Disclaimer: This article is a press release. COINTURK NEWS is not responsible for any damage or loss related to any product or service mentioned in this article. COINTURK NEWS recommends that readers carefully research the company mentioned in the article.

Memecoins are stirring excitement in the crypto world once again, with a trio showing promise for massive gains in the coming quarter. Standing out among them is Catzilla Coin, hinting at extraordinary growth potential. This article explores these standout tokens that could offer investors explosive returns, capturing the interest of those looking for the next big opportunity.

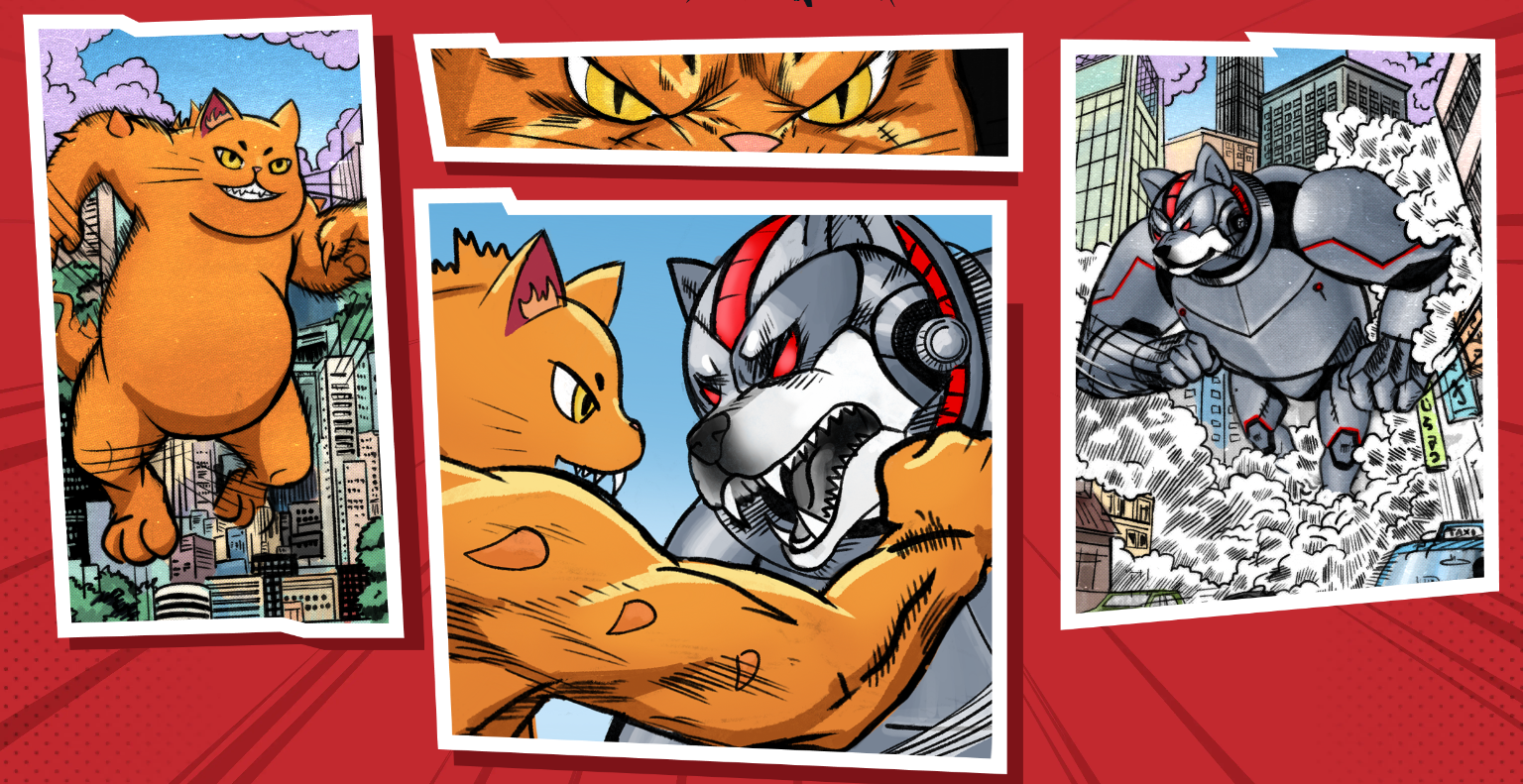

Catzilla Wrecks Chaos: The Meme Coin for Warriors of Crypto

In a world where financial freedom feels out of reach, a new opportunity emerges—Catzilla! Born from the frenzy of meme culture and set for explosive growth, this is the meme coin investors have been waiting for!

