As the countdown to Christmas begins, the crypto market is buzzing with anticipation to see if the festive spirit will ignite a record-breaking rally this year. Historically, Bitcoin (BTC) has delivered a “Santa Rally” during halving years, characterized by bullish price movements in the week leading up to Christmas.

The question remains: Will this year follow the same pattern, or will the market chart a different course?

Bitcoin Could Repeat Christmas Performance, Analysts Predict

Year-to-date (YTD), Bitcoin price has increased by 137%, as the coin surged past $108,000 recently before its recent decline. Despite the slight retracement, there are talks in some corners suggesting that BTC could trade higher in the coming Christmas week.

It is important to note that Bitcoin’s price doesn’t consistently rise every Christmas season. However, in bullish market phases, the cryptocurrency tends to perform strongly during this period. Conversely, bear markets have typically brought significant Christmas Bitcoin price declines during the festive season.

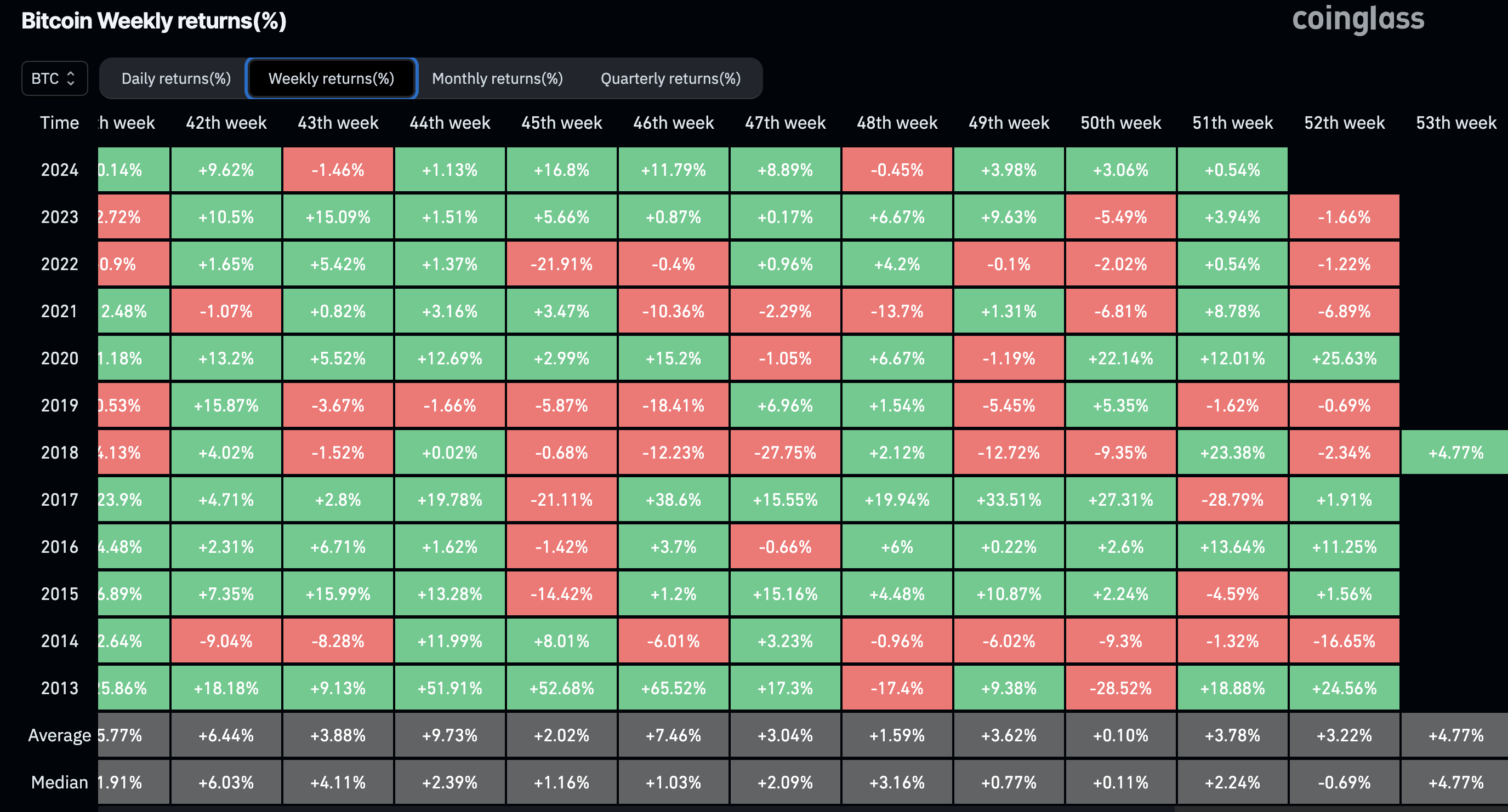

Data from Coinglass shows that in the 2020 halving year, Bitcoin surged by 25.63% during Christmas week (the 52nd week). Similarly, in 2016, BTC climbed by 11.25%, and in 2012, it posted another double-digit gain.

