Key takeaways:

- NEAR price prediction shows it will reach a maximum price of $9.57 by the end of 2024.

- By 2027, NEAR is expected to rise to $16.90, driven by mainstream adoption.

- Looking ahead to 2030, NEAR Protocol could witness a significant surge, with its price potentially reaching $27 or beyond.

Overall, the prevailing sentiment within NEAR Protocol’s community is one of cautious optimism, with stakeholders closely monitoring its progress and evolution. As NEAR continues to advance its technology and forge strategic partnerships, questions surrounding its price potential persist, inviting further analysis and exploration of its prospects.

Overview

| Cryptocurrency | NEAR Protocol |

| Ticker | NEAR |

| Price | $4.97 |

| Market Cap | $6.04B |

| Trading Volume 24-h | $1.64B |

| Circulating Supply | 1.22B NEAR |

| All-time High | $20.42 Jan 17, 2022 |

| All-time Low | $0.526, Nov 04, 2020 |

| 24-h High | $5.65 |

| 24-h Low | $4.85 |

NEAR Protocol price prediction: Technical analysis

| Sentiment | Bearish |

| 50-Day SMA | $6.00 |

| 200-Day SMA | $5.16 |

| Price Prediction | $10.91 (119.95%) |

| F & G Index | 19.43 (extreme fear) |

| Green Days | 15/30 (50%) |

| 14-Day RSI | 20.1 |

NEAR Protocol price analysis

TL;DR Breakdown

- NEAR Protocol price analysis shows a fall to the $6.50 mark.

- NEAR price fell by over 1.2% at the time of writing.

- NEAR Protocol sought support and resistance at $5.00 and $5.50, respectively.

Near Protocol price analysis for today, December 22, shows that the price has fallen below the $5.00 mark as bears dominate the markets.

NEAR Protocol price analysis 1-day chart: NEAR falls below $5.00

The 1-day NEAR/USD price chart indicated an upward trend in the market as prices moved toward the $6.50 level. The bulls were unable to climb past $8.00 or establish a secure foothold above $5.00 and the price has come crashing down in the last ten days.

The Indicators reflect the increasing bearish price sentiment as all three major technical indicators signal rising bearish price sentiments. The MACD is bearish at -0.288 units and suggests strong bearish momentum. Moreover, the EMAs are below the mean position, and the indicator shows a steady bearish momentum. The RSI also shares this sentiment as the indicator fell to 32.41 from above the 70.00 index level. The diverging Bollinger Bands suggest increasing volatility, indicating that the $5.00 support may not hold for the week.

NEAR price analysis 4-hour chart

The 4-hour price chart of NEAR shows a sudden spike in NEAR price as the asset broke past $6.0. The price movement was followed by a short return to $5.70 before crossing back above the $6.00 mark as the bulls sought to go past the $7.50 resistance. However, the bulls failed to secure a foothold above $5.00 and the price has come crashing down in the last ten days.

The RSI is at 36.28, suggesting that the asset is at the bottom of the neutral zone, which indicates that the bears have less room for more upward movement in the short term. However, the downward slope suggests increasing selling pressure on the asset, suggesting further gains. The MACD is bullish , with the MACD line at 0.015 showing slight bullish dominance across the 4-hour charts, which has been decreasing in recent candles. These indicators collectively issue a steady bullish trend that suggests a consolidation below $5.50.

NEAR Protocol technical indicators: Levels and actions

Daily simple moving average (SMA)

| Period | Value | Action |

|---|---|---|

| EMA 3 | $ 5.96 | SELL |

| EMA 5 | $ 6.19 | SELL |

| EMA 10 | $ 6.50 | SELL |

| EMA 21 | $ 6.61 | SELL |

| EMA 50 | $ 6.17 | SELL |

| EMA 100 | $ 5.68 | SELL |

| EMA 200 | $ 5.34 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

|---|---|---|

| SMA 3 | $ 6.04 | SELL |

| SMA 5 | $ 6.09 | SELL |

| SMA 10 | $ 6.38 | SELL |

| SMA 21 | $ 6.88 | SELL |

| SMA 50 | $ 5.98 | SELL |

| SMA 100 | $ 5.34 | SELL |

| SMA 200 | $ 5.17 | SELL |

What to expect from NEAR Protocol price analysis?

NEAR ended its bearish rally at the $4.00 mark, a key support to the asset that has been tested many times. The strong trade volume suggests increasing activity, indicating a robust force behind the recent fall. As such, the price rose rapidly to the $5.50 mark before stumbling below the $50 mark again.

Traders should expect NEAR to continue its bearsih rally as the bears chase the $4.00 mark. Currently, the closest support level is $5.00 and below at $4.50, while NEAR Protocol faces difficulty establishing a foothold above the $5.00 level.

