John Karony, the CEO of SafeMoon, has recently made headlines due to legal troubles surrounding the controversial cryptocurrency firm. He is currently facing serious charges, including conspiracy and money laundering, after allegations surfaced that he misled investors and misappropriated funds. As a result, Karony has become a notable figure in the ongoing discussion about ethics in the cryptocurrency industry.

With a background in digital assets, Karony co-founded SafeMoon, which promised high returns to investors. However, the firm’s rapid rise was followed by a crash, leading to bankruptcy and investigations. His arrests raised questions not only about his leadership but also about the practices within the cryptocurrency space as a whole.

John Karony Background

John Karony has a diverse background that combines his early career experiences with significant achievements in the cryptocurrency world. His journey led him to become the CEO of SafeMoon.

Early Career and Education

John Karony was born in Provo, Utah. He pursued his education with a focus on the analytical skills that would serve him later in life. Before venturing into the world of cryptocurrency, he worked as an analyst at the U.S. Department of Defense. This role provided him with valuable insights into financial systems and regulatory frameworks. His expertise in analysis also helped him understand complex data and make strategic decisions.

Rise to CEO of SafeMoon

In March of 2021, Karony took a big step by launching SafeMoon, which quickly gained popularity. The project introduced unique tokenomics that attracted many investors. Under his leadership, SafeMoon positioned itself as a different type of meme coin, promoting decentralized finance practices.

Karony’s vision for SafeMoon focused on community engagement and rewarding holders. His hands-on approach and innovative ideas helped the company grow in a crowded market. As CEO, he became a prominent figure in the cryptocurrency community, attracting both support and scrutiny.

SafeMoon Overview

SafeMoon is a decentralized finance digital asset that emerged during the cryptocurrency boom. The project gained attention for its unique approach to tokenomics and the innovation it brought to the crypto market. Its activities, however, have also led to serious controversies.

Cryptocurrency Emergence

SafeMoon was launched in March of 2021. It billed itself as a community-driven token that rewards holders while discouraging selling. When investors buy and hold SafeMoon, they receive a percentage of each transaction as a reflection. This mechanism creates an incentive to retain the asset rather than sell.

The launch coincided with a broader interest in meme coins, which allowed SafeMoon to gain traction. Its marketing strategy appealed to a large audience, resulting in its very rapid popularity.

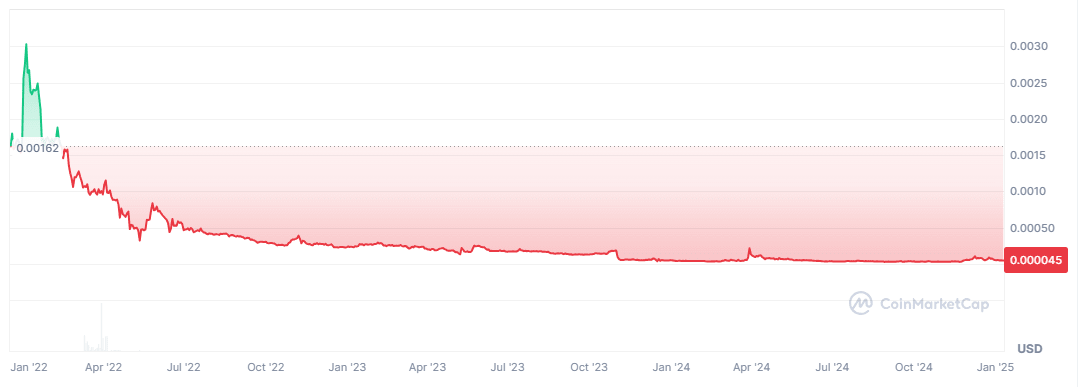

SafeMoon V2 all-time price movement (Source: CoinMarketCap)

Market Capitalization

At its peak, SafeMoon reached a market capitalization of over $5 billion. This growth placed it among some of the top cryptocurrencies for a brief time. Investors flocked to the token, drawn by the potential for high returns and the buzz surrounding the project. Currently, SafeMonn’s market cap hovers around $250 million.

The volatility of the cryptocurrency market has impacted SafeMoon’s standing. While it initially saw rapid gains, sharp price fluctuations have raised concerns among some investors.

