From mobile wallets to transaction fees, a16z crypto breaks down the top indicators shaping the crypto landscape in 2025.

The year 2024 was transformative for the crypto space as activity reached all-time highs, transaction fees dropped, stablecoins found practical use cases, and spot Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds finally received approval. Meanwhile, regulatory clarity began to emerge, offering the sector a more defined path forward. As 2025 begins, here are five metrics a16z’s partner Daren Matsuoka believes worth monitoring.

Mobile crypto wallets

Crypto wallets on mobile are where the action is. In 2024, over 35 million people were using them monthly, Matsuoka notes, bringing up such big names as Coinbase Wallet, MetaMask, and Trust Wallet, who are leading the charge. At the same time, newer apps like Solana-focused Phantom and World App are gaining steam too.

Mobile crypto applications have grown so popular that they now serve as an informal indicator of retail investor interest, with observers identifying a correlation between their high rankings in Apple’s App Store and rising crypto prices.

While millions own crypto, many remain passive holders. For broader adoption, Matsuoka says blockchain developers need to find the “right balance between security, privacy, and usability,” admitting that the task is “not trivial.” Nonetheless, the a16z partner believes blockchain infrastructure can now handle “hundreds of millions — or billions — of people on-chain,” adding it’s a “better time than ever to build a next-generation mobile wallet” than ever before.

According to data from Statista, the countries with the highest mobile wallet adoption are in Asia, despite the presence of major U.S. brands like PayPal, Apple Pay, and Google Pay. This trend is not accidental given that in emerging markets, mobile wallets are being used as a tool to address the issue of unbanked populations. As a result, the next major innovation in mobile crypto wallets may well emerge from this region.

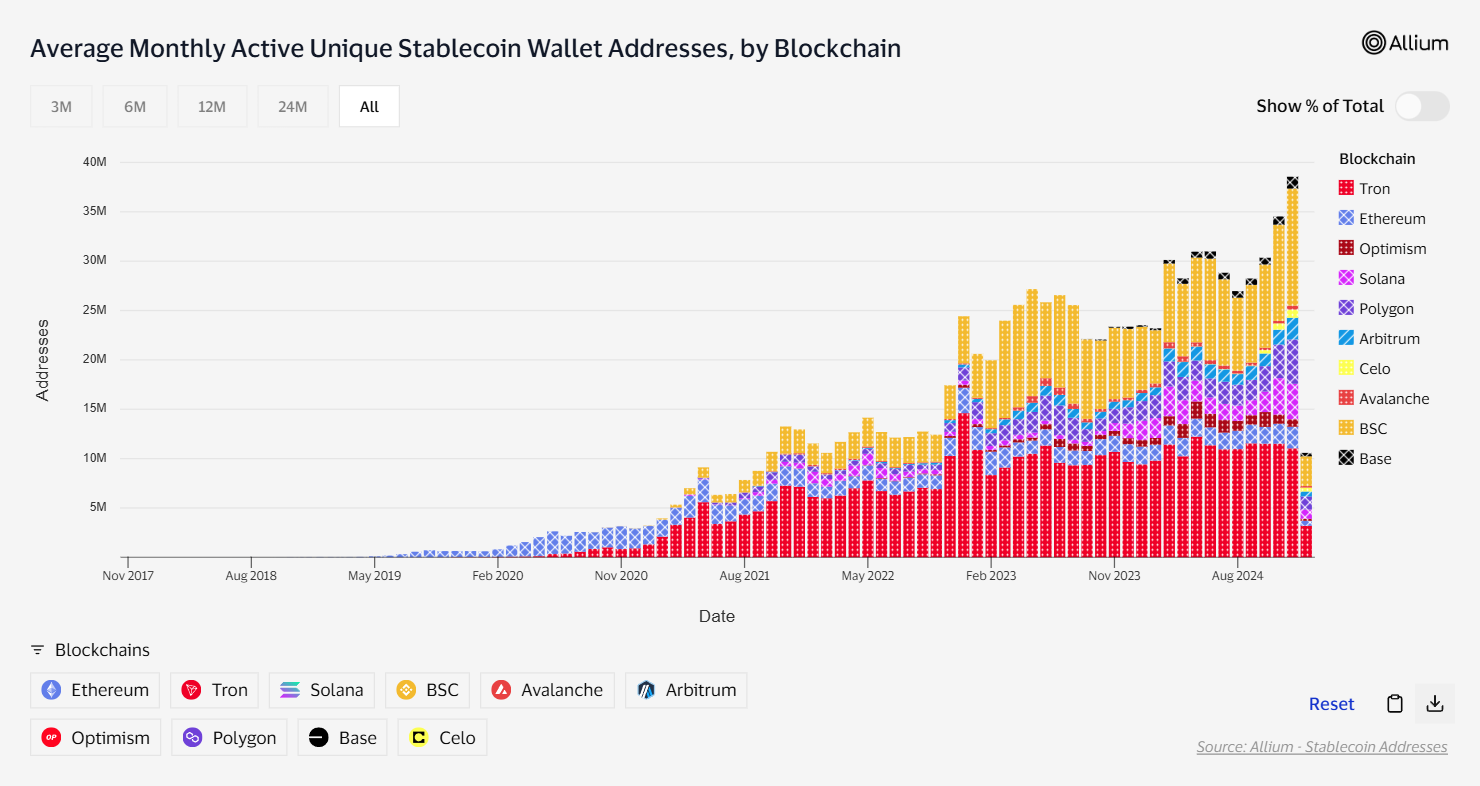

Stablecoins everywhere

Stablecoins had a big moment in 2024. Lower transaction fees made them even more useful for stuff like cross-border payments, remittances, and even just buying everyday stuff. They’re also helping people in countries with crazy inflation store value (e.g. Argentina and Turkey).

