CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

Geopolitics and economic turmoils are impacting cryptocurrencies in a way never seen before. Altcoins are navigating a phase of both innovation and market uncertainty as the crypto landscape matures. The future looks optimistic, though, for well-grounded projects with a focus on problem-solving and efficiency.

In this environment, Hedera Hashgraph, or simply Hedera, sets itself apart as a unique, efficient consensus mechanism (i.e., hashgraph) that emphasizes fairness and security. The platform’s mainnet has steadily grown, attracting developers and enterprises to its diverse ecosystem of applications. While many altcoins face challenges from regulatory pressures and market volatility, Hedera’s focus on stability and scalability is promising.

Overall, Hedera stands as a strong alternative for those seeking secure and high-performance decentralized solutions as well as investors looking to capitalize on its innovative tech with long-term growth potential.

What is Hedera Hashgraph (HBAR) and what makes it different?

Hedera is a public distributed ledger that leverages a unique consensus mechanism called hashgraph instead of a traditional blockchain. Founded by Leemon Baird and Mance Harmon, Hedera was built with a clear vision: to create a platform that offers speed, security, and fairness for decentralized applications. In 2018, the project conducted an Initial Coin Offering (ICO), raising $124 million to fund the development of its ecosystem. The network officially launched in 2019, offering services such as cryptocurrency transactions, smart contracts, and file storage.

At its core, Hedera employs the concept of “gossip about gossip,” where nodes share transaction information and its history with one another. This allows the network to reach consensus quickly through virtual voting, achieving high throughput and low latency. The system is also designed with fairness in mind, ensuring that no single node can manipulate the transaction order, and it leverages asynchronous Byzantine Fault Tolerance (aBFT) to maintain security even in the presence of malicious actors.

Over time, Hedera has evolved from an innovative idea into a functioning mainnet, attracting a diverse ecosystem of decentralized applications – from supply chain management to digital identity and financial services. The platform is governed by the Hedera Governing Council, a group of global organizations committed to upholding the network’s integrity and stability.

In essence, Hedera Hashgraph weaves together advanced technology and a commitment to fair, efficient transactions. As such, it provides a robust alternative for enterprises and developers seeking to build next-gen decentralized applications.

Key problems Hedera intends to solve

The challenges a project seeks to address – including their significance and the feasibility of solutions – are crucial indicators of its future performance, including the potential success of its associated cryptocurrency. With that in mind, let’s take a closer look at the key obstacles faced by traditional blockchain networks that Hedera wants to overcome.

Scalability

Many blockchains struggle with low transaction throughput and high latency. Hedera’s hashgraph consensus enables high-speed transactions with finality in seconds.

Energy efficiency

Unlike energy-intensive proof-of-work blockchains, Hedera is carbon-negative, making it an environmentally friendly alternative.

Fairness

The hashgraph algorithm ensures fair transaction ordering without giving any single node undue influence.

Security

Hedera achieves asynchronous Byzantine Fault Tolerance (aBFT), the highest level of security for distributed systems.

Cost-effectiveness

With transaction fees as low as $0.0001, Hedera is an affordable option for enterprises and developers.

HBAR price today and recent developments in the Hedera ecosystem

As of late March 2025, HBAR is trading around $0.194 to $0.196 USD, reflecting a dynamic market environment. The recent growth in Hedera’s DeFi ecosystem has contributed to a bullish sentiment among analysts, with some predicting a price increase to $0.223622 by the end of March, representing a 13.55% rise over the next five days. It’s worth stressing that the cryptocurrency has a significant presence in the crypto market with a market cap of over $8.1 billion USD.

