BitMEX CEO Arthur Hayes suggests that Trump’s administration should move from the Gold standard and incline more towards establishing a strategic Bitcoin reserve.

Hayes suggests that the best way for the US to achieve economic prosperity is for the Treasury Department to create more dollars by devaluing the price of gold to build a Bitcoin reserve.

Hayes Suggests Trump to Shift from the Gold Standard

According to Hayes’ latest Substack article, this devaluation would allow the Federal Reserve’s Treasury General Account (TGA) to receive a dollar credit.

This credit can later be injected into the economy directly. It eliminates the need for diplomatic efforts to persuade other countries to devalue their currencies against the US dollar. The larger the gold devaluation, the bigger the credit will be.

Currently, the treasury values gold at $42,22/oz. From Hayes’ perspective, this is overvalued. He explains that if incoming Treasury Secretary Scott Bessent would consider a $10,000 to $20,000/oz revaluation, then the TGA’s balance would immediately grow.

“Quickly and dramatically weakening the dollar is the first step towards Trump and Bessent achieving their economic goals. It is also something they can accomplish overnight without consulting domestic legislators or foreign finance ministry heads. Given that Trump has one year to show progress on some of his goals to help Republicans maintain their hold on the House and Senate, my base case is a $/gold devaluation in the first half of 2025,” Hayes wrote.

What Would a Bitcoin Reserve Mean for the US Economy?

Arthur Hayes argues that the strategy would inherently increase the price of Bitcoin and other cryptocurrencies if the Treasury decides to use the dollar credits to purchase BTC.

Given that the US already owns the largest amount of gold than any other nation-state, it could do the same by creating a Bitcoin reserve. This would consequently assert the country’s financial supremacy in terms of ownership over the world’s strongest digital asset.

Since the industry widely considers Bitcoin to be hard money due to its fixed supply cap, Hayes argues that the strongest government fiat currency would be the one whose central bank owns the largest reserve of BTC.

In turn, a government that holds a significant amount of Bitcoin would naturally implement policies that favor the growth of the cryptocurrency industry.

“If the US government creates more dollars via a gold devaluation and uses some of those dollars to buy Bitcoin, its fiat price will rise. This will in turn spur competitive sovereign purchases by other nations who have to play catchup with the US. The price of Bitcoin then would rise asymptotically, because why would anyone sell Bitcoin and receive fiat, which the government is actively devaluing?” Hayes explained in his article.

It’s also important to consider that the US is not the only country considering a strategic Bitcoin Reserve. As BeInCrypto reported earlier, Russian lawmakers are also suggesting the same.

Japan’s lawmakers also made similar suggestions earlier this month, and Vancouver, Canada, has already approved a Bitcoin Reserve plan for the city council. So, it’s likely that if the US doesn’t make the move soon, its international competitors will.

Yet, realistically, Hayes doesn’t expect the Treasury to purchase Bitcoin. However, a gold devaluation would create dollars anyway, which can be reinserted into the economy as goods and services or used as financial assets.

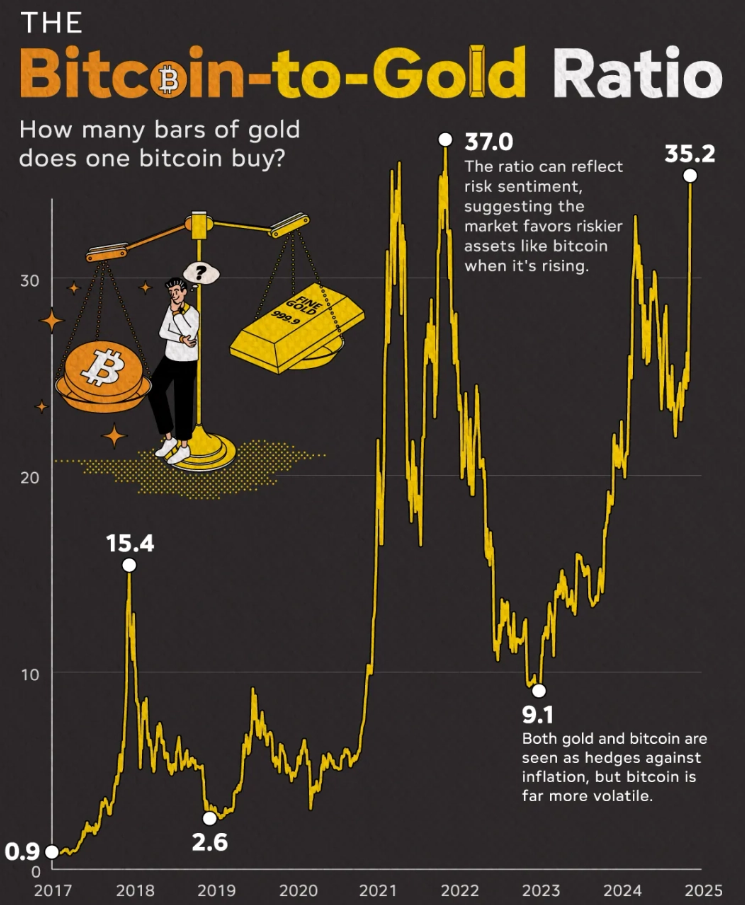

Hayes’ sentiment does align with the market stats, as Bitcoin ETFs currently hold more assets under management than Gold ETFs. These funds have been trading for less than a year.

How Much Time Does Trump Have?

Hayes showed weariness over crypto investors’ high expectations for how quickly the incoming Trump administration can enact changes that would benefit the crypto market.

He predicted that Trump would need at least a year to address underlying domestic and international issues.

At the same time, the president-elect will need to show results almost immediately, considering that most legislators will start to campaign for mid-term elections only a year after Trump’s inauguration.

If patience runs thin and sentiment turns negative quickly, Hayes expects there to be buyer’s remorse among investors.

“The market will instantly wake up to the reality that Trump has at best one year to enact any policy changes on or around January 20th. This realization will lead to a vicious sell-off in crypto and other Trump 2.0 equity trades,” he said.

Because of how little time Trump actually has to create change, Hayes emphasizes that gold devaluation is the most time-efficient way to generate money and stimulate the economy.

“The people are impatient because they are desperate. Trump is an astute politician and knows his base. To me, that means he must go big early, which is why my money is on a massive dollar vs. gold devaluation early into his first 100 days in office. It is an easy way to make production costs globally competitive in America quickly,” he concluded.

Hayes is not the only one who shares this perspective. Last month, Republican Senator Lummis also proposed that the Fed sell a portion of its gold to buy 1 million BTC and fund a Bitcoin Reserve.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.