CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

- $500M in liquidations hit traders, with a single $11.97M ETH trade on Binance leading the forced closures.

- Trump’s “Liberation Day” tariffs drew crypto community backlash, rebranded “Liquidation Day” as prices sank amid economic uncertainty.

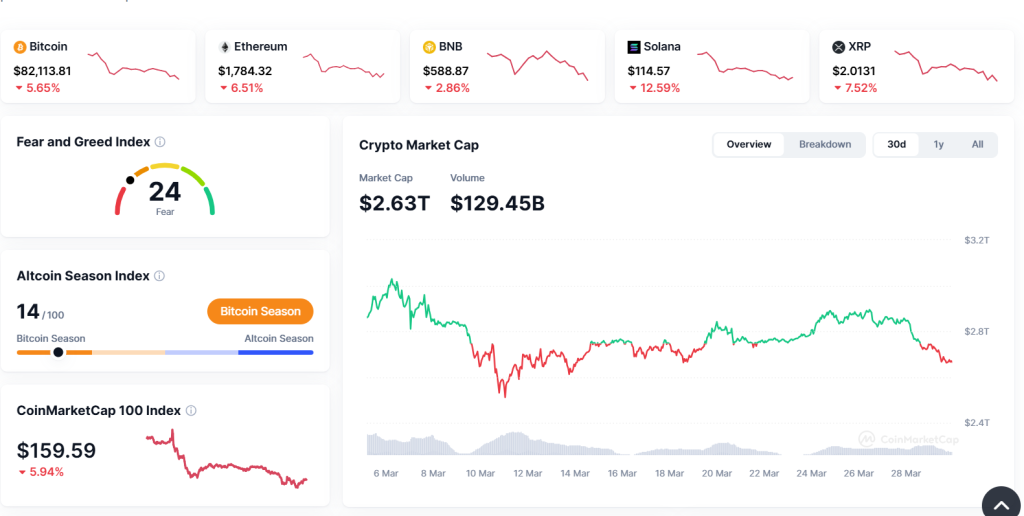

The crypto market lost 5.46% of its value Thursday, erasing $2.63 trillion in total capitalization. The drop followed former U.S. President Donald Trump’s announcement of new tariffs on international trade partners, which intensified worries about economic stability. Investors moved quickly to adjust their holdings, sparking a sell-off across digital currencies.

Bitcoin fell to $82,274.70, a 5.39% drop in 24 hours, while Ethereum declined 6.04% to $1,787.79. XRP dropped 7.76% to $2.00, and Binance Coin decreased 2.94% to $588.96.

Other cryptocurrencies faced larger losses: Cardano slid 9.25% to $0.6315, and Solana, Dogecoin, and similar assets fell between 4.83% and 11.18%. Stablecoins like Tether and USD Coin saw minimal price changes as traders shifted funds to reduce risk.

The market’s Fear & Greed Index dropped to 24, reflecting widespread caution. During the sell-off, traders lost nearly $500 million through forced closures of leveraged positions, per data from Coinglass.

Approximately $300 million of these losses occurred within four hours, starting with bets against rising prices before affecting those betting on gains. A single Ethereum trade on Binance accounted for $11.97 million in closed positions. In total, 159,333 traders experienced losses, with $257 million from bets on price increases and $232 million from bets on declines.

Trump described his tariff policy as a “Liberation Day” measure to address U.S. trade imbalances. However, cryptocurrency traders on social media platforms labeled the event “Liquidation Day” as prices tumbled. Bitcoin’s value has swung between $73,000 and $88,000 in recent weeks, settling near $83,500 by Thursday afternoon—a 0.9% daily decrease.

The broader digital asset market shed $200 billion from its recent high. ETHNews analysts observe that geopolitical decisions now directly influence cryptocurrency prices, highlighting ties between traditional finance and decentralized systems.