Investment Growth

SafeMoon attracted a diverse group of investors, ranging from crypto enthusiasts to those new to the market. Its unique token model allowed for perceptions of quick wealth accumulation. In fact, many early investors benefited from significant price increases.

Despite the highs, the investment landscape for SafeMoon has been rocky. The company faced regulatory scrutiny, which raised alarms among some investors. The potential for future growth is still uncertain, influenced by market stability and investor confidence.

Legal Challenges

John Karony is facing serious legal troubles. These issues stem from his involvement in alleged fraud and misleading activities tied to the popular cryptocurrency.

Securities and Exchange Commission Inquiry

The U.S. Securities and Exchange Commission (SEC) has been investigating SafeMoon and its leadership. The focus is on whether the company sold unregistered securities to investors. This inquiry raises questions about the management of liquidity pools and the claims that SafeMoon made regarding its digital assets.

The SEC is looking into the structure of SafeMoon’s offerings and whether they complied with federal laws. Any findings could lead to significant penalties, including fines and restrictions on future business operations.

Indictment and Allegations

John Karony was indicted in the Eastern District of New York. He faces multiple criminal charges, including conspiracy to commit securities fraud, wire fraud, and money laundering conspiracy. The indictment claims that he and other executives engaged in a fraud scheme that misled investors.

The U.S. Attorney’s Office alleges that Karony and his co-defendants manipulated the value of SafeMoon, leading to substantial losses for investors.

Alleged Fraud Details

John Karony and other executives of SafeMoon are facing serious accusations related to fraudulent activities. The allegations center on misuse of funds from liquidity pools and misappropriation of investor assets.

Liquidity Pools Misuse

The misuse of liquidity pools involves tapping into funds meant for buying and selling assets. Liquidity pools are designed to provide stability in trading a cryptocurrency like SafeMoon.

Investors believed their contributions were facilitating transactions. Instead, executives allegedly diverted these assets for personal gain. Manipulating these funds can lead to significant losses for investors. Safety measures are typically in place to protect such pools, making these actions particularly egregious.

Asset Misappropriation

Asset misappropriation includes allegations that Karony and his team diverted investor funds into personal accounts. They are accused of using these assets to line their pockets rather than investing in the company as promised.

This act of theft not only impacts investors but also raises questions about the integrity of the entire crypto market. Investors were led to believe they were part of a legitimate venture, only to be victims of a fraudulent scheme.

By misrepresenting their intentions, the executives put their interests above those of the investors.

Executive Implications

These implications stem from serious allegations of fraud and financial misconduct linked to the project’s leadership.

Actions Against Executives

Braden John Karony, the CEO, along with Kyle Nagy and Thomas Smith, faces criminal charges. They are accused of orchestrating a fraudulent scheme involving the unregistered sale of cryptocurrency. Investigations revealed that these executives allegedly withdrew large sums from the project.

Reports indicate over $200 million may have been misappropriated. The U.S. Attorney’s Office has also stated that Karony and Smith were arrested, while Nagy is still at large.

Financial and Legal Consequences

The legal troubles for these executives include hefty fines and potential prison time. Additionally, luxury vehicles and real estate linked to the executives may face seizure. Legal teams are also pulling away, indicating a weakening defense as the case unfolds. The financial and reputational impacts on SafeMoon could be severe, which could affect investor confidence and market standing.

Technological Aspects

The technological framework behind SafeMoon is significant in understanding its operation within decentralized finance.

Smart Contracts Role

Smart contracts are self-executing contracts with the terms directly written into code. SafeMoon employs these contracts to automate transactions and ensure transparency.

-

Automation: This feature allows for instant execution of transactions without the need for intermediaries.

-

Security: They help prevent fraud by ensuring that transactions are recorded on the blockchain, which is immutable.

For SafeMoon, smart contracts manage tokenomics, which reward users holding the asset. The distributed nature of these contracts aligns with decentralized finance principles. They help maintain trust among participants by being verifiable on the blockchain.

Digital Assets Specifications

SafeMoon is categorized as a crypto asset, specifically a meme coin. It leverages unique tokenomics to attract users.

