CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

CaryptosHeadlines Media Has Launched Its Native Token CHT.

Airdrop Is Live For Everyone, Claim Instant 5000 CHT Tokens Worth Of $50 USDT.

Join the Airdrop at the official website,

CryptosHeadlinesToken.com

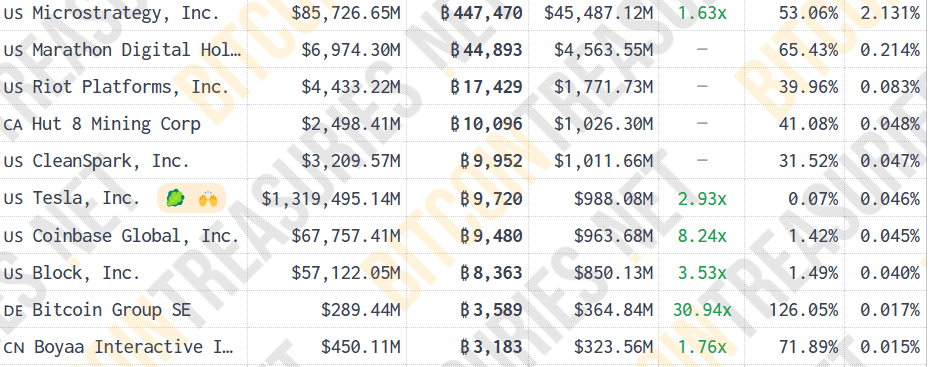

Bitcoin’s supply activity and institutional adoption, on the other hand, suggests that there is still growing demand for crypto. Companies like MicroStrategy and CleanSpark also recently expanded their Bitcoin holdings, with CleanSpark even surpassing Tesla as the fifth-largest corporate Bitcoin holder. Meanwhile, JPMorgan recently pointed out Bitcoin’s growing role as a hedge against inflation, and predictions for Bitcoin and Ethereum reaching record highs are boosted by the optimism around regulatory advancements and corporate treasury strategies.