“Stablecoins are already the cheapest way to send a dollar, and we expect enterprises will increasingly accept stablecoins for payments.”

Daren Matsuoka

Yet, there’s still no dominant solution that brings stablecoin payments closer to traditional methods, leaving a significant gap in the market.

Matsuoka notes that stablecoin payments are quickly gaining traction and show no signs of slowing down as payment giant Visa has developed a dashboard to distinguish genuine stablecoin usage from bot-driven transactions.

“If stablecoin adoption — one of crypto’s most clear use cases — takes off in 2025, this metric will be one to watch,” says Matsuoka.

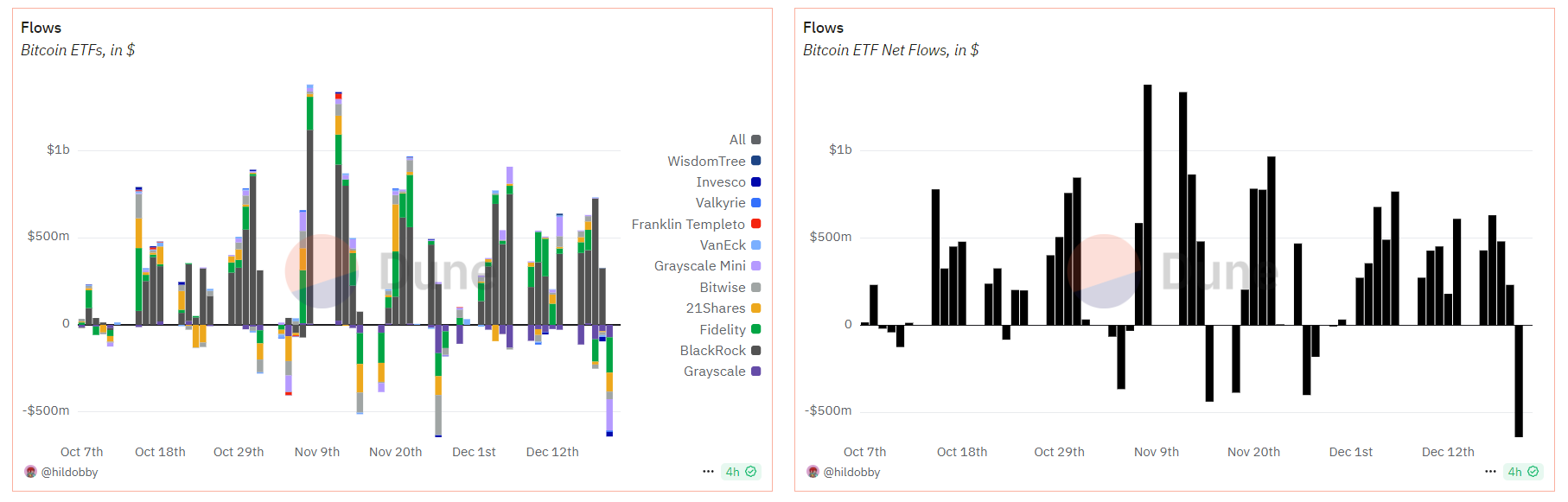

ETPs bring Bitcoin and Ethereum to masses

Last year, Bitcoin and Ethereum got their first proper exchange-traded funds approved in the U.S. This makes it way easier for regular people — and big institutions — to invest in crypto.

However, so far these ETFs have attracted only 515,000 BTC (around $110 billion) and 611,000 ETH (~$13 billion), Matsuoka notes, adding that “activating the distributors – the likes of Goldman Sachs, JP Morgan, and Merrill Lynch, who can get these products into retail investors’ portfolios – is going to take time.”

The a16z partner suggests tracking on-chain deposits and withdrawals of addresses “identified as custodians of the ETPs,” noting that more institutional investors are likely to seek exposure to crypto assets, which will lead to increased net flows for the ETPs.

DEXs vs CEXs

Decentralized exchanges are slowly eating into centralized exchanges’ market share. While their trading volume is still far from centralized rivals, they already handle about 11% of spot trading, Matsuoka pointed out, adding that the number’s climbing.

“Recently, DEX volume hit an all-time high — driven by a major uptick in transaction volume on high-throughput chains like Coinbase’s Base and Solana as new users entered the space.”

Daren Matsuoka

Although Matsuoka says DEXs are likely to keep gaining their share in 2025, it’s unclear whether retail investors will rush to switch from centralized platforms. So far, the pace has been slow, as it took decentralized trading platforms four years to capture more than 10% of spot trading volume compared to their centralized counterparts, per data from DefiLlama.

Transaction fees

In a bid to identify which blockchain network is gaining in popularity, transaction fees could show how much demand there is. But here’s the catch: while fees should show growth, they shouldn’t go so high they scare users away.

Last year, Solana passed Ethereum in total fees collected for the first time, even though Solana’s transactions are extremely cheap (less than 1 cent vs. $5+ on Ethereum). Matsuoka admits that that’s a big milestone, adding that many ecosystems and their associated fee markets are maturing, making it a “good time to start measuring the economic value facilitated by various blockchains.”

In the long run, demand for blockspace – measured as the total aggregate USD value of fees paid – could be the most important metric for tracking the crypto industry’s progress, as it reflects engagement in valuable economic activities and users’ willingness to pay for them, Matsuoka wrote.