Crypto de-dollarization shapes global finance as Russia uses digital currencies to avoid Western sanctions. This shift changes how international trade works. Russian firms now use cryptocurrencies to pay foreign partners, while BRICS gains more economic power, testing old financial systems and U.S. dollar control.

Also Read: VeChain Outperforms Bitcoin, Solana: VET To $0.07 Soon?

How Crypto is Reshaping Russia’s Economy and Challenging Global Powers

Russia’s Strategic Pivot to Cryptocurrency

Russian Finance Minister Anton Siluanov confirmed that Russian businesses are utilizing Bitcoin for international trade transactions. “As part of the experimental regime, it is possible to use bitcoins, which we had mined here in Russia. Such transactions are already occurring,” Siluanov stated to Russia 24 television channel.

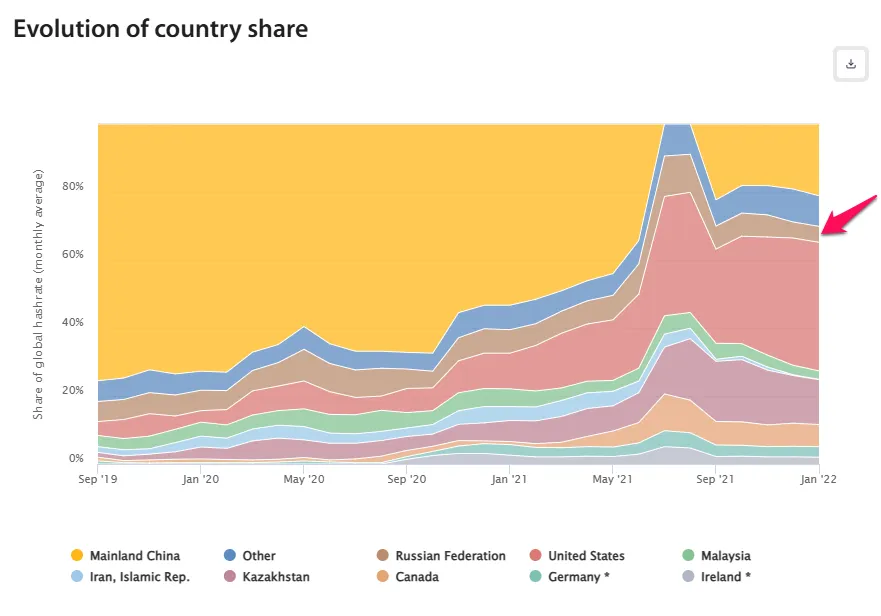

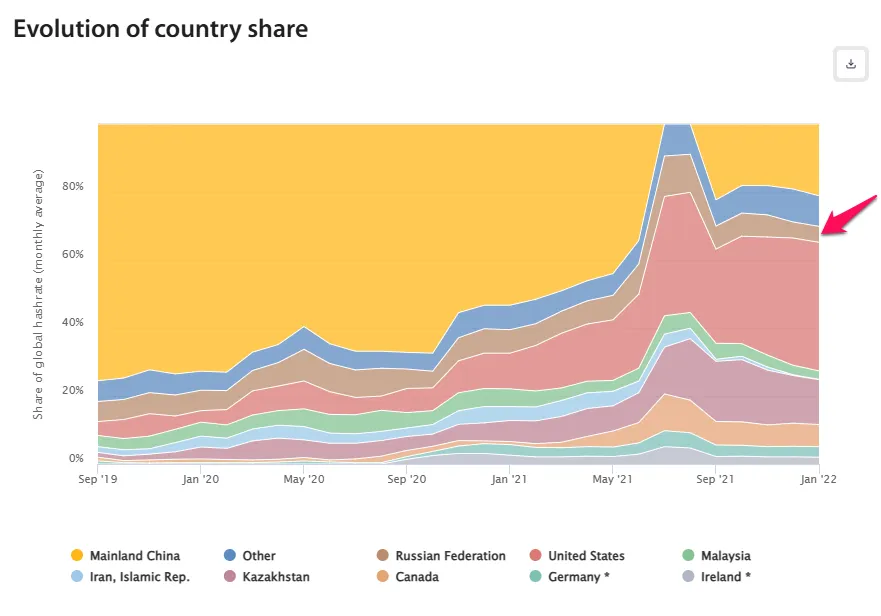

Russia leads Bitcoin mining, boosting its crypto de-dollarization plans and helping trade despite sanctions. “We believe they should be expanded and developed further. I am confident this will happen next year,” Siluanov added.

BRICS Economic Expansion Through Digital Innovation

Russia’s move to crypto matches BRICS’ rising global role. Russian Deputy Prime Minister Alexander Novak emphasized that “BRICS is a potentially high volume of global GDP, about 35%, and it is getting bigger and bigger every year.” Russia’s international payments through crypto keep rising as Novak sees BRICS taking over 50% of world GDP in 10-15 years. By purchasing power, BRICS now holds 37.3% of global GDP, beating G7’s 30%.

Also Read: Does Youtube TV have the History Channel?

Stablecoins and Cross-Border Payment Revolution

The global power shift grows as blockchain makes international payments easier and cheaper. Mastercard executive Raj Dhamodharan confirms that “blockchain technology and public blockchains are opening up a number of new use cases, one of which is to transfer value from one country to another.”

Sheraz Shere, general manager at Solana Foundation, adds, “Blockchain solutions and stablecoins — they’ve found product-market fit in cross-border payments. You get the disintermediation, you get the speed, you get the transparency, you get extremely low cost.”

Expanded BRICS Alliance Strengthens De-Dollarization

BRICS grew in 2024 by adding Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE. This makes the group stronger in energy markets and trade across developing nations.

Also Read: Top 2 Tech Stocks to Buy in 2025? ADBE and META Lead the Way

At October’s Business Forum, Russian President Vladimir Putin said BRICS’ GDP now beats G7’s and keeps growing, making the group key to global economic growth.