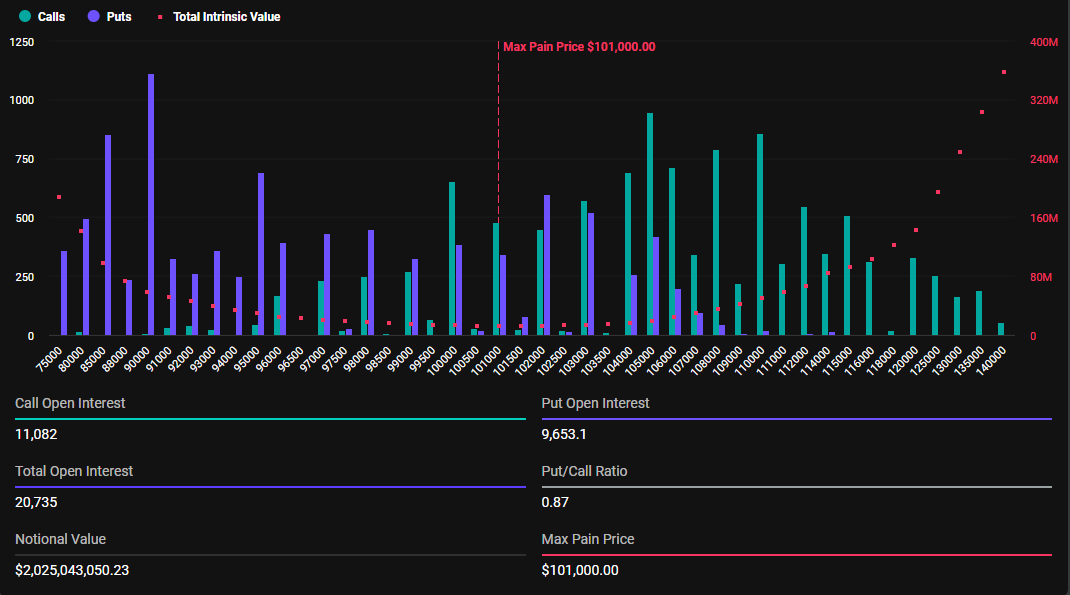

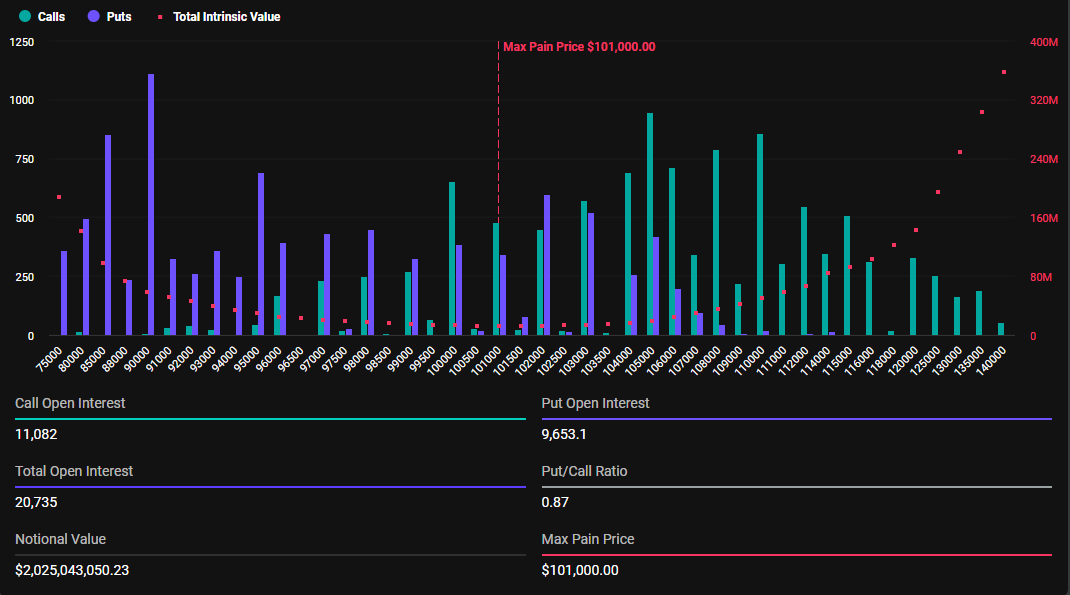

The cryptocurrency market is bracing for a significant event as $2.62 billion worth of Bitcoin and Ethereum options are set to expire today. This high-stakes expiration is expected to create short-term price fluctuations, especially with both assets recently experiencing a downtrend. Bitcoin options account for $2.02 billion of the total, while Ethereum options represent $598.99 million.

Bitcoin Options Expiry: A Key Market Indicator

According to The Bit Journal, Bitcoin’s options expiry features 20,728 contracts, slightly fewer than last week’s 20,815. The maximum pain point—the price level where most options expire worthless—is $110,000. With a put/call ratio of 0.87, the market sentiment leans bullish despite recent pullbacks. However, Bitcoin’s current price of $96,860, a 4.6% daily decline, is far below the maximum pain level. This gap indicates potential price volatility as traders adjust their positions.

