Trump’s transition team is working hard to seize the opportunity and fill the CFTC Chairman seat after Behnam resigned on Tuesday. As the crypto industry becomes more significant, Trump’s team is especially interested in identifying a candidate who holds a positive attitude toward cryptocurrencies. The CFTC is ready to regulate such assets as Bitcoin and Ethereum if Congress provides it with the appropriate jurisdiction.

At the moment, the crypto market is worth more than a trillion dollars. If the CFTC is granted jurisdiction over spot markets for digital assets, it would be a landmark in the regulation of such markets. The CFTC has always been more permissive towards the crypto industry than the SEC, which has become more actively regulatory under the leadership of Gary Gensler. While the battle between the CFTC and the SEC rages on as to which of the two should regulate the crypto markets, most in the crypto industry prefer the Commodity Futures Trading Commission.

Top Contenders for CFTC Chair

Trump has had a positive relationship with the crypto community for a while now. The industry invested a lot in his campaign, and he has not changed his position on cryptocurrencies after becoming the president. The current president has already nominated and hired many people with close ties to the industry to important positions.

Especially, Paul Atkins, who is a pro-crypto lawyer, is expected to replace Gensler at the SEC, while Scott Bessent, a supporter of Bitcoin, is expected to head the Treasury Department. Trump is making these appointments and what makes it even more likely that his team is looking for a Commodity Futures Trading Commission chair that is more likely to side with the crypto industry.

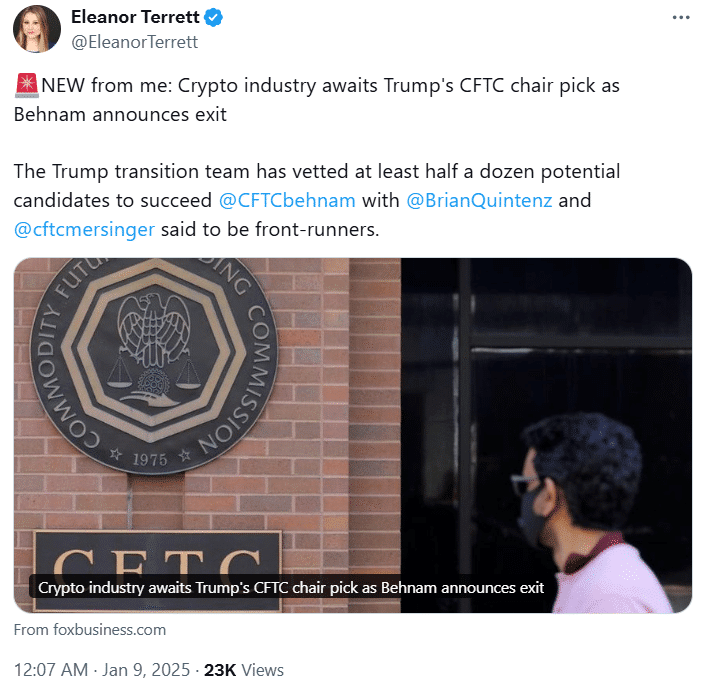

Currently, leading the race include Summer Mersinger who is a CFTC Commissioner, Brian Quintenz the head of Crypto Policy at Andreesen Horowitz, and Marco Santori former Chief Legal Officer at Kraken. Other people who are also in the race are; Republican Commissioner Caroline Pham, Neal Kumar, and Josh Sterling.

Crypto-Friendly CFTC Candidates

Mersinger and Quintenz are the favorite contenders for the CFTC chair position because of their government experience and their connections in the Washington D.C corridors. Both have been critics of the SEC’s more strident regulatory approach, especially since Gensler took charge of the commission. Mersinger and Quintenz have also emphasized the need for a better-coordinated approach to regulation in order to offer proper requirements for the cryptocurrency industry.

Quintenz has strong connections with the crypto industry, which makes him an interesting figure. His current role as the crypto policy chief at Andreessen Horowitz has made him have close ties with other industry leaders and regulators. He will be a strong candidate for the position based on his previous experience as a Trump-appointed CFTC Commissioner. In his time there, he was instrumental in expanding the company’s offerings by approving regulated futures contracts for Bitcoin and Ethereum.

On the other hand, Mersinger has gained much-deserved recognition for what can be described as a moderate approach to the issue. She has been labeled as a centrist who supports change but equally cares for the consumer. Some of the dissents on the Commodity Futures Trading Commission’s enforcement actions against Decentralized Finance (DeFi) organizations have made her a popular figure in the crypto world. Mersinger’s view on the need for better definitions has made her a supporter of the crypto industry, which has always wanted clear rules that will allow it to thrive.

Conclusion

With the probability of CFTC’s involvement in the regulation of Cryptocurrencies increasing, the selection of the next chair at CFTC gains importance. If the agency gets jurisdiction over spot markets for Bitcoin and Ethereum, it will shape the approach to these digital assets in the US jurisdiction. The next Commodity Futures Trading Commission chair will have a very important part to play in defining what that future looks like.

The crypto market has always preferred the CFTC over the heavy-handed SEC because of its relatively lighter rules. The new chair of the CFTC has to find the right approach between safeguarding the investors and supporting the further development of the cryptocurrency market. The crypto community is watching the process, and the transition team is whittling down its options. The next CFTC Chairman will probably define a new era of digital asset regulation in the United States.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

What role will the CFTC play in crypto regulation?

The Commodity Futures Trading Commission could regulate Bitcoin and Ethereum spot markets if Congress grants it jurisdiction.

Why is Trump prioritizing crypto-friendly CFTC candidates?

Trump’s team is looking for a CFTC chair who supports crypto growth and favorable regulation.

How does the CFTC differ from the SEC on crypto?

The CFTC is more lenient, while the SEC enforces stricter regulations on cryptocurrencies.

Who are the top CFTC Chair candidates?

Summer Mersinger, Brian Quintenz, and Marco Santori are leading due to their crypto expertise and connections.