14 Stages. Limitless Potential.

A legendary cat warrior with lives to spare, Catzilla offers you 14 chances to grab the power-packed $CATZILLA token before it goes public. Imagine leveling up your stash from Stage 1 to Stage 14, where your gains soar up to 700%! Catzilla evolves as the presale progresses, bringing you closer to financial victory with every step.

But beware, fellow warriors—the clock is ticking, and only the swift and the daring will secure their share of Catzilla’s unstoppable might.

Claim your share before Catzilla stomps the competition flat!

Cats Are Taking Over: Forget Dogs—It’s All About the Meow Money

The crypto world’s gone barking mad for years, but now it’s time for cats to claw their way to the top. MEW and Popcat are the latest feline sensations proving that dogs might fetch headlines, but cats bring home the gains.

- MEW: Purring into the top 15 meme coins, this clever kitty pulled off a 103.7% climb in just three months

- Popcat: This one didn’t just pounce—it soared, delivering a jaw-dropping 157.44% surge.

These aren’t just one-off flukes. Cats are on the prowl, staking their claim in the meme coin kingdom. And if you think MEW and Popcat are impressive, wait until Catzilla roars onto the scene. Forget chasing tails—this is where the real action is.

The Mission: Smash the Market. Rewrite the Rules

Catzilla is here to destroy the old systems that hold you back. It’s time to build a new world where you, the warriors of the crypto space, rise up and claim what’s yours. With every stage of this presale, the forces of profit grow stronger.

Time is running out, and the opportunity to join Catzilla’s army won’t last forever. The profits are set to explode, and only those brave enough to seize this moment will see their gains rise like a true anime hero’s power level.

Get in now, watch Catzilla wreck the market, and bring chaos to the competition!

CHILLGUY Poised for Comeback Amid Bullish Signals

Just a chill guy (CHILLGUY) is showing signs of a potential rebound. Trading between $0.26 and $0.46, it’s above its 10-day moving average of $0.21 and near the 100-day average of $0.29. The Relative Strength Index is at 31.29, indicating oversold conditions, which may lead to an upward move. If CHILLGUY breaks the nearest resistance at $0.56, it could rally towards the next level at $0.76. This would mean a significant increase from current prices. With the anticipated altcoin season and a global crypto bull run on the horizon, CHILLGUY might be set for impressive gains. Keep an eye on the support level at $0.16 as it could be crucial for the price direction.

Super Trump (STRUMP) Aims for Breakout Amid Bullish Sentiment

Super Trump (STRUMP) is currently trading between $0.001796 and $0.002959. The coin has dropped -84.74% over six months, but recent movements suggest possible stabilization. The 10-day and 100-day simple moving averages are both around $0.00218, indicating a consolidation phase. The RSI is at 45.71, close to the oversold zone, hinting at potential upward momentum. If STRUMP breaks the nearest resistance at $0.003694, it could rally toward $0.004857, marking a significant percentage gain. With growing optimism in the altcoin market, STRUMP might be poised for a strong rebound.

Conclusion

While coins like CHILLGUY and STRUMP show some promise, their short-term potential is limited. Catzilla stands out as the leading meme coin, offering a remarkable 700% ROI during its presale. With governance, incentives, and staking features, it unites enthusiasts to fight for financial freedom. Acquiring $CATZILLA tokens invites participation in this exciting movement.

Site: Catzilla ($CATZILLA)

Twitter: https://x.com/CatzillaToken

Telegram: Telegram Chat