The move is very similar to the House Financial Services Committee’s 2023 model and follows the FIT21 bill’s House passage. On the regulatory front, Summer Mersinger, a crypto-friendly candidate, is poised to succeed Rostin Behnam as CFTC chair. Meanwhile, the Federal Reserve is adopting a more neutral policy stance due to economic uncertainties, which could impact BTC’s price. There is also speculation around potential pardons by outgoing President Joe Biden for controversial crypto figures like Sam Bankman-Fried and Ross Ulbricht.

New Crypto Subcommittee On Its Way

The US Senate Banking Committee is reportedly preparing to establish its first-ever crypto subcommittee. This initiative aligns with the broader Republican agenda under President-elect Donald Trump, who is set to be inaugurated on Jan. 20. These developments also come at a time when the Commodity Futures Trading Commission (CFTC) may also see a shift in leadership where a pro-crypto commissioner could replace the outgoing chair.

According to reports from FOX Business and Punchbowl News, Senator Tim Scott, the new chair of the Senate Banking Committee, prioritized the creation of the crypto subcommittee. This move mirrors the model that was established by the House Financial Services Committee, which launched a similar subcommittee in 2023.

Senator Cynthia Lummis, a longtime cryptocurrency advocate, has been proposed to chair the subcommittee, with a vote on her approval expected soon. If confirmed, Lummis will spearhead efforts to align the Senate’s approach to digital assets with President-elect Trump’s vision of turning the United States into a global leader in cryptocurrency.

The subcommittee’s composition is likely to include Senators Bernie Moreno, Dave McCormick, Thom Tillis, and Bill Hagerty, who are all strong supporters of digital assets, according to the Stand With Crypto lobby group. However, any Democratic participation in the subcommittee is still uncertain as Senator Elizabeth Warren, a vocal critic of cryptocurrency, holds a senior position on the Senate Banking Committee.

This development also follows the House’s passage of the FIT21 bill in 2024. One of the main goals of the bill is to grant greater regulatory authority to the CFTC. The bill is a product of the House Financial Services crypto subcommittee, and is now awaiting Senate action.

Summer Mersinger

On the regulatory front, CFTC Commissioner Summer Mersinger emerged as a leading candidate to succeed Rostin Behnam as chair of the agency. Mersinger is a former Senate staffer with 12 years of experience, and has been favored over ex-CFTC commissioner and a16z policy head Brian Quintenz. Mersinger is also known for her crypto-supportive stance, and is not comfortable with the CFTC’s reliance on enforcement cases to set policy.

For now, the new Congress seems poised to make major progress on cryptocurrency legislation and regulation.

Fed Officials Lean Toward Neutral Stance

Meanwhile, Federal Reserve officials are signaling a shift toward a more neutral policy stance as they await clarity on economic policies under President-elect Donald Trump. On Jan. 9, Fed Governor Michelle W. Bowman stated that the Federal Reserve is approaching a neutral position after a year of strong economic performance and persistent inflation above its 2% target. Kansas City Federal Reserve President Jeff Schmid stated that the economy currently requires neither restrictive nor supportive measures, and suggested that a neutral policy stance is appropriate.

Philadelphia Federal Reserve President Patrick Harker pointed out some of the uncertainty surrounding economic conditions and called for a temporary pause in policy adjustments to assess ongoing developments. Bowman warned that aggressive rate reductions could stoke demand and reignite inflationary pressures.

Market analysts mostly anticipated this more cautious approach, with a 95.2% probability that the Federal Reserve will leave interest rates unchanged at its upcoming meeting on Jan. 29. However, Ryan Lee, chief analyst at Bitget Research, pointed to strong US economic data as a factor behind Bitcoin’s dip to $92,500 on Jan. 8. He attributed the market correction to signals of tighter monetary policy from the Federal Reserve.

The Federal Reserve’s December decision to cut interest rates by 0.25% was the final step in what Bowman described as a policy recalibration phase. This followed earlier cuts of 0.50% in September and 0.25% in November.