Market Tops in Sight and Experts Weigh In

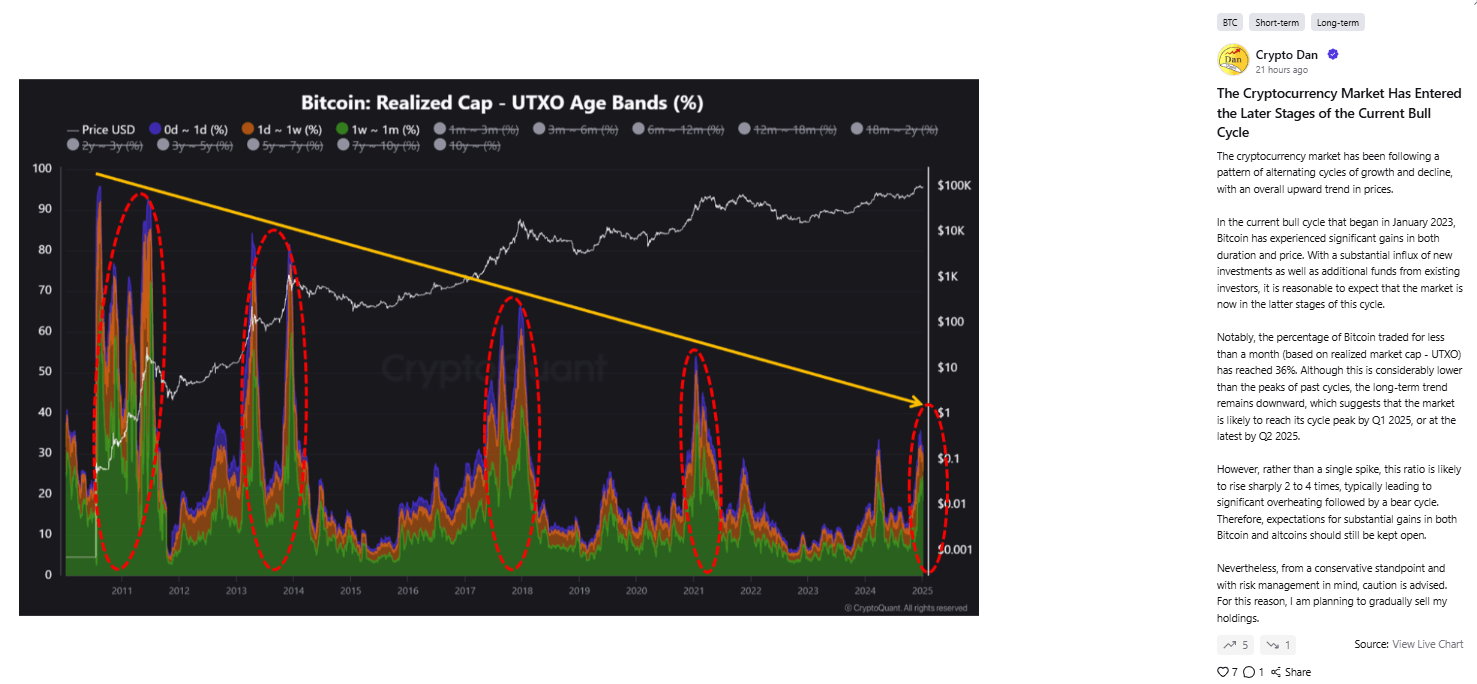

The cryptocurrency market seems to be entering the latter stages of its current bull cycle, according to CryptoQuant. In a recent post by Crypto Dan, it was suggested that the bull market, which started in January of 2023, could reach its cyclical peak as early as the first quarter of 2025, or by the second quarter at the latest. The post also pointed to a big influx of new investments and additional contributions from existing investors as evidence of the cycle nearing its climax.

Crypto Dan post (Source: CryptoQuant)

In the final quarter of 2024, Bitcoin saw 36% of its supply traded for less than a month, which is a pattern that is often associated with market tops in previous cycles. CryptoQuant noted that this ratio might increase two to four times before a corrective bear cycle begins. While there is still potential for gains in Bitcoin and altcoins, the firm urged investors to approach the market with caution and prioritize risk management.

This cautious outlook is very different from the predictions of other analysts who expect the bull market to extend through the end of 2025. Steno Research projects 2025 to be a record-breaking year for the crypto market, with Bitcoin and Ethereum expected to surpass all-time highs alongside other major advancements.

Similarly, VanEck forecasts a medium-term peak for the market in early 2025, which could be followed by a surge to unprecedented highs later in the year. VanEck’s head of digital asset research, Matthew Sigel, envisions Bitcoin reaching $180,000 and Ethereum surpassing $6,000 by the cycle’s apex.

VanEck’s top 10 crypto predictions for 2025 (Source: VanEck)

Market sentiment on platforms like Polymarket and Kalshi also reflects optimism, with traders betting on record highs for Bitcoin and Ethereum in 2025 as well. These projections align with expectations of regulatory progress, including the approval of new crypto exchange-traded funds (ETFs) and the establishment of a strategic Bitcoin reserve in the United States.

JPMorgan Sees Lasting Shift to Bitcoin and Gold

The “debasement trade” into gold and Bitcoin is becoming a lasting trend as investors navigate the persistent geopolitical uncertainty and inflation concerns, according to a recent research note by JPMorgan. Due to the record capital inflows into crypto markets in 2024, the bank stated that gold and Bitcoin are increasingly seen as essential components of investors’ portfolios. This demand stems from various factors, including heightened geopolitical risks since 2022, ongoing concerns about long-term inflation, and fears of debt debasement due to persistently high government deficits in major economies.

Institutional investors and well known people like Paul Tudor Jones are actively betting on Bitcoin and commodities, and see them as effective hedges against inflationary pressures in the United States. Similarly, US state governments are incorporating Bitcoin into their fiscal strategies to mitigate fiscal uncertainties, according to asset manager VanEck.

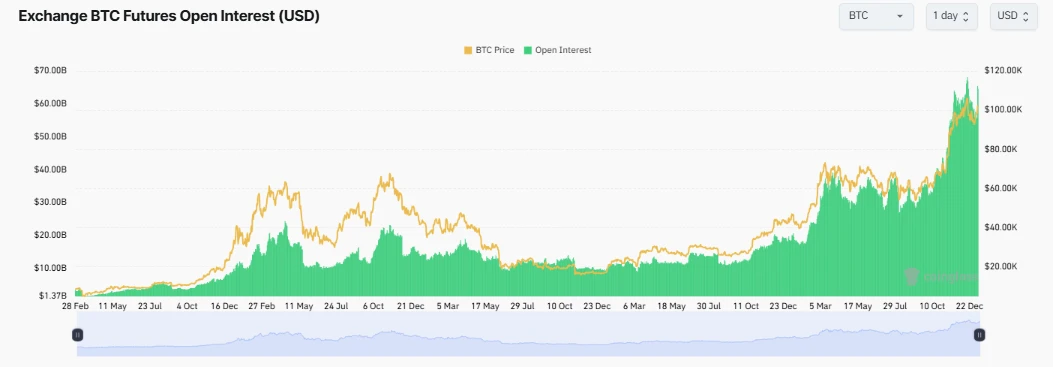

JPMorgan also pointed to the sharp increase in open interest on Bitcoin futures as an indicator that institutional funds are equating Bitcoin with gold as a strategic asset. Open interest on BTC futures surged from $18 billion in January to over $55 billion by December of 2024, according to CoinGlass data.

(Source: CoinGlass)

Retail interest in Bitcoin has also shown some renewed strength, with Bitcoin ETFs experiencing inflows starting in September 2024 after a temporary outflow in August. By November, the total net assets of US Bitcoin ETFs surpassed $100 billion for the first time, according to Bloomberg Intelligence. Crypto ETFs are considered a critical metric for gauging new market participants, as they are more likely to represent fresh inflows than other trading activities, according to Citi.

