CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

This article examines the recent predictions of Capo, a notable figure in the cryptocurrency market, whose forecasts have sparked both admiration and skepticism in 2023. Despite calling out numerous price movements accurately during the bear market last year, Capo found himself facing criticism as the market’s dynamics shifted. In contrast to the prevailing bullish sentiment, Capo’s predictions indicated a downward trend, leading to his mockery within the community. As 2023 unfolds, the crypto clairvoyant continues to draw attention with his latest insights.

Capo’s Crypto Predictions

Capo made headlines in 2022 with his precise forecasts, garnering significant attention. However, there were moments when his predictions fell short, showcasing the inherent unpredictability of the market. As we entered 2023, BTC reclaimed key levels while Capo cautioned that the current situation could be one of the largest bull traps in history. Presently, BTC is witnessing even more significant fluctuations than predicted.

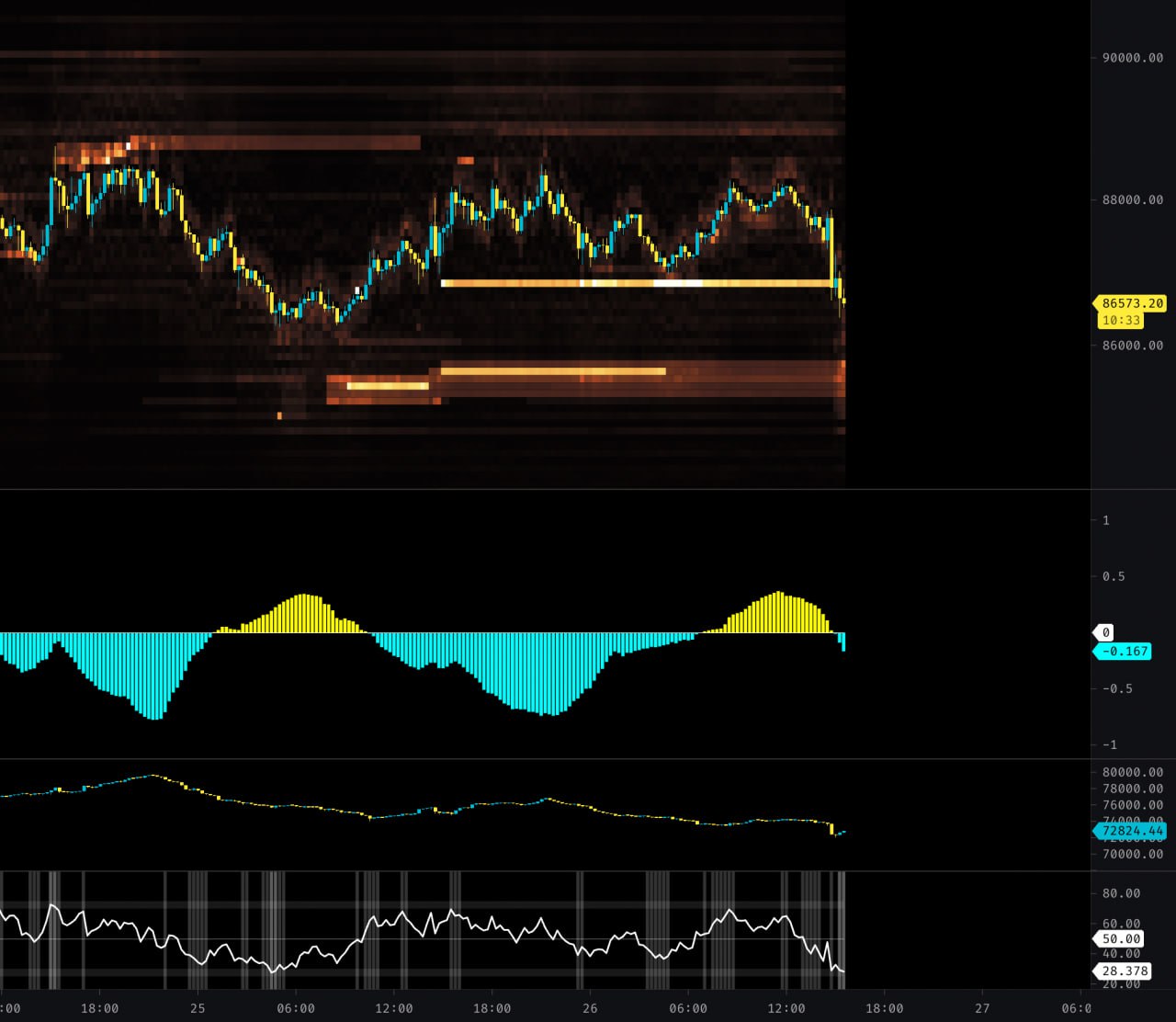

Following a recent decline in BTC’s price, Capo expressed his concerns, stating, “I really dislike this short-term price movement. I want to see a clean breakout above $89,000 for the upward trend to continue.”

He mentioned that the short-term upward trend in altcoins still persists while he searches for additional supporting signals.

Capo expressed satisfaction with NEAR Coin’s response from support, indicating that he targets $4.50 as a price point.

He believes BTC’s recent decline could set the stage for a rebound.

HYPE Coin Developments

The situation for Hyperliquid has become complex. Low liquidity in cryptocurrencies results in speculative trading actions. A similar scenario unfolded with JellyJelly today, where whale movements initiated speculation, prompting Binance and OKX exchanges to consider listing the altcoin for trading. The team announced on Discord that they would delist JELLY perpetual contracts following evidence of suspicious market activities.

“After gathering proof of suspicious market activities, the validator set voted to delist JELLY. All users outside marked addresses will be completely removed from Hyper Foundation. This process will be automatic based on on-chain data. No need to open tickets. Methodology will be detailed in a later announcement.”

Capo shared an updated graph during the article’s preparation, declaring a target price of $10 for HYPE, indicating potential significant losses.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.