- ETFs, governments, and MicroStrategy now hold 31% of all known Bitcoin, reflecting significant institutional market adoption.

- MicroStrategy’s substantial Bitcoin holdings reach 439,002 BTC, emphasizing its strategic investment in cryptocurrency as a reserve asset.

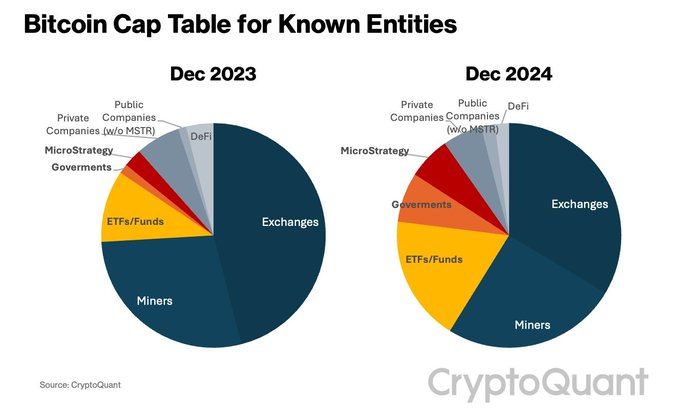

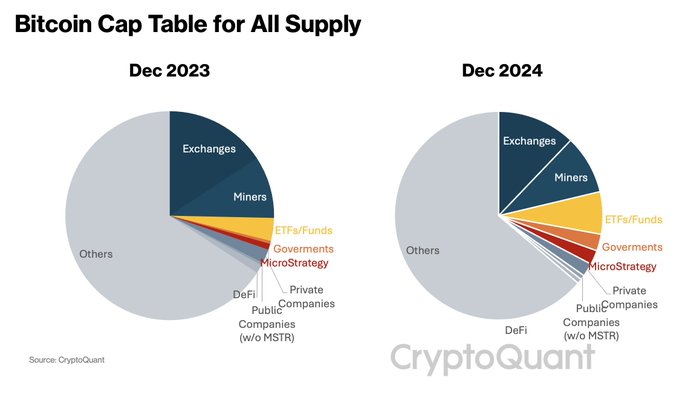

Exchange Traded Funds (ETFs), governments, and MicroStrategy (MSTR) now collectively hold 31% of all publicly known Bitcoin holdings as of December 2024. This represents a significant increase from just 14% the previous year, according to an analysis by Ki Young Ju, shared on the social media platform X.

MicroStrategy has significantly bolstered its position in the Bitcoin ecosystem, owning 439,002 bitcoins by mid-December 2024, which were acquired for a total of $23.41 billion USD. This strategy underscores the company’s commitment to Bitcoin as both a reserve asset and an investment vehicle.

The analysis by Ki Young Ju, accompanied by circular charts, vividly illustrates the shift from a dispersed to a more centralized Bitcoin ownership structure over the course of a year.

#Bitcoin Cap Table Update: ETFs, governments, and $MSTR now account for 31% of all known Bitcoin holdings, up from 14% last year. pic.twitter.com/csZQICpM4o

— Ki Young Ju (@ki_young_ju) December 23, 2024

The rise in institutional holdings is not just a testament to Bitcoin’s growing acceptance among formal financial entities but also signals a potential increase in market stability and investor confidence.

ETFs, governmental bodies, and significant corporate holders like MicroStrategy are becoming pivotal to the cryptocurrency’s ecosystem, potentially paving the way for more regulated and mainstream investment pathways.

Moreover, Ki Young Ju clarifies that the 31% figure pertains solely to known Bitcoin holders and does not encompass the entire circulating supply, which remains partly in the hands of anonymous or unidentified entities.

This distinction is crucial in understanding Bitcoin distribution and the ongoing evolution of its market.

The increased concentration of Bitcoin ownership among institutional entities could have far-reaching implications for its valuation and integration into larger, more traditional financial systems.

The current price of MicroStrategy (MSTR) stock is $348.99, reflecting a decline of 4.18% in the last trading session. Over the past week, the stock has dropped 15.98%, and its one-month performance shows a decline of 13.93%.

Despite the recent downturn, MSTR has achieved a remarkable 401.66% year-to-date increase, driven by its significant Bitcoin holdings and the broader cryptocurrency market trends.

MicroStrategy continues to make headlines with its aggressive Bitcoin acquisition strategy. Recently, it purchased an additional 5,262 BTC for $561 million, funded by the sale of 1.3 million shares. This move brings the company’s total Bitcoin holdings to approximately 444,262 BTC, cementing its position as one of the largest corporate Bitcoin holders.

From a technical perspective, the stock faces strong resistance near $370, while key support levels lie around $300.