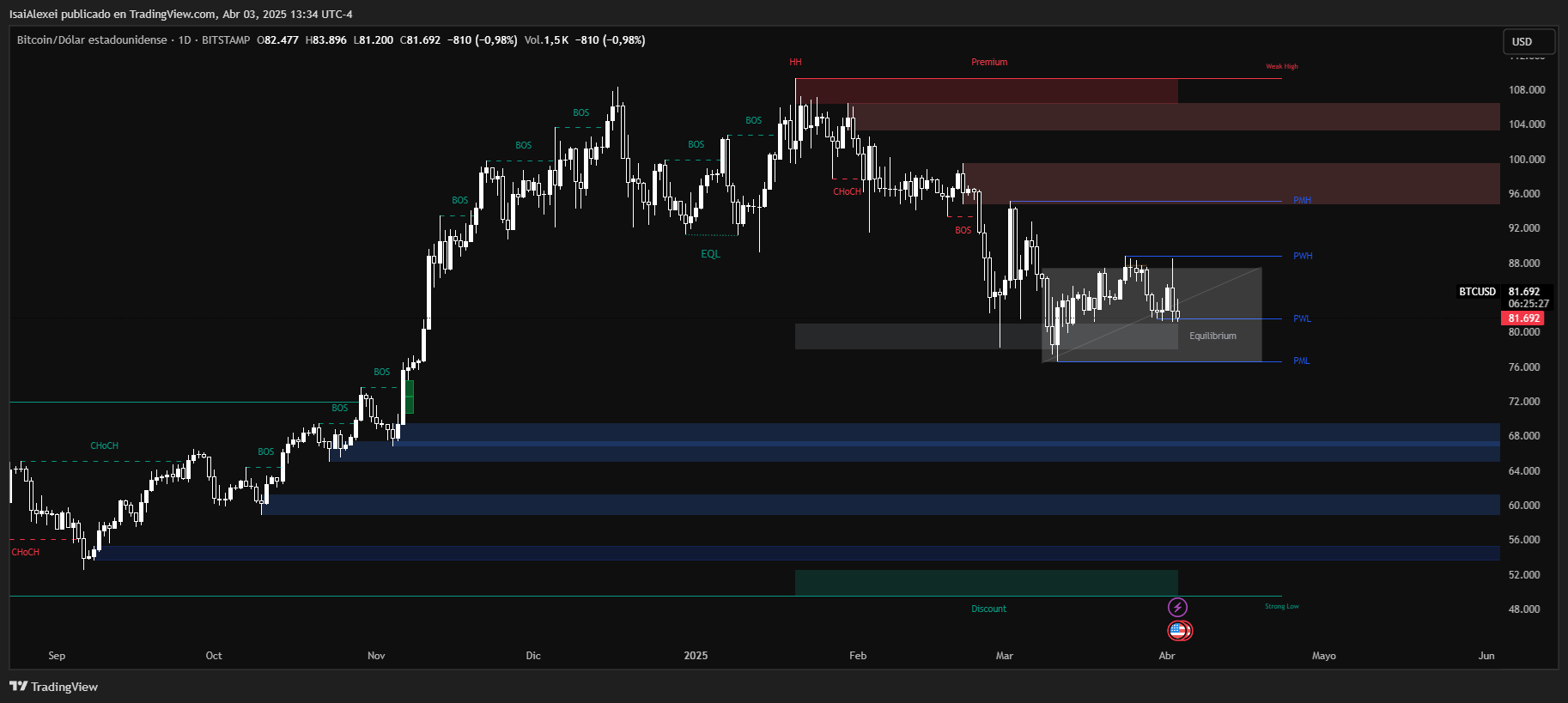

The current price of Bitcoin (BTC) is $81,839.14 USDT, reflecting a −0.82% intraday loss. BTC is trading within a volatile range today, from a low of $81,211.24 to a high of $83,998.02, continuing its pullback from the recent rejection at $88,000.

Over the past 7 days, Bitcoin has declined −5.87%, and in the last 30 days, it’s down −5.12%. Year-to-date, BTC has lost −12.58%, despite still holding a +24.97% gain over the past year and +31.77% over the last 6 months, showing that the larger trend is still positive even within this correction phase.

