Solana Price Prediction 2025: What’s Driving SOL’s Growth?

After three days of selling pressure, the crypto market is attempting to stabilize ahead of the release of the US Non-Farm Payrolls data. SOL’s price has risen to $192, marking a 0.50% increase over the past 24 hours. Additionally, the market cap has seen a significant boost, reaching $92.80 billion.

Whale Activity and On-Chain Data

On-chain data from Lookonchain reveals significant whale activity, with a large holder unstaking 245,922 $SOL, valued at approximately $45.85 million, and transferring it to Binance. This substantial movement, occurring roughly 8 hours ago, suggests potential trading intentions or market activity that could impact price dynamics.

Solana Faces Critical Support Test Amid Bearish Pattern

On Solana’s daily chart, the price action reveals a clear downtrend, marked by consistent lower highs and lower lows. The token remains confined within a falling wedge pattern, with a recent rejection at resistance levels increasing the likelihood of a drop to support.

Market analyst Ali Martinez has cautioned that Solana ($SOL) is at risk of a significant price decline. He emphasizes the importance of holding above the $180 level, warning that failure to maintain this support could lead to a sharp drop, with potential downside targets ranging between $150 and $130.

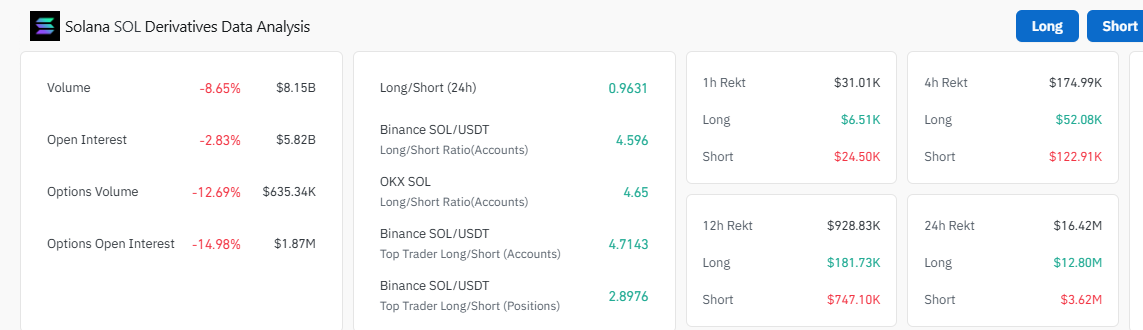

Declining Activity in Solana’s Derivatives Market

Over the past 24 hours, $16.42 million in liquidations occurred, with $12.80 million coming from long positions and $3.62 million from shorts. Solana’s trading volume has dropped to $8.15 billion, an 8.65% decline, while open interest has decreased by 2.83% to $5.82 billion.

Additionally, options open interest has fallen significantly by 14.98%, now at $1.87 million. These figures highlight waning activity and diminished interest in Solana’s derivatives market.

Rising Long Ratio Signals Shift Toward Bullish Sentiment

Rising Long Ratio Signals Shift Toward Bullish Sentiment

The long ratio, which measures the percentage of long positions relative to total market positions, has seen a significant uptick. Previously at 47.70%, indicating a near-equal balance between long and short positions, it has now increased to 51.48%. This shift reflects growing optimism and a tilt in market sentiment toward bullish expectations.

Conclusion: A Pivotal Moment for Solana

Solana ($SOL) finds itself at a critical juncture, with on-chain data, price patterns, and market sentiment painting a mixed picture. Significant whale activity and declining derivatives metrics suggest caution, while the rising long ratio hints at growing bullish sentiment.