Ethereum Options Expiry: A Mirror of Bitcoin’s Sentiment

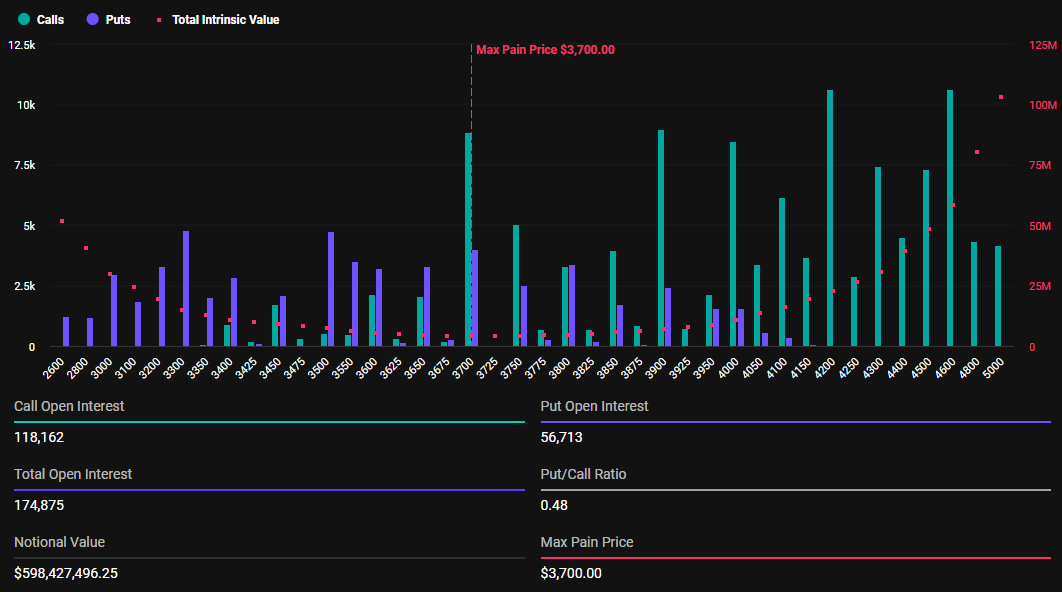

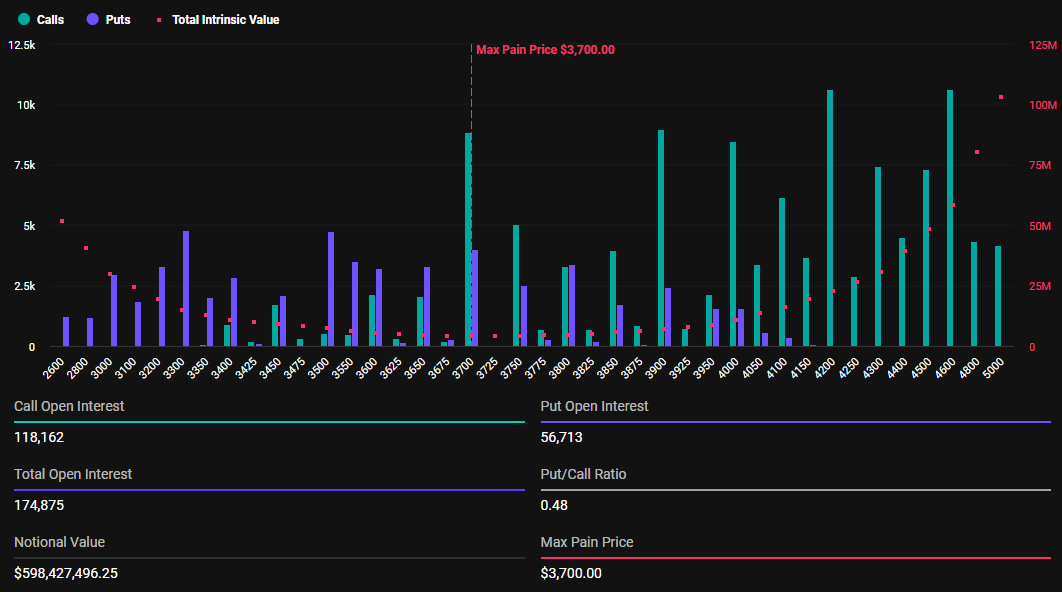

Ethereum’s options expiry includes 174,863 contracts, an increase from the previous week’s 164,330. The maximum pain point for Ethereum is $3,700, while its put/call ratio stands at 0.48, signaling optimism. However, Ethereum’s current price of $3,392 remains significantly below this level, suggesting similar volatility expectations as Bitcoin.

What Does the Expiry Mean for Both Assets?

The maximum pain point is a critical metric, representing the price level where most options expire worthless. Both Bitcoin and Ethereum’s sub-1 put/call ratios reflect a market leaning towards optimism, with more traders betting on price increases. However, the sheer volume of expiring options indicates that investors should prepare for potential turbulence.

An analyst from The Bit Journal notes:

“Options expiry can amplify volatility as traders adjust their positions. Watch for potential movements in SPX and BTC as the market reacts to these dynamics.”

Could the Expiry Catalyze a Market Recovery?

Bitcoin’s recent drop to $94,235 underscores the significance of today’s options expiry. While the current price remains below the $101,000 maximum pain level, the theory behind options trading suggests that prices may gravitate towards these levels as expiries approach. This potential alignment could catalyze a recovery for both Bitcoin and Ethereum.

The maximum pain theory assumes that options writers, often large institutions or professional traders, have the resources to influence closing prices towards the maximum pain point. For Bitcoin, this implies a possible reclaim of the psychological $100,000 level, signaling a potential turnaround.

Key Takeaways

- Bitcoin options worth $2.02 billion and Ethereum options worth $598.99 million are set to expire.

- Maximum pain levels for Bitcoin and Ethereum are $110,000 and $3,700, respectively.

- Sub-1 put/call ratios indicate market optimism despite recent pullbacks.

- Expiries may drive short-term volatility but could also catalyze a recovery.

Investors are advised to monitor the market closely as today’s expiry unfolds. According to The Bit Journal, this event could significantly influence short-term price dynamics for Bitcoin and Ethereum.

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!