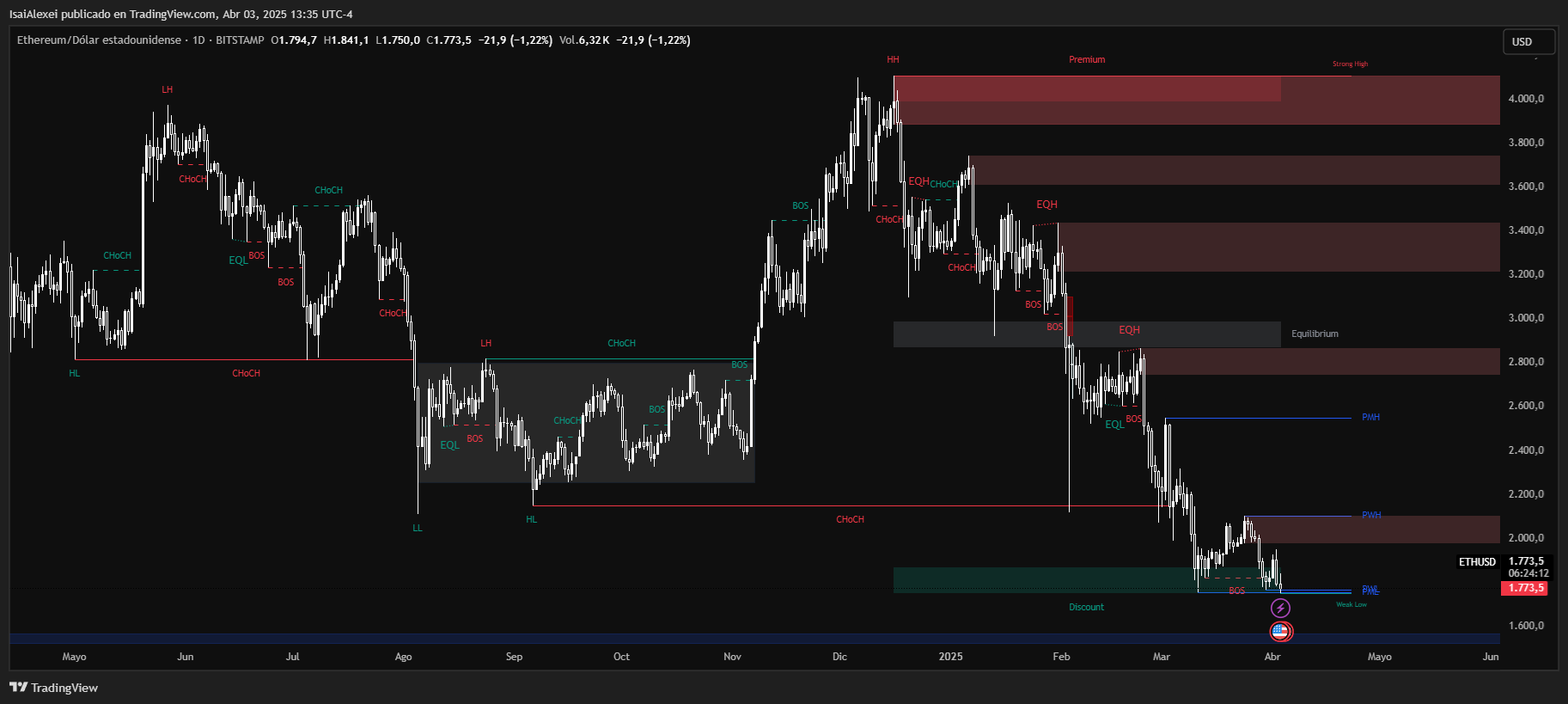

The live price of Ethereum (ETH) is $1,774.60 USDT, showing a daily loss of −1.15%. Today’s trading has ranged between $1,750.00 (low) and $1,845.26 (high), reflecting a continuation of Ethereum’s recent bearish trend. Volume remains high, with over 422,000 ETH traded today, suggesting that despite the decline, investor activity remains strong.

Over the last 7 days, ETH has dropped −11.71%, and over the last 30 days, the decline deepens to −17.44%. Year-to-date, Ethereum is now down −46.85%, and it has fallen −45.89% over the last year, underscoring the persistent downtrend that has pressured Ethereum throughout Q1 2025.