The growing institutional adoption of Bitcoin, fueled by these surging inflows, could lead to big demand shocks that may drive prices higher. Sygnum Bank suggested that this trend might propel Bitcoin’s price to new heights in 2025.

MicroStrategy Acquires More BTC in 2025

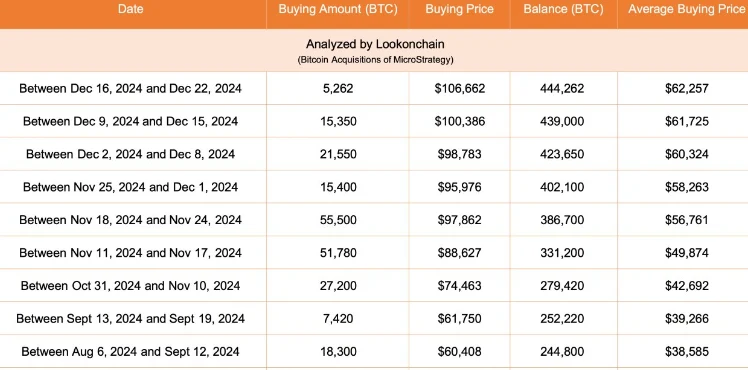

MicroStrategy also sees great potential in Bitcoin, and announced its latest acquisition of 1,070 BTC that was made during the final two days of 2025. According to a Jan. 6 filing with the United States Securities and Exchange Commission (SEC), the company spent approximately $101 million in cash between Dec. 30 and Dec. 31 to buy Bitcoin at an average price of $94,004 per coin. This purchase brings MicroStrategy’s total Bitcoin holdings to 447,470 BTC, which is valued at around $27.97 billion, with an average acquisition price of $62,503 per Bitcoin. The company now holds 2.1% of all Bitcoin that will ever be mined.

The acquisition was funded by using proceeds from the issuance and sale of shares under a convertible notes sales agreement, consistent with MicroStrategy’s purchasing strategy. The buy happened after a hint from MicroStrategy co-founder Michael Saylor, who posted a Bitcoin chart from the SaylorTracker website on Jan. 5.

Despite this addition, MicroStrategy’s Bitcoin buying activity has shown some signs of slowing. In December of 2024, the company purchased a total of 45,370 BTC, representing only 30% of its acquisitions during the previous month-long period from Oct. 31 to Dec. 1.

Some of MicroStrategy’s latest Bitcoin purchases (Source: Lookonchain)

This reduced activity was likely due to market caution, with people like BitMEX co-founder Arthur Hayes warning people about potential market volatility ahead of the inauguration of US President-elect Donald Trump. Reports also suggest that MicroStrategy could enter a blackout period in January 2025 that could potentially halt any further Bitcoin purchases through share and convertible bond issuances.

The latest purchase also follows MicroStrategy’s announcement of plans to raise $2 billion through a perpetual preferred stock offering to fund additional Bitcoin acquisitions. However, the decision to proceed with the offering is still at the company’s discretion and depends on market conditions.

CleanSpark Surpasses Tesla in Bitcoin Holdings

CleanSpark, a United States crypto mining company, expanded its own Bitcoin holdings a lot in December of 2024. The company pointed to efficiency gains and rapid hashrate growth as drivers of its success.

According to a Jan. 6 report, CleanSpark mined 668 BTC in December, contributing to a total of 7,024 BTC mined for the year. The company’s hashrate increased by 287.9% year-over-year, reaching 39.1 exahashes per second by year-end. Efficiency also improved by 33.3% compared to 2023.

In December, CleanSpark sold 12.65 BTC at an average price of $101,246, generating $1.28 million in proceeds. This sale represented just 58% of its daily production for the month. The company’s mining capacity received a nice boost in 2024 with the acquisition of seven facilities in Knoxville, Tennessee, which increased its hashrate by 22%. CleanSpark’s stock, which is trading under the symbol CLSK, also rallied on Jan. 6.

By the end of 2024, CleanSpark accumulated 9,952 BTC, valued at approximately $1.01 billion, making it the fifth-largest corporate Bitcoin holder and surpassing Tesla. Only MicroStrategy and three other mining companies hold more Bitcoin. Publicly traded companies now collectively hold 593,152 BTC, accounting for around 20% of institutional Bitcoin treasuries, though this figure includes government-held confiscated Bitcoin.

Top corporate bitcoin holders (Source: Bitcoin Treasuries)

The trend of corporations adding Bitcoin to their balance sheets is still picking up steam. In December, space technology company KULR converted $21 million in cash into Bitcoin, while Canadian firms Matador Technologies and Quantum BioPharma made similar moves as part of their treasury strategies. Bitwise CRO Hunter Horsley predicts that 2025 will start the rise of “Bitcoin Standard” corporations as more companies embrace Bitcoin as a strategic asset.