Is Near Protocol a good investment?

NEAR Protocol distinguishes itself in the cryptocurrency market, emphasizing scalability, usability, and developer-friendliness. It aims to facilitate the creation of decentralized applications (dApps) and smart contracts, catering to developers and end-users. NEAR’s innovative technology and user-centric approach make it attractive for mainstream adoption of blockchain applications.

With a focus on user experience and developer tools, NEAR Protocol is positioned to drive significant growth in the decentralized application ecosystem. Its potential to disrupt traditional industries and capture market share in the blockchain space makes it an intriguing investment opportunity for those interested in innovative technology solutions.

Why is NEAR down?

NEAR price rose rapidly to the $8.00 mark, however, the bulls failed to secure a foothold above $5.00 and the price has come crashing down in the last ten days.

Will NEAR reach $10?

NEAR is experiencing a volatile market movement that may see it reach the $10 mark before the year closes.

Will NEAR reach $20?

NEAR is expected to cross the $20 threshold by 2027 as the industry continues to see increasing adoption across the mainstream. The bullish rally will be supported by NEAR’s vision of a scalable future and user and developer-friendly architecture that sets it apart from other blockchains.

Will NEAR reach $50?

The chance of NEAR reaching the $50 mark depends on various circumstances, such as future network development, market regulations, and the broader cryptocurrency market growth. If NEAR continues its current trajectory, it can reach $50 in the next decade.

Does NEAR have a good long term future?

Yes, NEAR has a good long-term future due to its innovative technology, focus on scalability, and strong ecosystem development. However, the project needs to keep up with sector developments to maintain its edge in the digital ecosystem.

Recent news/opinions on Near Protocol

NEAR recently conducted an AMA with fraxfinance founder Sam Kazemian sitting down with NEAR Co-Founder to discuss AI, PMF, DeFi, cross-chain interoperability, and more.

NEAR price prediction December 2024

| Month | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| December | 3.18 | 3.76 | 4.86 |

NEAR protocol price forecast for December 2024 is expected to trade at a minimum price of $3.18, with an average of $3.76, and a maximum price of $4.86.

NEAR price prediction 2024

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2024 | $3.36 | $7.49 | $8.28 |

