Following the report released by the Institute for Supply Management (ISM), sentiment across the cryptocurrency landscape has shifted towards the bearish side for a short period. Amid this, Bitcoin (BTC) the world’s largest cryptocurrency by market cap has experienced a price decline of over 10% and has reached a crucial level.

$1.02 Billion Worth of BTC Outflow from Exchanges

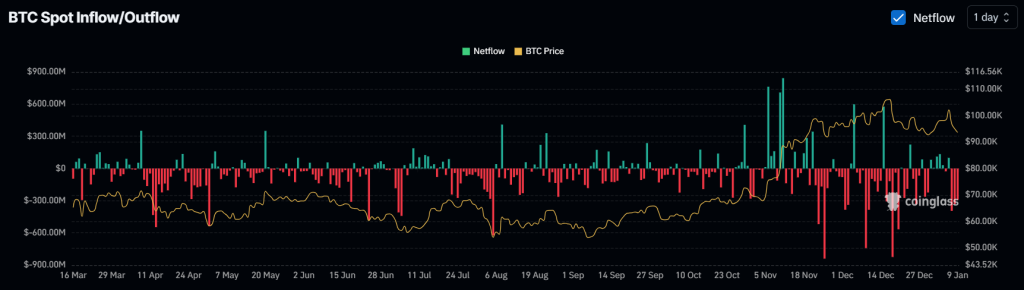

It has been three days since the market witnessed a continuous price decline, but one thing gathering significant attention from crypto enthusiasts is the ongoing accumulation by long-term holders, as reported by the on-chain analytics firm Coinglass.

Data from spot inflow/outflow reveals that exchanges, during the same period, witnessed an outflow of over $1.02 billion worth of BTC. This substantial outflow indicates that long-term holders have withdrawn these BTC from exchanges to their wallets, which is a positive sign.

Is This the Right Time to Buy Bitcoin?

This data clearly shows that whales and long-term holders are consistently buying BTC, taking advantage of the recent price decline ahead of President-elect Donald Trump’s inauguration.

BTC’s Path to $100K or a Drop to $74K?

With the continuous price decline, the BTC price has reached its crucial level near the $92,250 mark, where it consistently experiences price rebounds. Historically, BTC has reached this level four times, and each time it witnessed a rally of nearly 10%.

Based on this data, experts and analysts speculate a similar upside momentum. If this occurs, there is a high possibility that Bitcoin could once again reach the $100,000 mark in the coming days.

Meanwhile, if BTC fails to hold this crucial level and closes a daily candle below the $91,000 mark, there is a strong possibility it could drop another 18% to reach the $74,000 support level.

Current Price Momentum

Currently, BTC is trading near $92,450 and has experienced a price decline of over 1.40% in the past 24 hours. Meanwhile, traders and investors appear hesitant to participate, resulting in a 9% drop in trading volume.