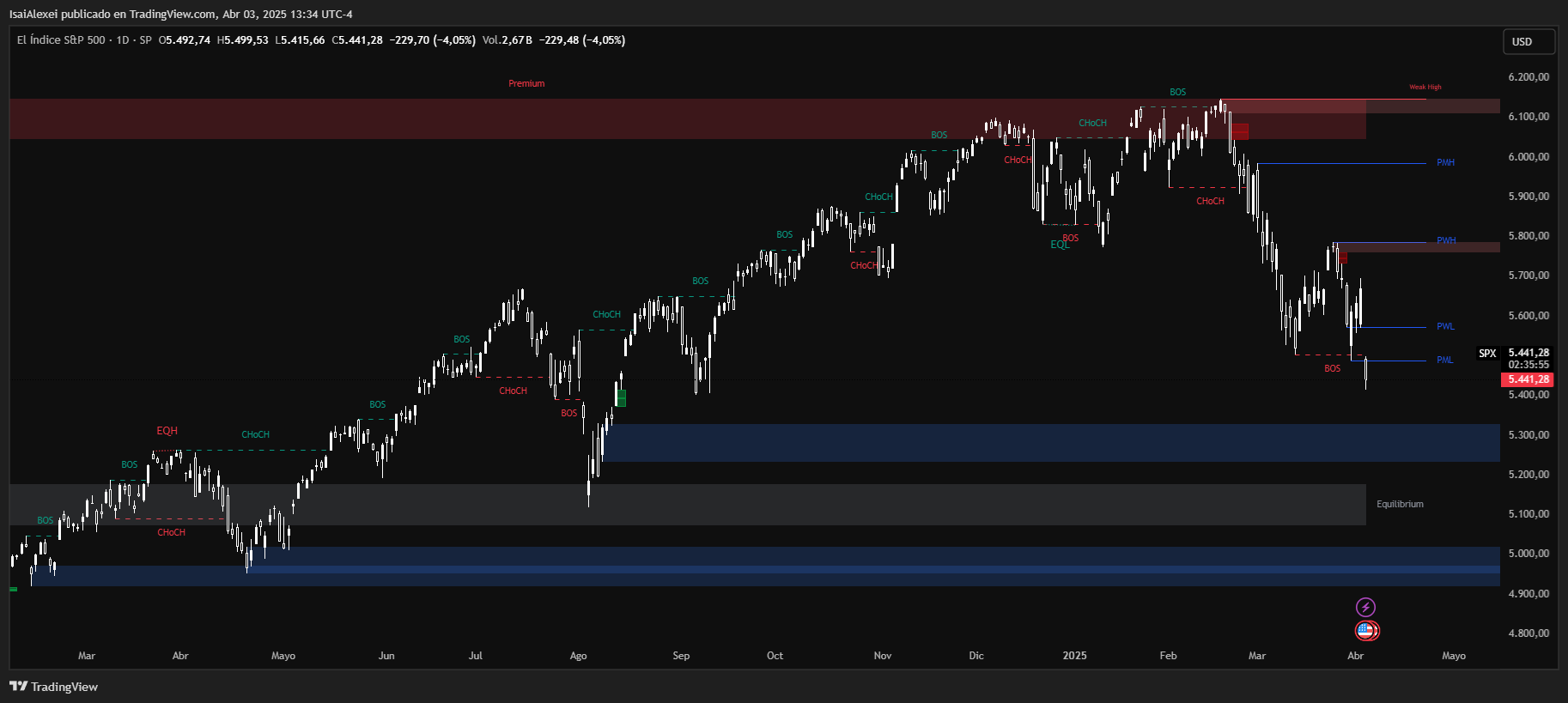

The S&P 500 Index (SPX) is trading at 5,447.17 points, reflecting a sharp daily drop of −3.95%. The index opened at 5,492.74, reached a high of 5,499.53, and a low of 5,415.66, signaling increased intraday volatility and broad-based equity selling. The total volume traded reached approximately 2.6 billion, showing intense activity across U.S. markets.

On a broader horizon, the S&P 500 has lost −4.05% over the last 5 days, −6.24% over the past month, and is now down −7.69% year-to-date, officially entering correction territory. Despite this, the index is still up +4.91% over the past year, and +116.68% over the last 5 years, reflecting its long-term resilience.

The current move lower comes amid heightened macro uncertainty, aggressive Fed rhetoric, and growing fears of a slowdown in economic growth. The largest drag on the index today includes mega-cap tech stocks like Apple (−8.79%), NVIDIA (−6.76%), and Amazon (−7.54%), while volatility has spiked sharply with the VIX up +28.49%, now trading at 27.65.