Bitcoin (BTC) sought relief on Dec. 20 after Wall Street’s opening, as a sharp leverage flush continued to impact late bullish traders.

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD climbing back above $96,000 on Bitstamp.

Despite a 1.5% daily decline, Bitcoin created challenging trading conditions, revisiting $92,000 lows from earlier in December, hitting long positions hard.

“The cascade of support loss has indeed occurred,” noted trader and analyst Rekt Capital on X, adding, “Bitcoin is now down -15% on this pullback.”

Rekt Capital had previously cautioned about potential corrections during bull markets, typically occurring six to eight weeks after breaking prior all-time highs. He remarked that the current dip “almost matches” a similar event from 2021.

“These corrections tend to last a few weeks,” he explained.

“Also, there tend to be up to 4 Price Discovery Corrections at most until a Bull Market ends. This is the first Price Discovery Correction in this cycle, which means it is an optimal re-accumulation opportunity with a high probability of price reversal to the upside.”

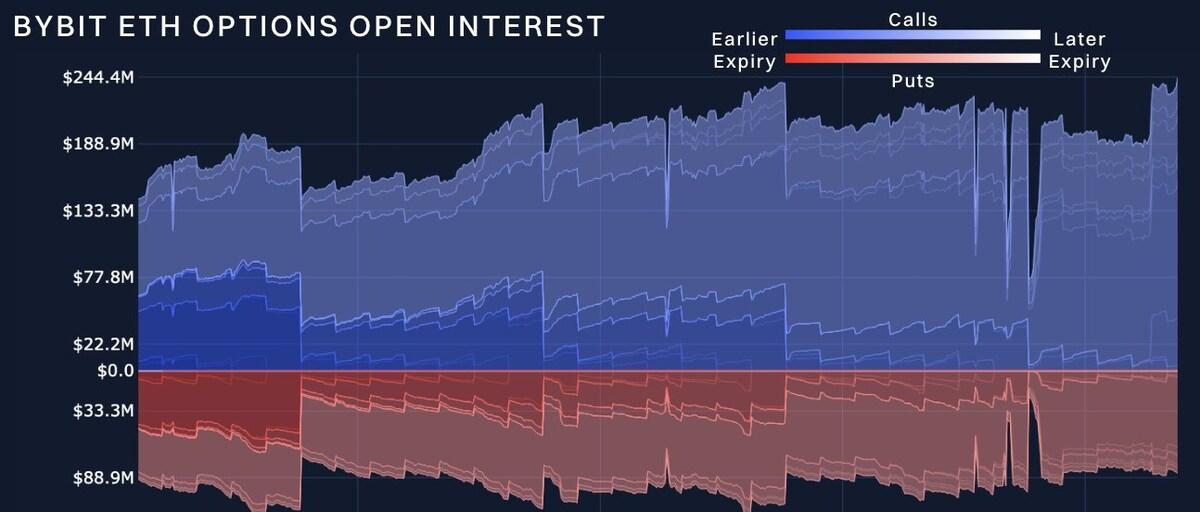

Liquidation data painted a stark picture for crypto traders. Monitoring resource CoinGlass reported $1.4 billion in liquidations across the crypto market over the past 24 hours.

Analyzing the source of Bitcoin’s short-term weakness, CryptoQuant contributor J. A. Maartun highlighted sell-side pressure originating from the United States.

Coinbase, the largest U.S. exchange, showed particularly strong selling activity. Maartun shared on X that the Coinbase premium — the price difference between Bitcoin on Coinbase and Binance — remained significantly negative.

As Bitcoin continues to test key support levels, traders are closely watching for signs of a reversal or further downside risk.

No information published in Crypto Intelligence News constitutes financial advice; crypto investments are high-risk and speculative in nature.