Furthermore, BTC has already recorded an 8.71% increase this December. If historical trends hold true, the cryptocurrency could see further gains next week, potentially edging closer to the $120,000 mark.

Interestingly, some analysts have shown confidence that a similar thing might occur this year. One of those with such sentiment is BTC and altcoin investors Mister Crypto.

“Bitcoin always goes parabolic around Christmas in halving years. This time won’t be different,” Mister Crypto shared on X (formerly Twitter).

Like Mister Crypto, another analyst, Crypto Rover, mentioned that the Bitcoin “Santa Rally” would happen in 2024.

On-Chain Data Suggest the Coin Could Go Higher

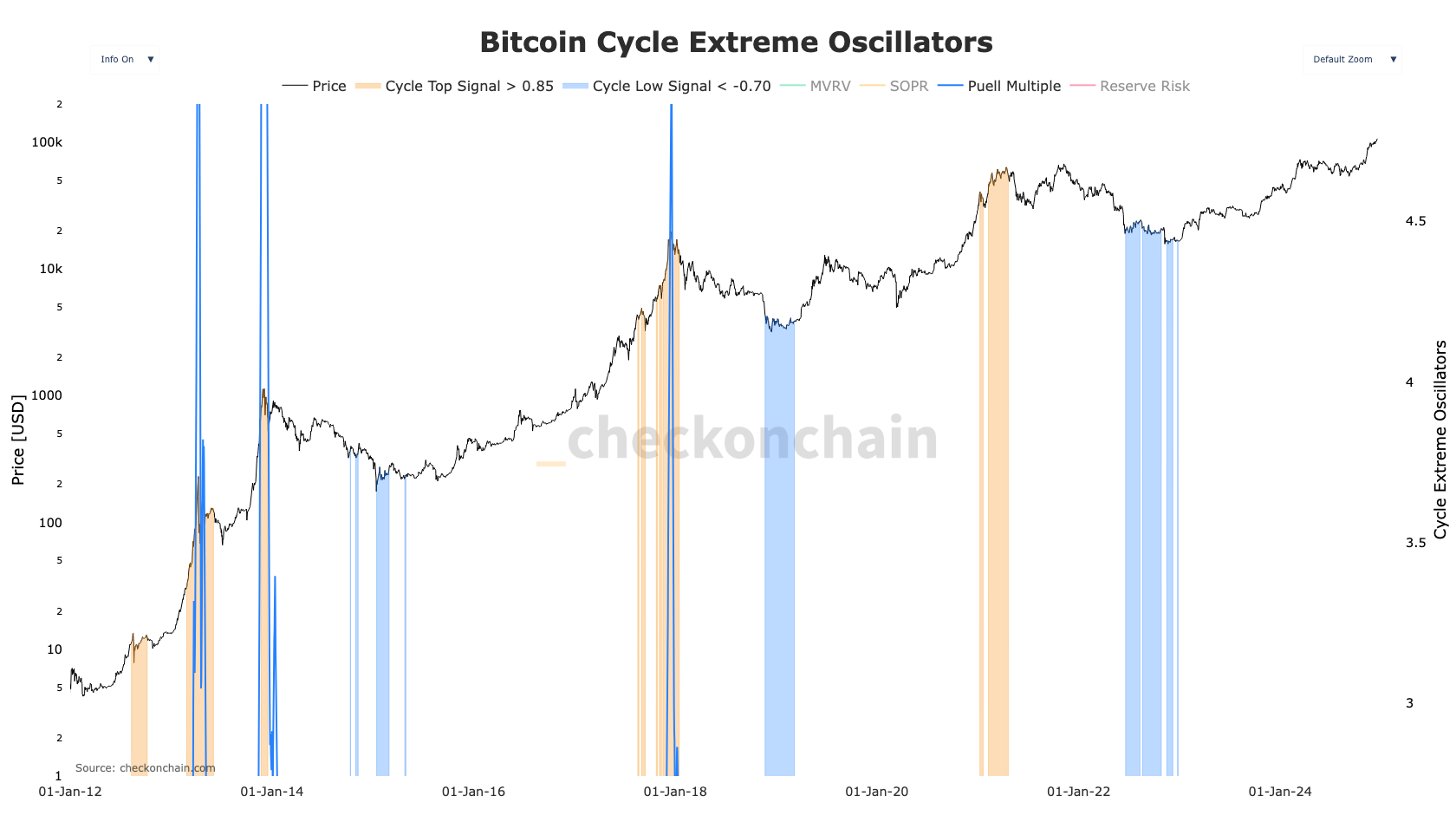

From an on-chain perspective, several extreme Bitcoin cycle oscillators support the possibility of a higher value. Taking the Cycle Top and Cycle Low signals, for example, BeInCypto observes that BTC hits the top when the Cycle Top is higher than 0.85.

On the other hand, the cryptocurrency hits the bottom when the Cycle Low reading is less than 0.70. As seen below, Bitcoin has moved beyond the bottom, but it has yet to hit the peak of this cycle. If buying pressure increases toward Christmas week, Bitcoin could surpass its all-time high of $108,268.