Key specifications include:

-

Découpage: Each transaction incurs a fee, part of which is redistributed to holders. This rewards long-term investment.

-

Liquidity Pool: It enhances market stability by automatically adding a portion of transaction fees to a liquidity pool, which is essential for trading.

The asset is built on Binance Smart Chain, utilizing its capabilities for lower transaction costs and faster processing times. While SafeMoon has gained popularity, it also emphasizes security measures, addressing concerns over crypto asset security and investor protection in a rapidly evolving market.

The community’s response to John Karony and the events surrounding SafeMoon has been complex. Investors and supporters have expressed a mix of loyalty and frustration, while public sentiment toward the company has wavered.

Investor Reactions and Support

Investors initially showed strong support for SafeMoon and its founders. Many believed in its potential for growth and profitability. However, as legal challenges emerged, some investors began to feel regret. This was especially true after reports of fraud charges against Karony.

Despite the allegations, a portion of the community still stands by SafeMoon. They argue that the project’s innovative aspects and roadmap should not be dismissed. Some believe that the current difficulties could eventually lead to a resurgence.

The feeling among investors varies widely. Some see it as a chance to grow, while others worry about a possible “rug pull,” where funds could vanish suddenly.

Public Sentiment and Trust

Public sentiment has shifted significantly amid legal challenges. Many community members express anger toward Karony, feeling that his actions have damaged their trust. The narrative around SafeMoon shifted from optimistic investment to skepticism and concern.

Trust in SafeMoon’s leadership has also declined. Some community members are calling for more transparency in operations and management. They want assurance that their investment is secure and that the leadership is acting in the community’s best interest.

The presence of negative news has fueled doubt. Continued legal troubles make it even more difficult for many to maintain confidence in SafeMoon’s future.

Notable Endorsements

John Karony, the CEO of SafeMoon, gained attention through various endorsements from high-profile celebrities and influencers. These endorsements played a significant role in shaping market perceptions and attracting investors to the cryptocurrency.

Influence on Market Perception

Celebrity endorsements significantly impacted SafeMoon’s reputation. Individuals like Lil Yachty and Jake Paul, along with platforms like Barstool Sports, helped promote the token. This raised public interest and bolstered the project’s visibility.

Dave Portnoy, the founder of Barstool Sports, also contributed to the hype. His support attracted an audience that valued his opinions, further amplifying awareness for SafeMoon.

These endorsements not only drew in retail investors but also created a sense of trust around the project. As a result, many individuals were excited about potential profits, even as subsequent legal troubles arose for the company and its leaders.

Future Prospects

With ongoing legal troubles, John Karony’s future in the cryptocurrency sector poses some serious questions. The fate of SafeMoon and its investors heavily hinges on how these allegations play out.

Moving Forward after Allegations

SafeMoon was launched in 2021, and quickly attracted investor attention, peaking with a market cap in the billions. The future of SafeMoon may depend on recovery strategies or new partnerships. With estimated losses around $200 million, a transparent approach may help regain investor trust while addressing regulatory concerns.

Frequently Asked Questions

What is the professional background of John Karony?

John Karony has been involved in the cryptocurrency industry since 2021. He became known as the CEO of SafeMoon, a meme-based cryptocurrency, which gained attention during the crypto boom. His leadership has been riddled with both rapid growth and controversy.

How has John Karony contributed to the development of SafeMoon?

Karony played a key role in launching SafeMoon, promoting its unique features like tokenomics that included automatic liquidity generation. He aimed to create a strong community focus and engage users, which helped the token gain a significant following.

What is the business model of SafeMoon under John Karony’s leadership?

SafeMoon’s business model relies on a deflationary mechanism. It includes transaction fees, a portion of which is redistributed to existing holders and another part is used for liquidity. This structure is designed to encourage holding the token and enhance its value over time.

Who is Kyle Nagy and what is his role in relation to SafeMoon?

Kyle Nagy served in various roles, but is most well known as the creator of SafeMoon or ‘Safemoon Dev.’

What are the major milestones achieved by SafeMoon since its inception?

Since its launch, SafeMoon has reached several key milestones. These include substantial market capitalization growth, community engagement initiatives, and various partnerships. However, the project has also faced legal challenges.