Airdrop Is Live  CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

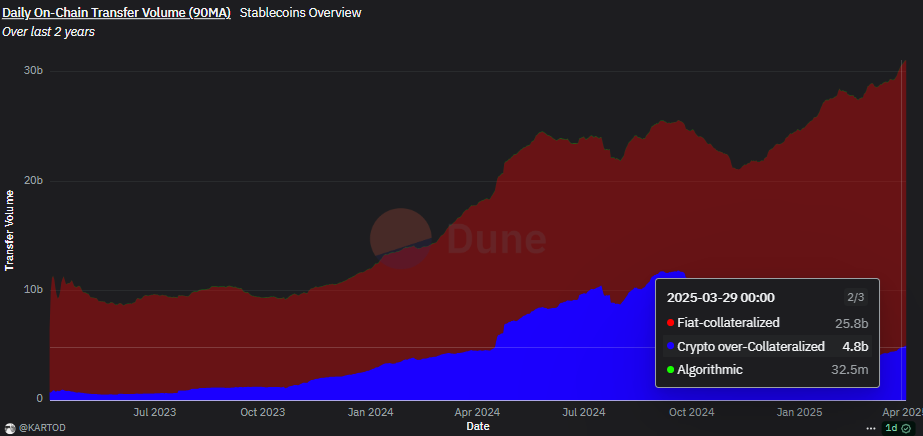

Republican U.S. lawmakers, including Senator Tim Scott and Representative French Hill, have promised action on digital assets legislation, with plans to advance crypto market-structure bills like the Financial Innovation and Technology for the 21st Century Act (FIT21) and a stablecoin bill. Hill emphasized the importance of bipartisan support for successful legislation, which is expected in 2025. In Scott’s opinion, crypto is “the next wonder of the world,” and he claimed he would be the chairman to create a digital assets subcommittee for the first time.