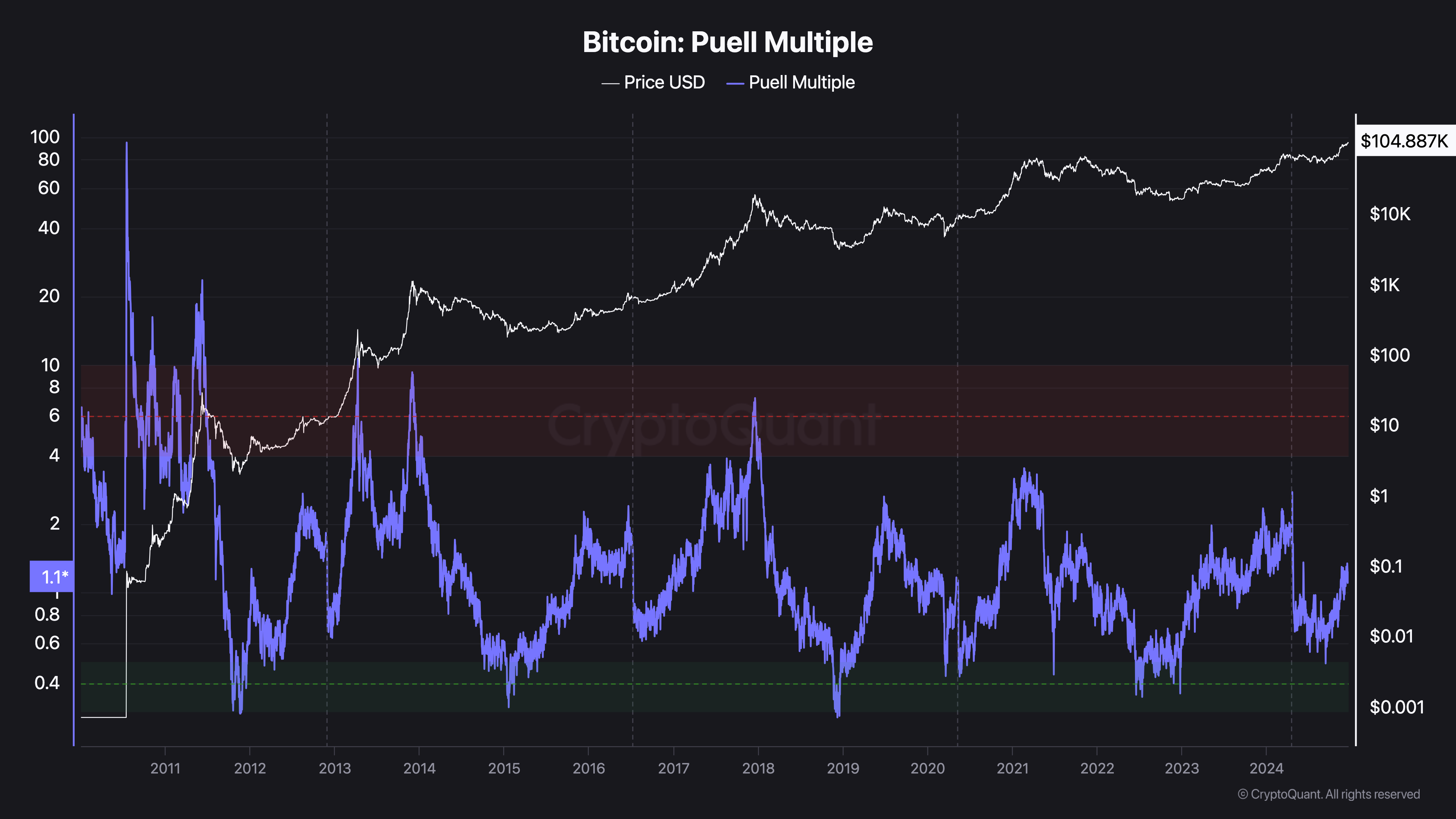

Furthermore, the Puell Multiple also aligns with the bias. The Puell Multiple utilizes Bitcoin’s current price to provide a comparable perspective. It helps determine whether Bitcoin’s price is relatively high or low when compared to its historical trends.

Readings over 6 indicate a market top, while those below 0.4 signify the bottom. According to CryptoQuant, Bitcoin’s Puell Multiple is 1.15. This current reading indicates that BTC is now above the bottom but still has room to grow as it is still far below the top.

BTC Price Prediction: Possible Run to $116,000?

On the daily chart, Bitcoin’s price seems to be towing the same path that saw it surpass $73,750 in March. During that period, BTC climbed by 81.95% in less than three months. Between November 5 and the time of writing, the cryptocurrency has increased by 56.58%.

A look at the Accumulation/Distribution (A/D) line shows that reading has increased. This rise indicates a notable accumulation over distribution. The Money Flow Index (MFI), which gauges the level of capital flow, has also jumped.

Should these indicators continue this same trend, Bitcoin’s price by Christmas week could be above $116,000 and nearly $120,000. However, if BTC faces selling pressure before December 25, this might not happen. Instead, it could slide below $100.000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.