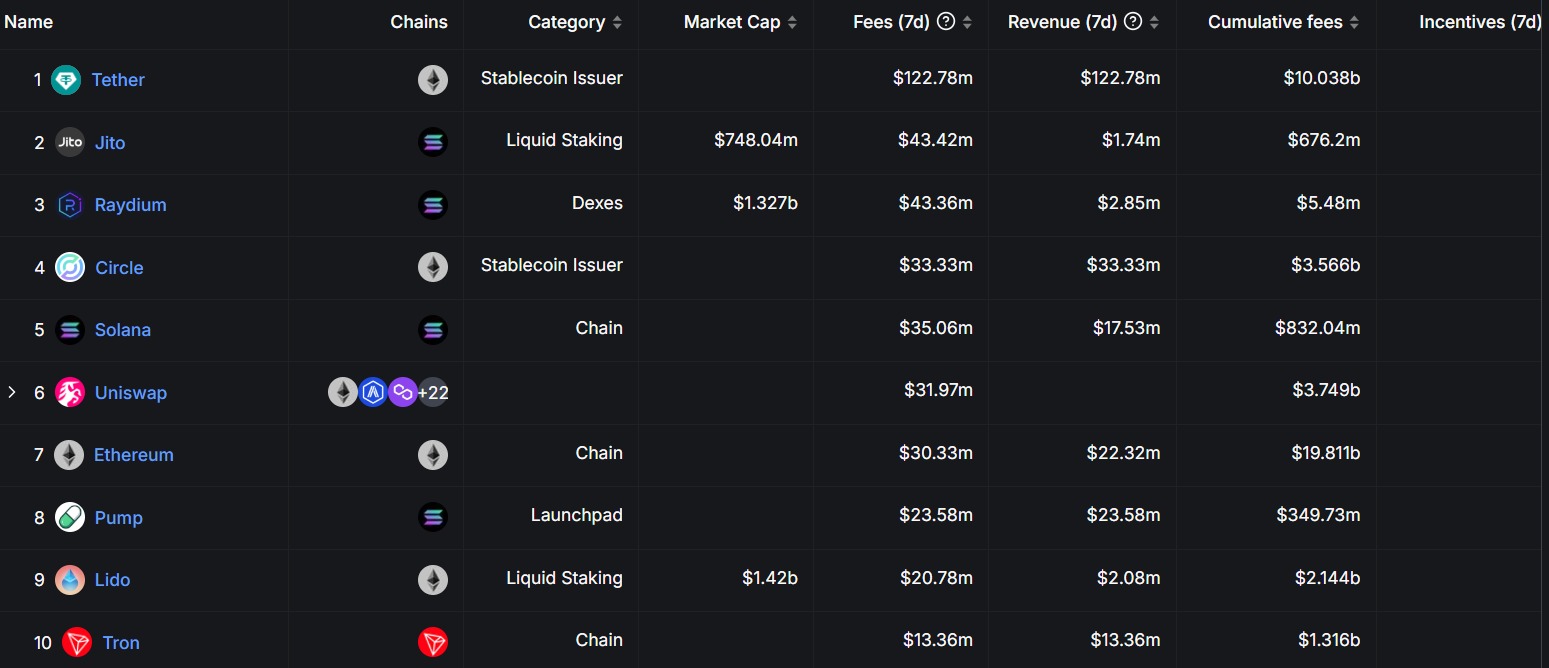

The cryptocurrency market has been busy with several transactions, generating millions in revenue from different protocols. As the weekend approaches, Tether has performed exemplary, topping the weekly revenue chart with $122.78 Million in fees for the last seven days.

The latest data from DefiLlama shows the revenue performance of different sectors within the crypto ecosystem. The data shows that stablecoin issuers are performing well.

This weekly fee revenue data highlights the success of protocols that focus on providing value to users willing to pay for services rather than relying solely on token price speculation.

The revenue data indicates a change in crypto trading. Early crypto traders depended on price surges, while current traders relied on earning fees from actual services, including payment processing, lending, trading, and blockchain usage fees.

The dominance of Tether in fee generation, followed by Circle ($33.33 Million) and Ethereum ($30.33 Million), shows how critical financial infrastructure commands the highest user payments.

Stablecoins are putting up top performance in the blockchain ecosystem

Tether’s weekly revenue of $122.78 Million shows how critical stablecoins have become to crypto’s financial system. The fee accumulates from transaction costs as users always transfer USDT across different blockchains. Tether supports 11 networks, including Ethereum, Tron, and Solana.

Circle appeared second among stablecoin issuers, after generating revenue worth $33.33 Million in weekly fees. The pattern gives a clear indication that the need for digital dollars in crypto payments has gone up.

Layer-1 blockchains have not been left far behind in fee generation. Solana raised a $35.06 million weekly fee, outperforming Ethereum’s $30.33 million and Tron’s $13.37 Million. The fees show that the Solana network attracts more transactions due to more active users.

Liquid staking is also generating a lot of revenue. Jito appears at the top with $43.42 Million earned in weekly fees, with Lido generating $20.78 Million across several chains. There is an increase in demand for staking services that give users a way to earn yield without interfering with liquidity.

DeFi protocols are keeping up as their performance is promising

Most DeFi revenue comes from decentralized exchanges, with Raydium earning $43.36 Million in weekly fees. Uniswap, which is running in more than 22 chains, earned $31.97 Million in weekly fees.

Lending platforms like Aave managed $15.32 Million, way below Raydium and Uniswap, which shows that the current market supports trading more than lending. Uniswap has a straightforward revenue model; its fee comes from traders paying to swap tokens.

The lending sector, under the DeFi protocol, drives a narrative of a market condition. Aave’s $15.32 million weekly revenue comes from interest rates spread between borrowers and lenders.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap