Virtuals Protocol (VIRTUAL) daily chart depicted a pronounced bullish trend followed by volatility, indicating possible entry points for high time frame (HTF) support areas, notably around the $2.50 to $3.00 range.

This period of anticipated decline represent a significant correction from a high of over $5, diving to current levels near $3.90, with potential for further dips suggested.

Historical data points to consistent recovery in similar conditions, supporting the analysis that VIRTUAL could indeed touch down near $2.50 before witnessing a strong rebound.

This projection relied on past market behavior where significant drops were followed by robust recoveries, aligning with identified support zones that traditionally offer substantial bounce-back potential.

The current market setup, with a recent sharp decline, suggests that the asset is in a phase where traders might anticipate further downward movement before any substantial recovery.

This forms a strategic buying opportunity for those looking at long-term gains, speculating that the price could descend to as low as $2.50, providing a lucrative buy zone for investors focused on potential future upswings.

– Advertisement –

The extreme volatility within cryptocurrency markets, where swift declines often precede significant gains, provided savvy investors and traders with opportunities to capitalize on these fluctuations.

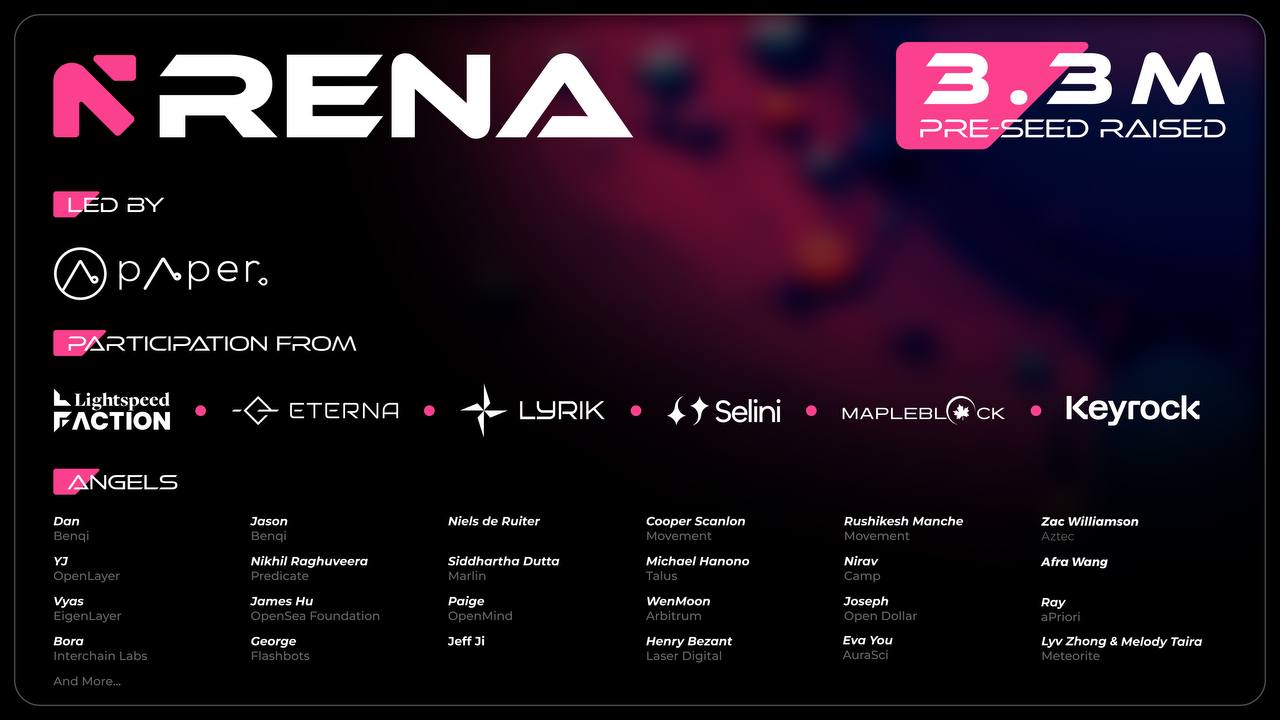

Top 15 Grayscale Research Coins by FDV with Potential in Q1 2025

Further dig into the AI protocol showed VIRTUAL is among the Top 15 crypto assets by Grayscale Research, focusing on their fully diluted values (FDV).

The data showcased Bitcoin and Ethereum at the top with FDVs of $2.01T and $441B, respectively, illustrating their dominant market positions.

Solana and Sui also featured prominently with FDVs of $104B and $15.2B, indicating their significant roles within their respective ecosystems, especially linked to developments in U.S. elections and AI technologies.

VIRTUAL, noted for its FDV at $3.86B, emerged as a key player. The analysis suggested that even if VIRTUAL’s price were to drop to $1.5, its substantial FDV points to a strong base of market capitalization that could support a rebound.

The mention of new entrants like HYPE, ENA, and JUP implied a refreshing of the investment landscape, with VIRTUAL positioned among tokens with potential for substantial price movements.

This inclusion by Grayscale signified endorsement, which could stabilize VIRTUAL’s valuation and potentially cushion it against severe downturns, making it poised for recovery if the market dips.

The strategic focus on tokens associated with next-generation tech and political events could drive investor interest, influencing VIRTUAL’s price trajectory positively in the upcoming quarters.

Scaling of the Virtual Protocol Ecosystem

Also, the continued expansion of the Virtual Protocol ecosystem, particularly through its integration into the gaming industry, marked a pivotal step in the evolution of AI-driven agents.

The shift from basic gaming bots to autonomous agents capable of complex decision-making mirrors significant technological advancements within virtual environments.

This development not only enriched the gaming experience but also enhanced the application of blockchain technology in creating intricate, user-driven narratives.

The strategic partnership to incorporate these agents into Tier-1 games underlined a potential increase in adoption and demand for Virtual Protocol’s tokens.

Such collaborations are expected to introduce new business models in gaming, driven by AI and blockchain integration, which could substantially boost the protocol’s valuation and market presence.

Historically, price of cryptos have shown responsiveness to major ecosystem enhancements.

The anticipation of upcoming game integrations, highlighted in past trends, suggests a possible uplift in the protocol’s market value.

If these integrations capture the interest of the gaming community, a significant price appreciation in the short to medium term could be likely.

The broader implication is a reinforced position of Virtual Protocol within the AI memecoins sector, promising expanded utility and value generation.