Cardano price could be off to an interesting start this week. Potentially even a bullish one now that the sell pressure observed last week has since subsided.

ADA had a $0.88 press time price tag and has been hovering near this level after last week’s dip. This observation could signal that the recent wave of sell pressure had already ran course.

The bearish momentum appears to have cooled off after price entered the 0.5 and 0.618 Fibonacci range ($0.817 and $0.698). This was based on its lowest price in November and recent local top earlier this month.

The Cardano price has been hovering above the aforementioned Fibonacci range, indicating positive liquidity flows. In other words, there was noteworthy accumulation when price tested the range.

A Liquidity Trap or An Incoming Bullish Pivot For Cardano Price?

A significant amount of liquidity sits on the same price range anticipating a demand resurgence to fuel more upside. However, these liquidity zones also underscore inducement zones where heavy liquidation may occur in case Cardano price moves in the opposite direction.

Interestingly, ADA longs vs shorts ratio confirmed that a sentiment shift occurred. There were slightly more long positions at the time of writing than short positions in the last 24 hours.

– Advertisement –

Spot outflows were quite active last week, peaking at $44.75 million. They declined considerably to $8.11 million as of 22 December. This confirmed that sell pressure has been declining.

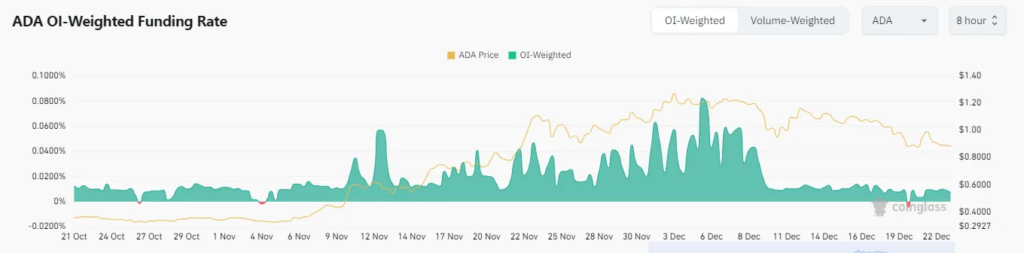

The dip in spot outflows was also in line with the derivatives segment. For example, Open interest funding grates briefly dipped into negative territory on 20 December. It has since shifted back to positive.

The positive funding rates and declining negative funding rates underscore the potential for a rally. However, not all signs point towards such an outcome.

As mentioned above, the recent accumulation may also create a liquidity trap for new buyers that expect a rally. This suggests that more downside could be incoming based on the lack of bullish enthusiasm.

Whales have so far not been capitalizing on a bullish probability. Large holder outflows peaked at 18.55 million ADA on Friday last week. This was the initial bounce back which confirmed whale accumulation.

Large holder flows maintained negative netflows during the weekend, indicating a lack of enthusiasm among whales. One of the main reasons for this could be the fact that Bitcoin dominance has been rallying.

Altcoins usually face lower liquidity injection in instances where Bitcoin dominance rallies aggressively. This could indicate that a bullish recovery for Cardano price, if it occurs, may not be as aggressive as the November rally.

A look at ADA addresses profile may also help to paint a picture of the difference between now and in November when the rally started.

The total addresses with balance dipped from 4.45 million addresses on 5 November to 4.37 million addresses as of 9 December. The addresses with balance have since stagnated.

Total addresses with balance could signal aggressive accumulation if it regains a positive trajectory. The decline reveals that a lot of profit-taking has been happening as Cardano price rallied.