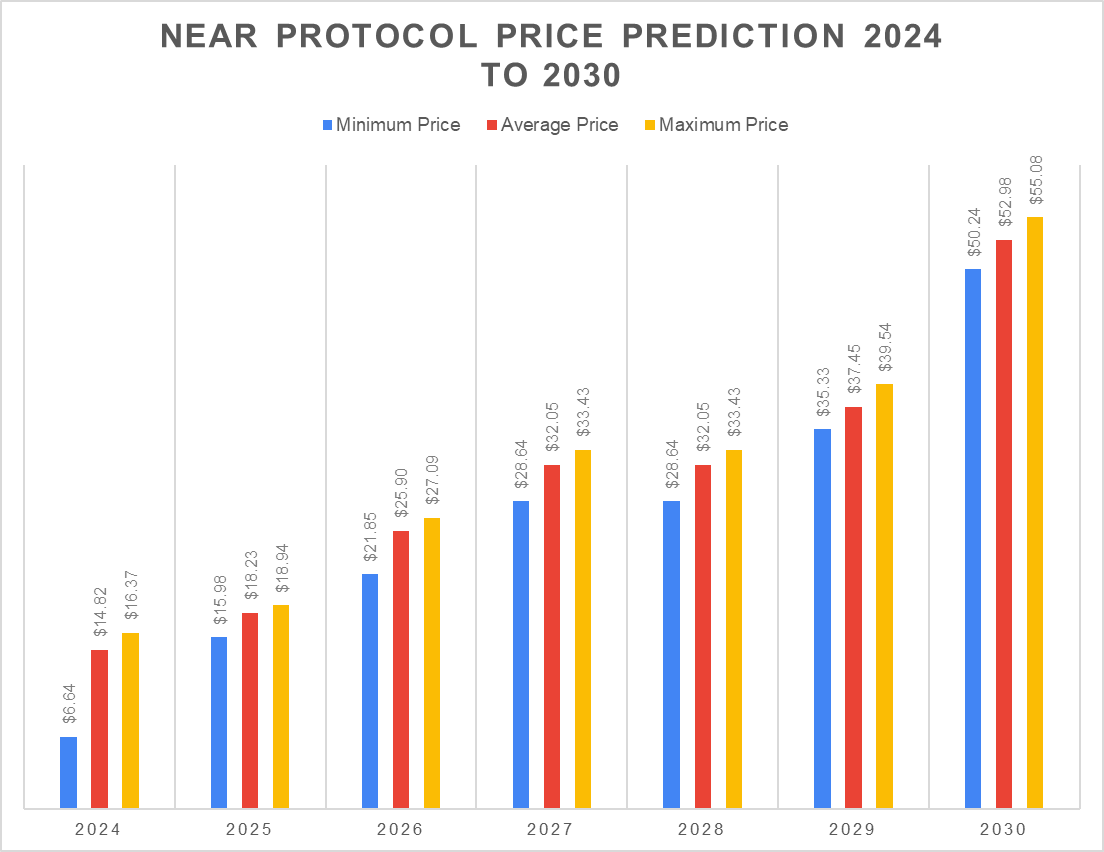

At the beginning of 2024, there was a recovery in the price of cryptocurrencies, but recent events have shown that bears are now in control of price dynamics, slowing growth. Experts expect that NEAR might reach a maximum price of $16.37, an average price of $14.82, and a minimum price of $6.64.

NEAR price prediction 2025-2030

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2025 | $8.08 | $9.22 | $9.57 |

| 2026 | $11.05 | $13.10 | $13.70 |

| 2027 | $14.48 | $16.20 | $16.90 |

| 2028 | $14.48 | $16.20 | $16.90 |

| 2029 | $17.86 | $18.93 | $19.99 |

| 2030 | $25.40 | $26.79 | $27.85 |

NEAR price prediction 2025

The forecast for 2025 suggests a continuation of price rise with a minimum value of $15.98, an average price of $18.23, and a maximum value of nearly $18.94.

NEAR price prediction 2026

Technical analysis and projections for 2026 anticipate the minimum price to be around $21.85, with an average trading price of $25.90, and a maximum value of nearly $27.09 by the end of 2026.

NEAR price prediction 2027

In 2027, NEAR price prediction estimates NEAR Protocol’s price to be trading at a minimum price of $28.64, with an average price of $32.05, and a maximum price value nearly reaching $33.43 by the end of 2027.

NEAR protocol prediction 2028

The NEAR Protocol price prediction for 2028 suggests the bullish sentiment will continue with a minimum price of $28.64, an average trading price of nearly $32.05, and a maximum value of $33.43 by the end of 2028.

NEAR price prediction 2029

In 2029, NEAR protocol price prediction forecasts NEAR could trade at a minimum of $35.33, an average price of nearly $37.45, and a maximum value of $39.54 by the end of 2029.

NEAR price prediction 2030

The NEAR Protocol forecast for 2030 suggests a sustained bullish sentiment with a minimum value of $50.24, an average trading price of nearly $52.98, and a maximum value of $55.08

NEAR price prediction 2024 – 2030

NEAR market price prediction: Analysts’ NEAR price forecast

| Firm | 2024 | 2025 |

| Coincodex | $23.79 | $34.28 |

| DigitalCoinPrice | $9.30 | $11.44 |

Cryptopolitan’s NEAR protocol (NEAR) price prediction

Cryptopolitan’s predictions show that the price of NEAR protocol will reach a high of $16.37 in the second half of 2024. In 2025, it will range between $15.98 and $18.94, with an average of $18.23. In 2030, it will range between $50.24 and $55.08, with an average of $52.98. Note that these predictions are not investment advice. Seek independent professional consultation or do your research.

NEAR Protocol historic price sentiment

- The Near Protocol (NEAR) began its journey in August 2020, aiming to create a scalable and permissionless blockchain. The first recorded trade value in October 2020 was $1.072, closing the year at $1.459 after a recovery.

- In 2021, NEAR showed an uptrend, starting at $1.305 and reaching an all-time high (ATH) of $7.572 by March 13. A market downturn pushed the price down to $1.537 by July 19, but it rebounded to $11.776 on September 9 and further to $13.168 on October 26.

- By 2022, NEAR’s price crashed to below $2.00, losing over 90% of its peak value. Throughout 2023, NEAR saw low volatility, with prices remaining below $2.50 for most of the year.

- Since the start of 2024, NEAR experienced a strong recovery, climbing to $7.80. However, after reaching the $8.00 mark in mid-May, it fell back to $5.60. In June, NEAR traded between $4.48 and $7.66. It rose from $5.20 to $6.04 in July but closed the month below $5.00. NEAR started August at $5.00, declining to $3.89 by the end of the month.

- In September 2024, the asset bounced back and closed the month above the $5.20 mark. In October, the price stumbled and fell to $4.850 in the first few days before closing the month below the $4.00 mark leaving a negative outlook at the start of November.

- November saw NEAR making remarkable strides as the bulls held strong control of markets during the month, a trend that is likely to continue into December.