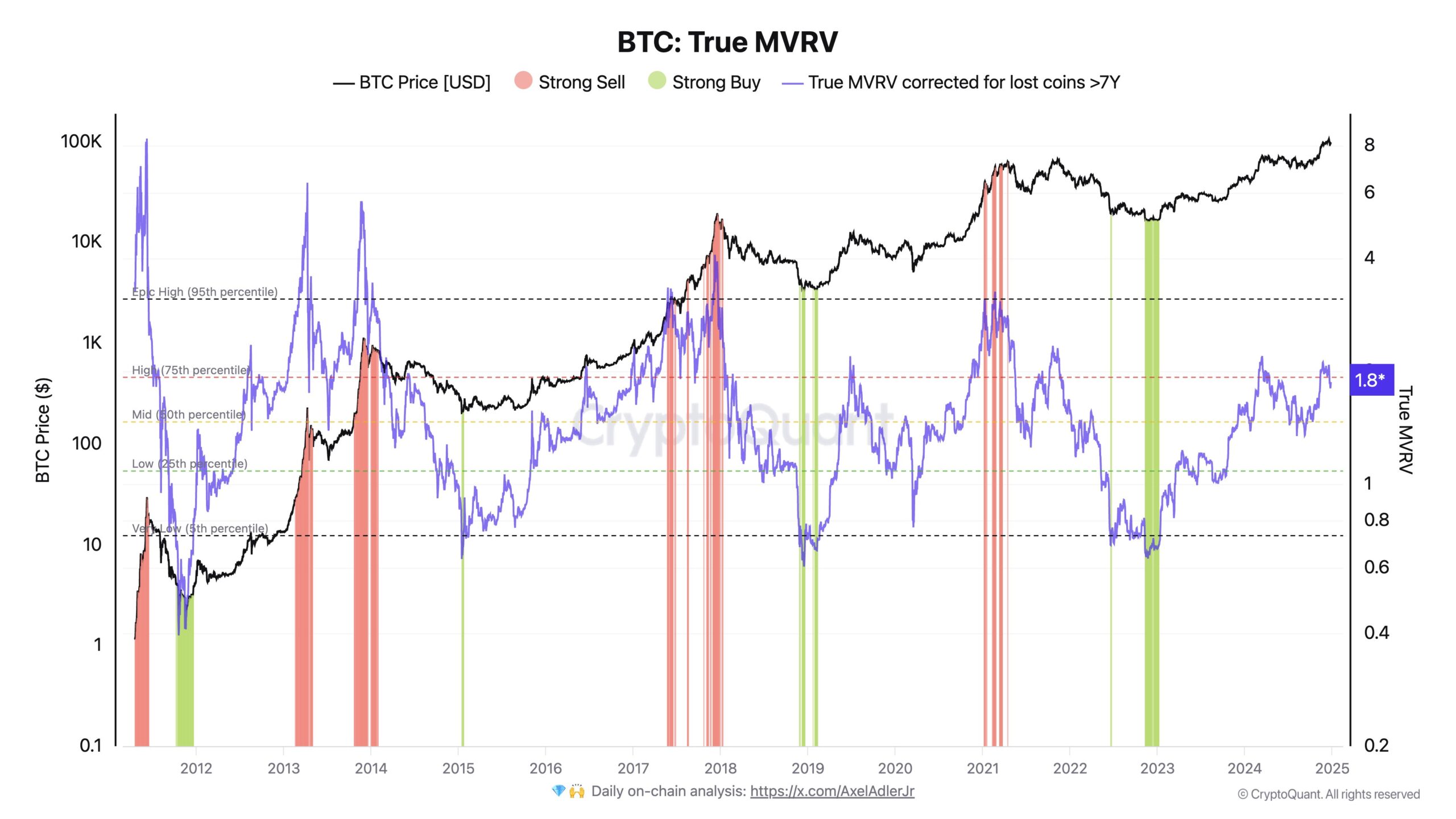

BTC is holding above $90,000, a situation that persists even as the Fed’s optimism for 2025 wavers. Despite the recent drop causing liquidations in futures markets, CryptoQuant CEO Ki Young Ju reassures that the situation is not dire.

The on-chain expert shared a graph and provided comforting statements to investors.

“The narrative of whale accumulation in Bitcoin has become so widespread that it now feels routine.

Just two to three years ago, news of whale accumulation would shock the market. Now, this is no longer surprising but expected information. This reflects the current reality: individual investors are distancing from Bitcoin, allowing whales to dominate the market. It seems that most individuals are aware of this dynamic.

I define a bubble as a period when the market price significantly exceeds incoming capital as measured on-chain. We are clearly in a bull market, with data showing a weekly capital influx of $7 billion into the market.

News of whale accumulation no longer mobilizes people—perhaps due to the bullish trend over the last two years. However, the bull market is not over yet. If Bitcoin turns into a bubble, all analysts will be shouting about the cyclical peak. For now, it is clear that we are not in a bubble. Corrections may occur, but a decline of more than 30% is unlikely during a bull cycle. Even if such a drop happens, it would likely be short-lived, with prices potentially rising by over 30% after the correction.

The peak of this Bitcoin cycle still appears distant. I would like to hear the reasoning from those predicting a bear market. One thing is clear: they are not looking at the on-chain data.”

In today’s market assessment, Carl focused on the price of ETH. At the time of writing, ETH stands at $3,354. According to the analyst, a convincing breakout in the symmetrical triangle could push the price to either $3,980 or $2,920. For now, ETH is lingering at its support line.

Waleed Ahmet, sharing his current forecast for AXS Coin, noted that sustained closures above $4.05 indicate ongoing upward potential, suggesting that prices may exceed $13.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.