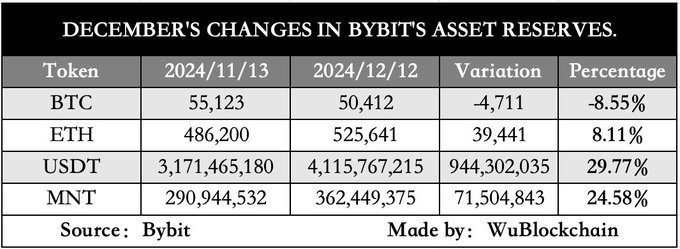

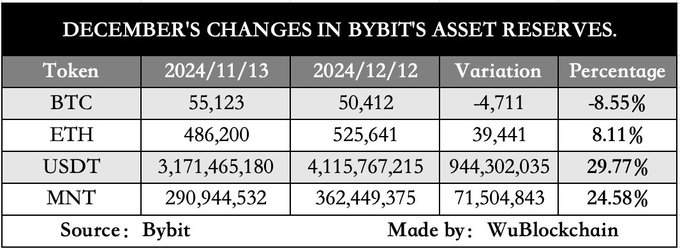

Bybit has released its 17th proof of reserves report, revealing notable shifts in user asset holdings as of December 12, 2024.

The snapshot shows a difference between Bitcoin and other major assets, with BTC holdings declining 8.55% to 50,412 BTC since the November 13 report. However, Ethereum and stablecoin holdings experienced substantial growth. Ethereum assets increased by 8.11% to 525,641 ETH, and USDT holdings surged by 29.77% to reach 4.11 billion.

The exchange maintains healthy reserve ratios across its supported assets, with most cryptocurrencies showing coverage above 100%. This indicates Bybit holds more assets in its wallets than required to cover all user deposits, with some tokens like USDC showing reserve ratios as high as 128%.

Bitcoin holdings decline as ETH gains momentum

The most important change in Bybit’s reserves comes from Bitcoin holdings, which dropped by 4,711 BTC from the previous month to 50,412 BTC. Despite this reduction in user assets, Bybit maintains a healthy 115% reserve ratio for Bitcoin, meaning the exchange holds 58,283 BTC in its wallet assets compared to user deposits.

In contrast, Ethereum has shown growth, with user assets increasing by 39,441 ETH to reach 525,641 ETH. The exchange maintains a 106% reserve ratio for ETH, with wallet assets of 558,467 ETH.

The changing trends between Bitcoin and Ethereum holdings might show the changing user preferences and market dynamics.

While Bitcoin’s reserve ratio remains strong at 115%, the reduction in overall holdings could indicate users taking profits during Bitcoin’s recent price rally or diversifying into other assets.

Stablecoin dominance in reserve growth

Bybit’s stablecoin reserves have shown growth, led by USDT’s increase of 944.3 million to reach 4.11 billion in user assets. This 29.77% surge represents the largest percentage increase among major assets on the platform. The exchange maintains a 103% reserve ratio for USDT, with wallet assets of 4.27 billion USDT.

Other stablecoins show similar metrics. USDC maintains the highest reserve ratio among all assets at 128%, with user assets of 148.87 million and wallet assets of 190.80 million. USDE shows a perfect balance with a 100% reserve ratio, holding 533.99 million in both user assets and wallet assets.

MNT has also shown growth, with user assets increasing by 71.50 million to reach 362.44 million, a 24.58% increase. MNT maintains a healthy 119% reserve ratio, with wallet assets of 432.89 million.

Diverse asset reserve ratios

Bybit’s proof of reserves reveals consistently strong coverage across its wide range of supported cryptocurrencies. Meme coins show particularly strong ratios, with Dogecoin (DOGE) maintaining a 118% reserve ratio and Shiba Inu (SHIB) at 108%. In practical terms, this means Bybit holds 1.83 billion DOGE in wallet assets against 1.55 billion in user deposits and 4.50 trillion SHIB against 4.13 trillion in user assets.

Layer-1 blockchain tokens show similarly healthy metrics. Solana (SOL) maintains a 104% ratio with 3.15 million tokens in wallet assets, while Polkadot (DOT) shows a strong 112% coverage with 14.10 million tokens backing user deposits. Among DeFi tokens, Uniswap (UNI) stands out with a 117% reserve ratio, holding 4.41 million tokens against 3.74 million in user assets.

The reserve data also highlights the exchange’s strong position in other categories. Gaming tokens like SAND maintain a 109% ratio, while newer protocols such as RENDER and SHRAP both show 117% and 119% ratios, respectively.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap