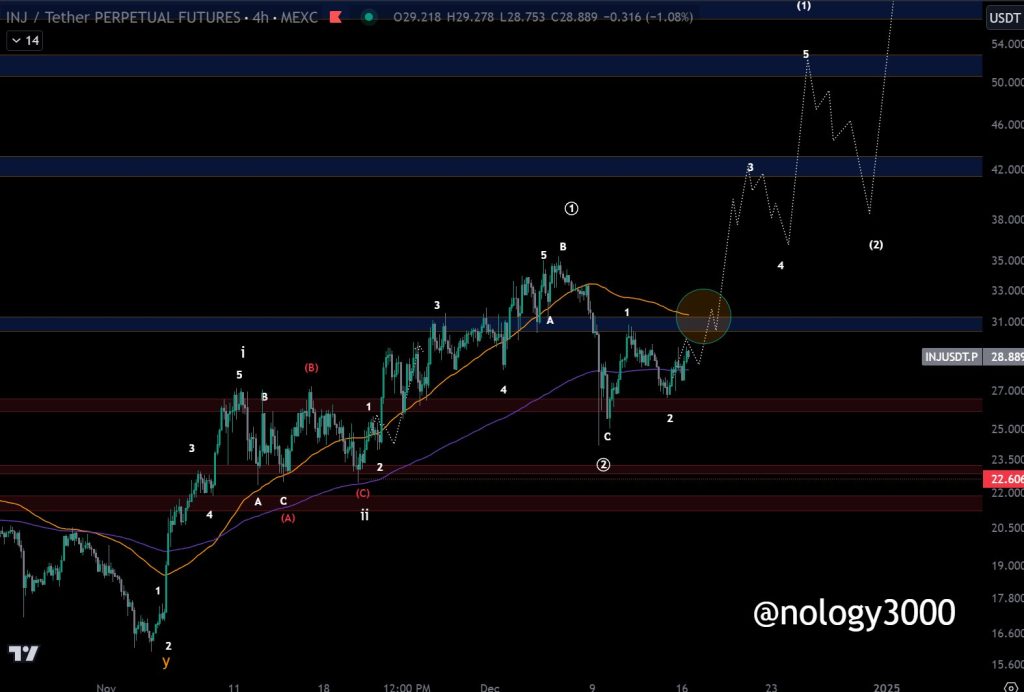

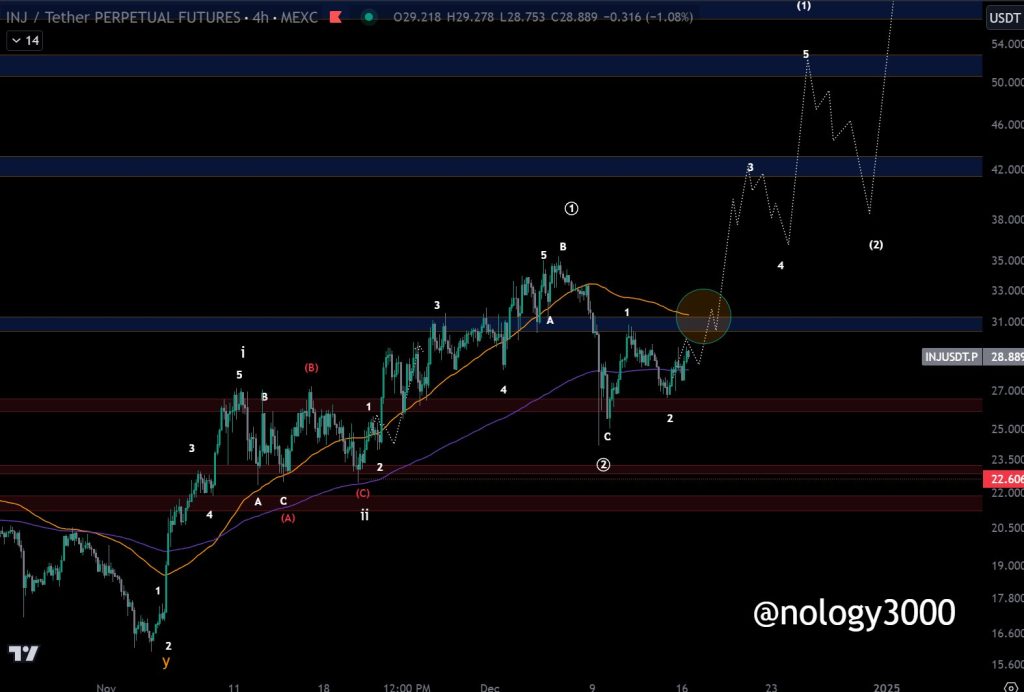

Injective (INJ) is showing signs of a strong impulsive move, with chart analysis pointing to potential price targets near $53.

Crypto analyst Nology has highlighted the INJ’s structure, noting $30 as a key level for confirmation. The price movement aligns with Elliott Wave Theory, suggesting a continuation of the upward trend.

The current chart for Injective reflects a clear Elliott Wave structure. The asset’s upward momentum began near $22.60 and has continued to form higher highs and higher lows. Analysts interpret this movement as the start of a primary impulsive wave cycle.

Wave 1 established the initial upward move, followed by an ABC corrective phase. The price has now entered Wave 3, which signals further upside. According to Nology’s projections, Wave 3 could push INJ’s price above $35 in the short term.

Long-term targets suggest the completion of Wave 5 could drive the price toward $50-$53, aligning with historical resistance zones.

Key Injective Price Levels to Monitor

The chart identifies $30 as immediate resistance, with Nology emphasizing the need for sustained action above this level. A breakout above $30 would confirm the bullish continuation and support the Wave 3 projection.

On the downside, strong support exists near $27.50, which has acted as a mid-level base during retracements. At press time, INJ trades at $29.07 with a 2.91% increase over the last day.

Further support lies at $22.60, a horizontal level where price accumulation previously occurred. Traders are watching these zones closely as they provide critical levels for re-entry or validation of the upward trend.

The 50-period MA has crossed above the 200, forming a Golden Cross. This technical signal is often interpreted as a sign of bullish momentum and trend continuation. The alignment of these moving averages supports the Elliott Wave projections for Injective’s price path.

Read also: Bitcoin (BTC) Price Faces Potential Correction – Here’s Why

Nology’s Analysis and Ethereum Correlation

In his tweet, Nology pointed to $30 as a confirmation level for Injective’s current move.

The analyst also set a target of $53, which aligns with the projected completion of Wave 5. Nology added that Injective, as an Ethereum beta play, could respond positively to movements in Ethereum’s price.

Ethereum’s performance often influences altcoins, with assets like Injective experiencing amplified price moves during ETH rallies. Traders remain watchful for Ethereum’s trajectory as a catalyst for Injective’s potential breakout.

All in all. the chart forecasts an immediate upward move toward $35-$38 as part of Wave 3. A small corrective phase (Wave 4) may follow before Injective resumes its upward momentum.

The long-term target of $50-$53 remains in focus, supported by technical indicators and resistance zones.

Follow us on X (Twitter), CoinMarketCap and Binance Square for more daily crypto updates.

Get all our future calls by joining our FREE Telegram group.

We recommend eToro

Active user community and social features like news feeds, chats for specific coins available for trading.

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.

Source link