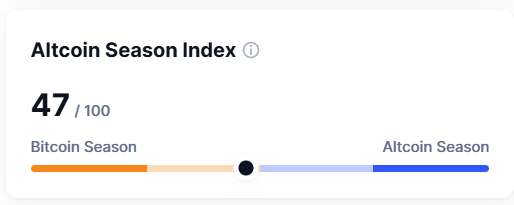

Altcoin Season Index Climbs to 47: What It Means for the Crypto Market

The Altcoin Season Index, a widely watched metric in the cryptocurrency world, rose by seven points to 47 at 00:34 UTC on Dec. 28, as reported by CoinMarketCap (CMC). This movement highlights a subtle shift in market dynamics but still indicates that the market remains in Bitcoin Season.

The index serves as a barometer for determining whether Bitcoin or altcoins are leading the market’s performance. Understanding this metric is crucial for investors and traders looking to navigate the ever-evolving crypto landscape.

What Is the Altcoin Season Index?

The Altcoin Season Index measures the relative performance of the top 100 cryptocurrencies (excluding stablecoins and wrapped tokens) against Bitcoin over the past 90 days.

Key Indicators

- Bitcoin Season: Occurs when 25% or fewer altcoins outperform Bitcoin.

- Altcoin Season: Declared when 75% or more altcoins outperform Bitcoin.

- Current Index Score: With a score of 47, the market leans towards Bitcoin dominance but shows increasing competitiveness from altcoins.

The index score ranges from 1 to 100 and is updated daily, offering a snapshot of market sentiment and trends.

What Does an Index Score of 47 Mean?

1. Bitcoin Season Prevails

- With a score below 50, the market remains in Bitcoin Season, meaning Bitcoin’s performance has outpaced most altcoins.

- Investors continue to prioritize Bitcoin as a safe-haven asset, particularly during periods of market uncertainty.

2. Emerging Altcoin Momentum

- The seven-point rise to 47 indicates a growing interest in altcoins, hinting at potential shifts in the market.

- Projects with strong fundamentals or innovative features are starting to gain traction.

Altcoin Performance Trends

Top Performers

- Ethereum (ETH): Despite Bitcoin’s dominance, Ethereum often leads the altcoin market due to its DeFi and NFT ecosystems.

- Solana (SOL) and Polygon (MATIC): Both continue to gain momentum, thanks to their scalability solutions and developer adoption.

Notable Developments

- Layer-2 Solutions: Platforms like Arbitrum and Optimism are drawing attention for reducing Ethereum’s gas fees.

- Gaming and Metaverse Tokens: Projects like Decentraland (MANA) and Axie Infinity (AXS) are experiencing renewed interest.

Factors Driving Bitcoin Season

1. Institutional Adoption

- Major companies and institutions have increased their Bitcoin holdings, reinforcing its status as the flagship cryptocurrency.

- Bitcoin ETFs and mainstream financial products have boosted investor confidence.

2. Macroeconomic Conditions

- Bitcoin is often seen as a hedge against inflation and macroeconomic instability, leading to sustained demand.

3. Liquidity and Stability

- Bitcoin’s market depth and liquidity make it the preferred choice during volatile periods, sidelining altcoins.

When Could We See Altcoin Season?

While the market is currently in Bitcoin Season, several catalysts could trigger an Altcoin Season:

- Breakthrough Projects: Altcoins introducing disruptive technologies or partnerships may attract significant attention.

- Bull Market Continuation: Extended bullish trends often lead to diversification as investors seek higher returns in smaller-cap assets.

- Ethereum Layer-2 Adoption: The scaling of Ethereum and other platforms may drive capital inflows into altcoins.

How to Navigate the Market Based on the Index

1. For Bitcoin Investors

- Current Strategy: Maintain or increase exposure to Bitcoin as it continues to lead the market.

- Opportunities: Use this period to capitalize on Bitcoin’s relative stability and strong institutional backing.

2. For Altcoin Enthusiasts

- Short-Term Play: Focus on high-performing altcoins with solid fundamentals, particularly those in gaming, DeFi, and metaverse sectors.

- Long-Term Potential: Diversify into promising altcoins that may benefit from macroeconomic shifts or technological advancements.

3. Balanced Approach

- Combining Bitcoin’s stability with targeted altcoin investments can provide both security and upside potential.

Conclusion

The rise of the Altcoin Season Index to 47 signals subtle but notable changes in the cryptocurrency market. While Bitcoin remains the dominant force, increasing altcoin activity suggests growing investor interest in diversification and innovation.

As the market evolves, monitoring the index can help investors and traders make informed decisions, balancing risk and opportunity. Whether Bitcoin continues its reign or altcoins seize the spotlight, the crypto space promises dynamic opportunities for all participants.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.