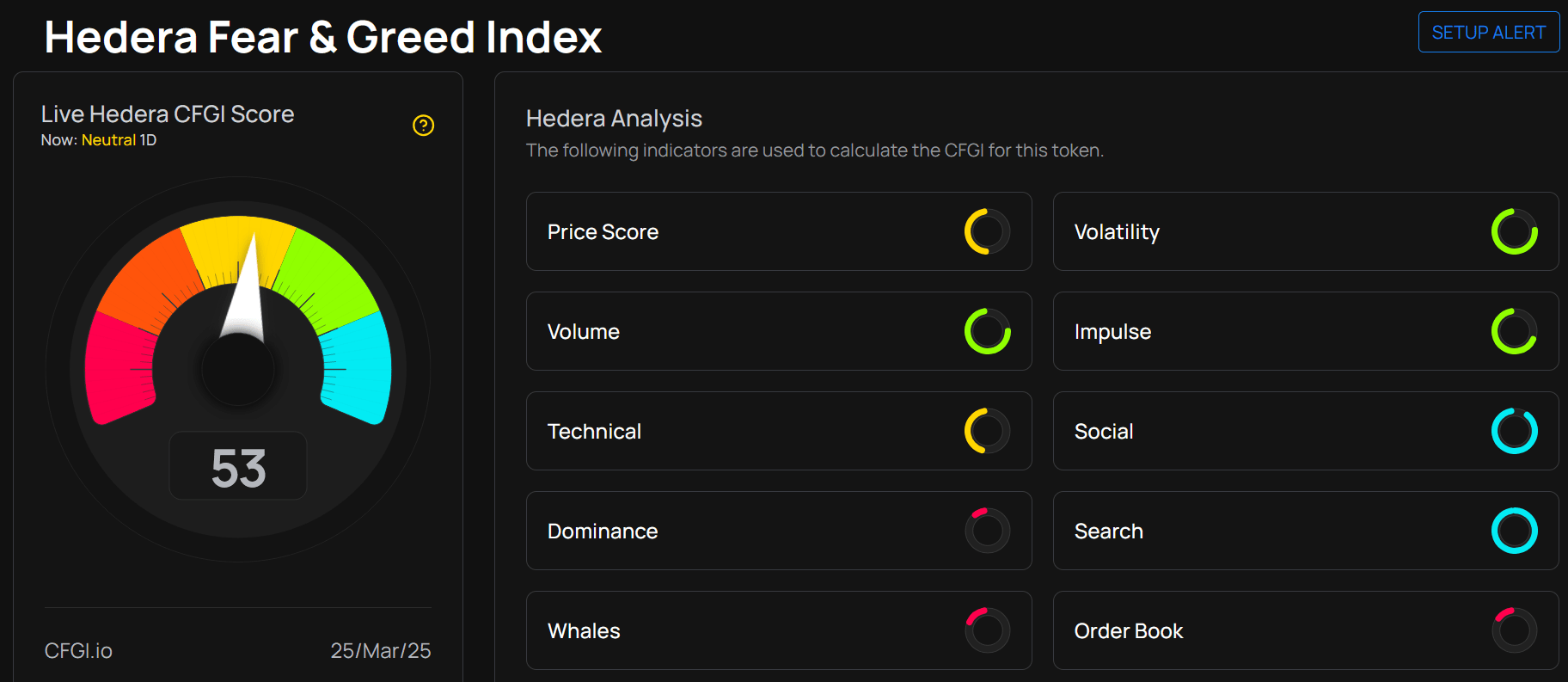

Hedera’s ecosystem has seen notable advancements, particularly in its DeFi sector. Analysts are optimistic about the platform’s potential for growth, driven by its unique consensus mechanism and expanding use cases. However, the fear & greed index remains at 53, indicating a neutral market sentiment.

In short, HBAR’s price is influenced by both technical factors and broader market trends. As Hedera continues to develop its ecosystem, particularly in DeFi, it may attract more investors and drive price growth. Despite current volatility, the platform’s innovative approach positions it well for future expansion.

Hedera (HBAR) price prediction for 2025

Based on current trends, analysts are cautiously optimistic about HBAR’s near-term potential. With renewed DeFi growth on Hedera and new partnerships, many forecast that HBAR could exceed $0.25 by the end of 2025. Key catalysts for the following months and beyond include continued DeFi expansion on the Hedera network, increased institutional interest, and strategic alliances with traditional financial players. Ongoing technological upgrades and a growing ecosystem of decentralized applications are expected to boost network activity, driving demand for HBAR. Additionally, regulatory clarity in key markets could further enhance investor confidence, supporting the near-term price growth.