While the crypto market anticipated the December adjustment, Federal Reserve Chair Jerome Powell’s indication that only two more rate cuts are expected in 2025 raised concerns among investors. Additionally, the committee’s decision to revise its 2025 inflation outlook from 2.1% to 2.5% also increased uncertainty.

Speculation Grows Over Biden Pardons for Crypto Figures

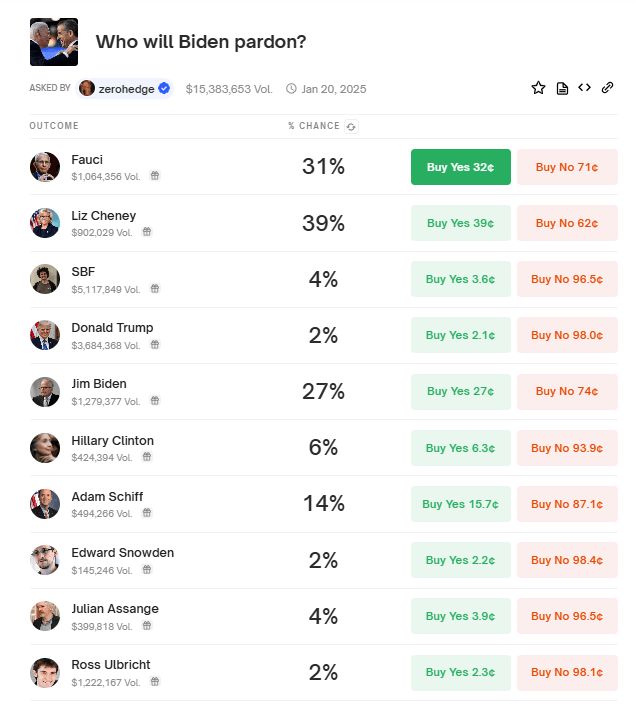

With only a few days remaining in his term, US President Joe Biden still has the power to issue pardons and commute federal sentences. This caused speculation about whether he might extend clemency to controversial figures in the cryptocurrency space, like former FTX CEO Sam Bankman-Fried and Silk Road founder Ross Ulbricht.

According to the crypto betting platform Polymarket, the odds of Biden pardoning Bankman-Fried stand at 4%, while Ulbricht’s chances are pegged at 2%. More than $5 million in bets were placed on Bankman-Fried and $1.2 million on Ulbricht.

Polymarket is a decentralized prediction market platform that allows users to trade on the outcomes of real-world events, including politics, finance, sports, and global affairs. The platform is powered by blockchain technology to ensure transparency, security, and reliability in its operations.

Users buy and sell shares in potential outcomes, with prices reflecting the collective probabilities of events occurring. In this case, traders think SBF has a 4% chance of being pardoned by Biden. Overall, Polymarket combines market-driven forecasting with crowd-sourced insights, which creates a very dynamic ecosystem for predictive analytics. By leveraging the wisdom of the crowd, it provides a very unique way to speculate on global developments like politics.

Odds of Biden pardons (Source: Polymarket)

Bankman-Fried is serving a 25-year sentence after being convicted on seven felony counts for his role in fraud at FTX. He filed an appeal but is still a very controversial figure across political lines. Meanwhile, Ulbricht was sentenced to life in prison without parole in 2015 for operating the darknet marketplace Silk Road. He gained a lot of support in the cryptocurrency community advocating for his release.

Biden already commuted the sentences of more than 1,500 people placed on home confinement during the COVID-19 pandemic and controversially pardoned his son, Hunter Biden, on felony firearm charges. However, he has not shared any formal plans to pardon or commute the sentences of Bankman-Fried or Ulbricht before leaving office on Jan. 20.

President-elect Donald Trump made commuting Ulbricht’s sentence a campaign promise to the crypto community, but has not yet acted on the matter just yet. While Trump’s first term included high-profile pardons, including one for National Security Agency contractor Edward Snowden, there is no public indication that he intends to pardon Bankman-Fried.