Hedera (HBAR) price prediction for 2030

Looking further ahead, by 2030 the digital landscape is expected to be more mature and interconnected. According to reports by leading consulting firms and think tanks, the digital economy could be worth in the range of $20–$25 trillion by 2030, driven by rapid digital transformation across industries. Artificial intelligence (AI) alone could contribute up to nearly $16 trillion to the global economy by 2030 in World Economic Forum’s prognosis, accounting for a 14% boost in global GDP

Hedera’s robust infrastructure and unique consensus model position it as a potential backbone for secure and scalable decentralized applications aligning with global trends. Conservative forecasts for this period suggest HBAR might see values in the $1.00–$2.00 range as it helps drive solutions in areas like supply chain, digital identity, and cross-border payments.

The convergence of mainstream crypto adoption and ongoing economic digitization could create a strong upward trajectory for Hedera. With its unique consensus model and scalable infrastructure, it could become the preferred platform for enterprise solutions in areas like digital identity, supply chain management, and cross-border payments. Moreover, robust regulatory frameworks and increased interoperability between blockchain systems and traditional finance are likely to drive mass adoption, fueling HBAR’s value.

Hedera (HBAR) price prediction for 2050

In a long-term scenario, the digital economy may evolve to rely heavily on decentralized and trustless systems, with Hedera playing a central role in facilitating these transitions. If Hedera successfully becomes a fundamental layer for global digital transactions, governance, and asset management, HBAR could be valued significantly higher – potentially reaching the $5–$10 range or beyond. This optimistic projection assumes widespread blockchain integration across industries, robust technological innovation, and a seamless melding of traditional and digital financial systems to solve future economic challenges.

Looking to 2050, when the digital economy is expected to be deeply integrated with blockchain technology, key catalysts for HBAR’s long-term potential could include the emergence of global, decentralized financial systems, smart cities, and fully tokenized economies. As blockchain becomes a standard tool for transparency, security, and efficiency in both public and private sectors, Hedera’s proven infrastructure may position it as a cornerstone of the future digital economy, significantly elevating HBAR’s market value.

| Year | Expected Price | Possible Key Catalysts |

| 2025 | $0.25 | DeFi growth and new institutional partnerships |

| 2030 | $1.00–$2.00 | Hedera’s scalable infrastructure in an increasingly digitalenvironment |

| 2050 | $5.00–$10.00 | The emergence of global, decentralized financial systems |

Key obstacles for Hedera’s (HBAR) value growth

Long-term projections inherently carry a margin of error, making investment decisions based on them risky. Hedera’s value growth depends on numerous variables. Before investing, it’s crucial to carefully assess the potential factors that could impede Hedera’s growth, such as the following.

Perceived centralization

Hedera’s governance model, managed by a council of major corporations, has drawn criticism for lacking decentralization. This perception could deter crypto enthusiasts who prioritize decentralized networks.

Stiff competition

The blockchain space is crowded with established players like Ethereum and newer competitors offering similar features. Hedera must continuously innovate to maintain its edge.

Regulatory challenges

As governments worldwide tighten regulations on cryptocurrencies, Hedera’s operations, particularly its enterprise-focused model, could face scrutiny and compliance hurdles.

Adoption barriers

While Hedera has made strides in DeFi and enterprise adoption, achieving widespread use remains a challenge. Convincing businesses and developers to switch from established platforms is no small feat.

Market volatility

Like all cryptocurrencies, HBAR is subject to market fluctuations, which can impact investor confidence and adoption rates.

Scalability in real-world use

Although Hedera boasts high transaction speeds, proving its scalability in large-scale, real-world applications is crucial to gaining trust and adoption.

Ultimately, Hedera’s performance will depend on its ability to drive widespread adoption, sustain innovation, navigate regulatory challenges, and maintain a competitive edge against other key players in the crypto and digital economy landscape.